AMPLIFY VOL. 36, NO. 7

An array of standard setters, raters, and advisors have emerged in response to increasing awareness of what some refer to as “nonfinancial factors” in company performance. Corporate disclosures have been broadly categorized into “financial” and “nonfinancial,” but this distinction is somewhat misleading.1 In reality, companies navigate systems of interconnected contexts (from community impacts to worker advancement) to create value for consumers, employees, and shareholders.

Ignoring workforce and community impacts to focus only on traditional financial factors means ignoring the larger palette in favor of one color, painting an incomplete picture of company value creation, cost, and risk.2 Stakeholders are increasingly demanding transparent and comparable disclosures that represent a more holistic assessment of company performance. Lacking a complete picture, companies, investors, and other stakeholders like employees, communities, and customers are unable to fully evaluate company performance and make informed decisions.

Environmental disclosures are becoming standardized, but workforce and community impact disclosures are less so, especially in the US. At the same time, elevated inflation, a tight labor market, attendant competition for talent, and shifting expectations from younger generations underscore the importance of workers and an organization’s community interactions in sustaining operational success.3 As stakeholders increasingly expect meaningful and transparent disclosure, companies are looking for clarity on what metrics to report and how to report them.

This article focuses on understanding how the American public perceives and prioritizes transparency in corporate disclosures and examines alignment with the public’s expectations for corporate transparency and corporate disclosure on key workforce topics. This framing is essential: the public drives perception of corporate reputation and brand loyalty and is composed of key stakeholders who impact company valuation, including consumers, investors, and workers.4

The American Public Wants More Corporate Transparency

Large majorities of Americans, across demographic groups and the political spectrum, want improved transparency and disclosure from America’s largest public companies.5 One survey found that 85% of Americans agree that companies should disclose more about their business practices, including their environmental (94%) and societal (86%) impact.6

In another survey, 93% of Americans favored large companies publicly releasing the wage ranges for various types of jobs at their company, and this finding held across the political spectrum, favored by 95% of Democrats, 91% of Independents, and 94% of Republicans.7 Similar bipartisan consensus was found among the 89% of respondents who favored the release of minimum wage rates for frontline and entry-level workers (94% Democrats, 87% Independents, 87% Republicans).8

Our company conducts yearly focus groups in the US. Participants are recruited to ensure representation by key stakeholders, such as workers at large companies, and across demographic groups and political affiliations. It is important to keep in mind that workers are also consumers and shareholders, and they often bring that lens to discussions.9

Last year, we conducted six focus groups, each containing seven participants and a moderator, to discuss topics related to just business behavior by the largest public corporations in America. Inductive thematic analysis revealed four main themes around transparent disclosure: (1) accessibility of information, (2) disclosure of missteps, (3) trust and follow-through, and (4) responsibility to society.10

Participants said that honest, transparent disclosures affect how positively or negatively consumers and shareholders value the company and that they expect large public corporations to follow through on commitments and statements. Studies have shown that greater corporate transparency results in higher levels of customer trust and brand loyalty.11,12

Accessible, Honest Disclosures

Five out of six focus groups explicitly stated that companies should disclose honestly, in good faith, and in more detail than required by regulatory mandates. Participants consistently noted that some disclosure was better than none, and more was better than less.

Disclosures written in accessible language and formats are considered the most transparent. As one participant said, disclosure should be written in a way that “the average Joe can look at it in bullet points and say, ‘These are the main points.’” Similarly, clear disclosure should include comparable standards. One person said, “Telling us how many gallons doesn’t put into perspective what other companies use and what the standard is. There’s got to be some level metric to delineate whether or not it’s good or bad. I think more transparency with all that would be better.”

Participants said accurate and contextual information should be provided to avoid the appearance of being misleading. As one participant put it, “So just saying we want to require them to report, this doesn’t necessarily mean that the information that they’re required to report is good. It just means that they reported it. I think proper plain context should be required, rather than just a reportability requirement.”

Disclose When You Mess Up

All six focus groups agreed that companies should disclose the bad with the good and not try to hide missteps. As one participant put it: “If you’re doing something evil, at least you told us, so we know.” Interestingly, there was also a perceived upside in disclosing such incidents: disclosing the bad with the good made a company’s good statements more believable.

When risk incidents occur, participants said companies should act quickly and disclose remedial plans clearly in an effort to “be transparent with what’s happened, to what’s going on. So as things occur, say, ‘Yeah, hey, we [messed] this up. That’s on us. And this is what we’re doing to recover from this, to repair the damage we caused.’” Failure to disclose missteps was perceived as “shady” by participants.

Most focus groups were understanding of mishaps and thought companies should be allowed to recover from mistakes. One woman said: “You can do bad things; just like humans, we make mistakes, so we can’t just keep them at fault.” However, participants wanted to see willingness to do better and learn from mistakes, with one noting that if companies were “not willing to fix themselves, then that’s an issue.” Disclosure of a clear plan can foster public trust and is seen as less risky than attempting to keep mistakes under wraps.

Transparency Equals Trust

Five out of six focus groups connected transparency to trust and confidence in a business. Participants made it clear that if a company was not transparent, the public trusted the company less. Participants also said if they had a choice between a more transparent and a less transparent company, they would do business with the more transparent company. As one person put it, “If I can’t trust you, I’m not dealing with you.”

Absent or bare-minimum corporate disclosure was perceived as “likely hiding something.” The risks of disclosing only the bare minimum required is considered reputational, but participants said it could also negatively affect company value. Some noted that companies that only disclose the bare minimum risk being “left behind” by peer companies that disclose more information.

One participant said: “When I think about the companies that have said something versus the ones that haven’t, it’s not a good look for the ones that haven’t. The fact that they haven’t said anything, or when they do it’s just like bare minimum, has definitely given them a negative reputation versus the other companies that have said something.”

Being proactive (rather than reacting to public pressure) and following through on commitments enhance trust in corporate statements. Participants said they want disclosures that allow them to “see [a company’s] vision for society and their communities,” so they can “maybe not necessarily hold them accountable but understand that they have a vision to begin with and then see how they progress with that vision year after year.”

Participants struggled to trust statements made by large companies if they did not follow through on commitments. Many viewed statements without clear actions and goals as performative. Although this theme emerged in many discussions, it was consistently reiterated when participants were asked if companies had followed through on recent diversity commitments. Many said that inclusion efforts were either not well publicized by companies or not clearly disclosed, and most did not believe that companies were making progress, dismissing the possibility with “not that I’ve really seen.”

Transparent, Honest Disclosure: a Responsibility to Society

Americans believe that large public companies have a responsibility to society to be transparent and to communicate honestly about policies and practices; four of the six focus groups discussed transparency as a “duty” or a “responsibility” of the firm. When asked what responsibilities large corporations have to society, transparency was often listed by participants. One man said, “They need to communicate the truth about their business, be honest with the public and their consumers, their stakeholders. I like transparency, and I wouldn’t want to be led to think one thing and the company be doing something else.”

Participants view public, transparent disclosure as a bare-minimum obligation that companies have to employees, customers, communities, and shareholders. Because transparency is linked to customer trust and brand loyalty, and thus company performance, companies can gain an edge on competitors by putting these principles into practice.

Disclosure Among America’s Largest Public Companies Is Low

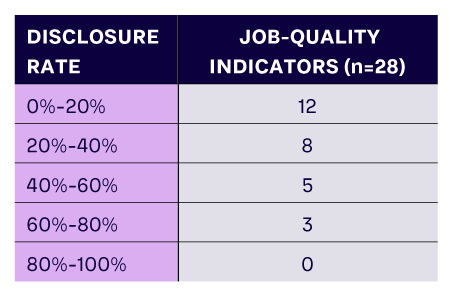

Our focus groups show that the American public seeks transparency, yet disclosure by the largest public companies falls short on workforce, job-quality, and equity topics. Our JUST Jobs Scorecard evaluates companies on 28 job-quality indicators. Table 1 shows that nearly half of all indicators have a disclosure rate of less than 20%, 20 out of 28 indicators have a disclosure rate between 0%-40%, and no indicators have disclosure rates between 80%-100% in Russell 1000 companies.13

This pattern of low disclosure is hardly new. In a 2021 study, we evaluated the state of disclosure by the 100 largest publicly traded US employers on 28 human capital topics, finding that 23 out of the 28 metrics had a disclosure rate below 20%, five between 20%-40%, and just one between 40%-60%.14

Similarly, our 2022 Racial Equity Tracker’s evaluation of equity disclosures by the 100 largest publicly traded US employers found disclosure was low on many topics, including less than 10% disclosure of internal hire or promotion rate by race/ethnicity, local supplier/small business spend amount, and reentry or second-chance policies.15 Because larger companies tend to disclose at higher rates compared to smaller companies, low disclosure in the largest 100 publicly traded US employers suggests that smaller companies have even lower rates.16,17

There have been some improvements. For example, the share of Russell 1000 companies that publicly disclosed the gold standard for workforce demographic disclosure (the EEO-1 report)18 or similar intersectional data more than tripled from September 2021 to September 2022, from 11% to 34%.19 Likewise, the share of Russell 1000 companies disclosing a gender pay gap analysis grew from 23% to 32% over the same period.20 These improvements demonstrate a willingness to clearly and transparently communicate performance, especially when given clear disclosure guidelines.

How to Meaningfully Communicate Corporate Impact on People & Communities

Employees, customers, shareholders, and other stakeholders share a desire to be better informed about the products and services they use. Business leaders can take the following steps to meaningfully communicate corporate impacts on people and communities. First, effectively organize information for the intended audience and clearly communicate the strategic purpose. Second, determine the scope of the disclosure based on the audience’s needs and what the company is comfortable disclosing. Third, provide contextual information to make disclosures accessible and comparable to stakeholders.

Effectively Organize Information & Clearly Communicate Strategic Purpose

To clearly communicate disclosures based on the intended stakeholder audience, companies can use taxonomies to align information with stakeholder objectives in a more digestible way. This kind of framing provides structure and focuses the messaging, helping stakeholders better interpret disclosed information.

Companies can use such taxonomies to cut through details and draw important analytical distinctions. For example, in the Racial Equity Tracker, we categorize corporate disclosures as either “commitment” or “action.” We provide a clear definition for each category, defining commitment as “a statement or generic policy that notes that a company is committed to a certain element of anti-discrimination or inclusion” and action as “a program, disclosure or policy that shows progress of accountability toward a commitment or one that has an immediate impact.”21

Similarly, in a 2022 analysis of workplace and human capital policies, we categorized items as “policy” or “performance.” The former referred to “whether companies disclosed the presence or absence of corporate workplace and human capital policies,” and the latter “[evaluated corporate] performance on these issues.” The latter can be understood as more detailed, evaluative, and transparent disclosure.

These distinctions draw a line from the underlying information to the larger messaging around how companies are performing on racial equity commitments and workplace and human capital policies. Companies can adopt similar taxonomies to include more information while providing a focused throughline that helps stakeholders accurately assess performance.

Determine the Scope

Companies should determine the scope of their disclosures by balancing operational objectives with meaningful, transparent information for stakeholders. Whenever a company can disclose more details, especially in regard to actions or policies that directly impact stakeholders, it should. These details make disclosure more meaningful for stakeholders.

In workforce and job-quality metrics, disclosing the details of a policy often provides more valuable information than simply disclosing whether the company has a policy.

Consider the example of paid parental leave. Some companies disclose only that they provide paid parental leave to employees. Other companies disclose both the paid parental leave policy and the number of weeks provided for various types of caregivers and employee classifications. The latter conveys more useful information to help stakeholders evaluate how competitive a company is in the labor market.

Including various types of disclosures with several levels of detail helps capture company performance and make disclosures more comparable, especially when companies can’t disclose more information due to legal risks.

This is well illustrated in our recent analysis of Russell 1000 companies’ performance on gender pay gap analyses. We assessed both disclosure of a gender pay gap analysis, and, if reported, the adjusted women-to-men pay ratio at the company. We found that although 32% of Russell 1000 companies (302 companies) say they conducted a gender pay gap analysis, only 14% (130 companies) disclose the pay ratio.22 Of the 130 companies that disclose a pay ratio, nearly all reported a ratio at or near gender parity (1:1).23

Having both metrics allows us to more accurately interpret the data. If we had only considered the adjusted women-to-men pay ratio disclosure, we would have concluded that although disclosure was low, nearly all companies have small, if any, gender pay gaps. Capturing the pay gap analysis disclosure led us to conclude that companies may not disclose results that reveal they are not near parity.

Although disclosing less may seem prudent, the public understands that companies are continuously improving. In the absence of disclosing direct results, companies should remember that some information is better than none. Disclosing clear roadmaps and goals lets stakeholders see the color palette even when the full painting is not yet ready to be displayed.

Add Context to Make Information Accessible

Companies should ensure that disclosures provide contextual information that makes them easily understood by stakeholders and comparable across similar companies. For example, in a disclosure about paid-leave policies, companies could provide details about which employees the policy applies to (e.g., full time, part time, temporary, gig), whether it is limited by geographic location, and whether it applies on the first day of employment or requires tenure.

For disclosures of quantitative metrics, such as turnover rate, companies should consider providing context. For example, if a relatively higher turnover rate is a part of a company’s business strategy, it may be beneficial to communicate that information so stakeholders can more accurately interpret the statistic.

Done mindfully, corporate disclosure is an opportunity for companies to demonstrate to stakeholders the value they add not only in products or services, but in the lives of workers and the communities where they operate — understanding that the two are intertwined. In good times, it is a space to invite stakeholders to share in visions and plans for the future. In difficult times, it is a space for companies to provide context to decisions and disclose clear goals and plans that show they are more than their mistakes.

Future Directions

Over the last decade, it has become clear that traditional financial disclosures do not represent a complete picture of company performance; financial outcomes are inseparably fused to workforce and community impacts and actions.

We expect transparent disclosure of corporate impacts on workers and communities to continue to be a priority for multiple stakeholders, including the American public, investors, and regulatory bodies like the US Securities and Exchange Commission (SEC). Increasing global attention to transparent disclosures will bring pressure from regulatory bodies for companies to disclose new quantitative and qualitative information clearly, consistently, and in a way that allows for benchmarking and comparison.

Although the US may be slow to enact standards, many American companies will be impacted by the Corporate Sustainability Reporting Directive requirements the EU will implement in a phased approach over the next few years.24 This framework will require companies to assess both past actions and future goals, as well as independent auditing plans.

As disclosure of workforce and community impact factors are increasingly regulated, the largest companies will likely adopt consistent and comparable disclosures and model clearer best-practice standards for other companies to follow. Similar practice diffusion can be expected across key metrics that are not required, but where consensus from stakeholders advocating for disclosure nevertheless exists.

For example, the UK’s requirement of gender pay gap reporting for companies with more than 250 employees has prompted pay gap analyses by multinational corporations across employees in other countries and created an expectation among investors and other stakeholders that companies implement and disclose such analyses.25 Stakeholder demand has also led to a significant uptick in the public disclosure of EEO-1 workforce demographic data, a step not legally required of companies. Pressures from both stakeholders and regulatory bodies indicate that companies should prepare to disclose more across a range of topics.

The key themes and perspectives highlighted in this article indicate a path forward to develop more comprehensive disclosures and help companies recognize how to expand their palette in an effort to paint a more complete picture.

References

1 Some use the term “human capital” to capture topics associated with “nonfinancial factors,” but both of these terms obscure the fact that investors consider topics like workforce cost and turnover as being financially material. To avoid using terms that mean different things in different fields, in this article, we talk about “workforce and community impact” metrics and disclosures. We define these as topics that entail material risks and opportunities to companies.

2 Working Group on Human Capital Accounting Disclosure. “Petition for Rulemaking.” US Securities and Exchange Commission (SEC), 7 June 2022.

3 Markenson, Steve, and David Orgel. “Transparency in an Evolving Omnichannel World.” NielsenIQ/Food Industry Association (FMI), 2022.

4 “The State of Corporate Reputation in 2020: Everything Matters Now.” Weber Shandwick/KRC Research, 14 January 2020.

5 These findings are based on quantitative surveys conducted by our company of representative samples of the American public.

6 Tonti, Jennifer. “Survey Analysis: Americans Want to See Greater Transparency on ESG Issues and View Federal Requirements as a Key Lever for Increasing Disclosure.” JUST Capital, 15 February 2022.

7 Mizell, Jill, and Kelley-Frances Fenelon. “Across Political Divides, Americans Agree: Companies Should Prioritize Workers’ Economic Security, Driving Competitive Advantage.” JUST Capital, 31 August 2022.

8 Mizell and Fenelon (see 7).

9 “JUST Capital Ranking Methodology.” JUST Capital, January 2023.

10 Braun, Virginia, and Victoria Clarke. “Using Thematic Analysis in Psychology.” Qualitative Research in Psychology, Vol. 3, No. 2, July 2008.

11 Maloney, Devon. “Transparency in Business: The Next Wave in Company Evolution.” Slack, 30 November 2019.

12 “BBB Business Tip: Demonstrating Transparency Increases Consumer Trust and Brand Loyalty.” Better Business Bureau (BBB), 8 June 2021.

13 “JUST Jobs Scorecard Shows Room for Companies to Lead on Job Quality Disclosure, with Established Leaders Outperforming Peers.” JUST Capital, 13 March 2023.

14 Bonta, Emily, et al. “The Current State of Human Capital Disclosure in Corporate America: Assessing What Data Large US Employers Share.” JUST Capital, 5 October 2021.

15 “The 2022 Corporate Racial Equity Tracker.” JUST Capital, 30 May 2022.

16 Radeva, Aleksandra, Ian Sanders, and Shane Khan. “The Current State of Disclosure on Worker Issues: Assessing What Data Russell 1000 Companies Publicly Share.” JUST Capital, accessed July 2023.

17 Thornton, Laura, et al. “The Current State of Environment Disclosure in Corporate America: Assessing What Data Russell 1000 Companies Publicly Share.” JUST Capital, accessed July 2023.

18 Companies with 100 or more employees in the US are legally required to submit the EEO-1 report to the US Equal Opportunity Commission and Department of Labor (though not to publicly disclose). This includes Component 1, which shows workforce demographics by race, ethnicity, and gender by 10 standardized job categories; see: “EEO-1 Data Collection.” US Equal Employment Opportunity Commission, accessed July 2023.

19 Nestler, Matthew, Aleksandra Radeva, and Ian Sanders. “Companies Disclosing the Gold Standard of Workforce Diversity Data — The EEO-1 Report or Similar Intersectional Data — More Than Tripled Between 2021 and 2022.” JUST Capital, accessed July 2023.

20 Nestler, Matthew, Aleksandra Radeva, and Ian Sanders. “Despite an Uptick in 2023, Only 32% of the Largest US Companies Analyze Their Gender Pay Gaps.” JUST Capital, 14 March 2023.

21 “The 2021 Corporate Racial Equity Tracker.” JUST Capital, accessed June 2023.

22 Indeed, we found that disclosure of the performance data points was even lower than policy data points.

23 Nestler et al. (see 20).

24 These requirements will mandate that companies publicly report nonfinancial information detailing impacts on people and the environment. Although 2024 compliance will only impact EU companies with over 250 employees and an annual turnover more than US $43 million, these provisions will also eventually apply to some of the largest non-EU companies who do business within the EU; EU companies with an annual turnover that exceeds $163 million will also be expected to comply, with a few exceptions.

25 Schlager, Tobias, et al. “Research: Customers Will Reward Companies for Smaller Gender Pay Gaps.” Harvard Business Review, 15 November 2021.