AMPLIFY VOL. 36, NO. 9

In an era marked by unprecedented global environmental challenges, our common resources (including the atmosphere, the oceans, soils, and the rainforest) are in peril. Despite concerted international efforts and agreements around climate (COP27) and biodiversity (COP15), the Intergovernmental Panel on Climate Change’s latest assessment confirms global temperatures are on track to rise well above the 1.5°C target set in the Paris Agreement, with catastrophic implications for ecosystems and human communities.1

COP15 highlighted the loss of biodiversity at an unprecedented rate, making it clear we are in the throes of a sixth mass extinction event, with more than 1 million plant and animal species threatened with irrevocable extinction.2 These converging crises call for urgent, innovative solutions and the need to adopt novel approaches to stave off further degradation and restore our ecosystems.

Two types of actions should be taken in parallel and at an unprecedented scale to achieve sustainability. First, we need to reduce the adverse environmental effects of industrial activity by accelerating the green transition and adopting reduce/reuse/recycle waste management for industries responsible for the making, moving, and mining of physical products (e.g., manufacturing, mining, cement and steel production, transportation, apparel, and energy).3,4 Second, we need to increase our investment in nature to strengthen the earth’s carrying capacity and restore damaged ecosystems.

The former objective has long been part of political and business debates and is anchored in the narrative of carbon-footprint measurement and reduction. The latter is rapidly rising to the top of corporate and governmental agendas under impetus from the 30x30 Initiative and is rooted in the more recent “handprint” approach.5

This article focuses on the handprint approach (i.e., regenerative sustainability), juxtaposing it with the more familiar footprint approach reminiscent of legacy sustainability. Our goal is to provide insight into how Web3 technologies can help address the tragedy of the commons.6 Elinor Ostrom’s seminal research found that non-excludable, open access, and unregulated common-pool resources do not invariably suffer exploitation in localized settings, yet solutions for averting the degradation of such resources on a global scale remain conspicuously absent.7

The governance systems we have employed over the last decades to stave off environmental collapse have not succeeded, to put it mildly. Legacy sustainability approaches, for all their complexity, data collection, and reporting requirements, and increased governmental regulation pertaining to environmental, social, and governance (ESG) have so far failed to incent sufficient environmental actions.

Government systems have not stimulated the collective action needed to achieve the goals of the various transnational nature-protection agreements and have failed to enforce regulations. A lack of strong incentives to tackle these problems head-on has led to businesses failing to collect needed data and develop innovative business models for shared value creation.8

Core Components of Regenerative Finance

Regenerative finance (ReFi) has the potential to address governance failures and underpin new sources of business value creation and capture. ReFi is an alternative to traditional financial systems for sustainability that can be defined as a “decentralized movement leveraging blockchain technology and Web3 applications for the coordinated financing, governance, and regeneration of common pool resources.”9

ReFi uses the principles of circularity, decentralization, and transparency to incent sustainable practices for rejuvenating natural resources. These three principles underpin both the ReFi movement and the more generic regenerative sustainability paradigm:

-

The principle of circularity replaces the traditional linear economic model of take/make/ dispose with a cyclical framework focused on regeneration and restoration. In this paradigm, resources are not mere consumables but assets to be reused, refurbished, or recycled, thereby extending their lifecycle and reducing environmental impact. This goes beyond simple recycling to include considerations in product design, manufacturing, and business models, aiming to decouple economic growth from environmental degradation. Circularity offers a sustainable, restorative approach that embeds ecological resilience into economic transactions, reshaping how we view production and consumption.

-

The principle of decentralization counters the notion of centralized authority by advocating for a more democratic and distributed approach to governance, in which power is more equitably dispersed among stakeholders. For environmental and social impact, credibility often hinges on either reputation (as evidenced by trust in established nongovernmental organizations [NGOs]) or authority (as in the case of third-party-verified carbon credits). However, these traditional credibility markers face scaling limitations across diverse impact types, since each impact type may necessitate unique verification processes, standards, or domain-specific expertise that cannot be universally applied. As a result, reputation and authority become bottlenecks, an inefficiency we cannot afford given the immediacy and magnitude of our global challenges. In contrast, a decentralized governance model that harnesses the wisdom of crowds, fosters competitive innovation, and ensures visibility presents a more versatile and scalable solution.

-

The principle of transparency is central to decentralized governance, providing clear insight into system processes, decisions, and outcomes. Transparency is not a theoretical construct; it is instrumental in actualizing equitable power dynamics and facilitating informed participation among stakeholders. By ensuring that information is accessible to all participants, regardless of their position within the system’s hierarchy, transparency diminishes the information asymmetry that often accrues to the advantage of centralized authorities. Transparency fosters accountability through more effective audits and evaluations while engendering a culture of trust essential for collaborative decision-making. As such, it acts both as a safeguard against power abuses and an enabler of informed, democratic governance.

These three principles are supported by digital measurement, reporting, and verification (D-MRV) and blockchain applications. D-MRV approaches range from space-based intelligence to the use of local, sensor-derived source data and expansive big data techniques.10,11 Space-based approaches can help us understand the current state of the earth by using remote sensing technologies and various earth-surveying techniques to collect data on biological, physical, and chemical processes.

Since conventional approaches entail meticulous manual expert review, there’s a growing trend toward using machine learning (ML) to elevate this process. Through ML, data from diverse sources can be triangulated, ensuring data consistency and revealing any tampering.12

Blockchain’s Role

Blockchain technology has the potential to substantially elevate the credibility, exchangeability, and transparency of environmental data and action. Its architecture includes an immutable ledger, facilitating an auditable trail of data points and lending an additional layer of credibility. Blockchain supersedes traditional centralized data repositories by offering a decentralized approach to data governance, thereby democratizing data access, portability, and exchangeability.

Such democratization has the potential to shift transparency into tangible accountability for environmental outcomes.13 The principle of accountability is intrinsically bound to data transparency, availability, accuracy, and reliability, as it empowers stakeholders to independently access and scrutinize reported information. This fosters a climate conducive to peer review and public oversight, ensuring the fidelity of a party’s declared actions and progress.

By enhancing information sharing and implementing a comprehensive, transparently codified system of rules, ReFi enables the tokenization of nature as digital assets. This means translating the inherent value of resources into digital representations, like community currencies, regenerative non-fungible token collections, and social tokens.

Tokenization is a mechanism to associate a quantifiable value and transferable ownership to positive impact claims. This paves the way for businesses to capture and represent value derived from the generation of public goods, offering the potential to “solve” the tragedy of the commons.14

For example, ReFi components could enable systems in which governance is not monopolized but inclusive. ReFi could also facilitate integration between environmental and social impact metrics and financial models, bridging the gap between economic outcomes and tangible sustainable efforts.

Incorporation of smart contracts in blockchain platforms ensures that transactions are not only automated (enhancing efficiency) but characterized by an unprecedented level of reliability and reduced counterparty risk.

Investment Priorities in Digitalizing Sustainability

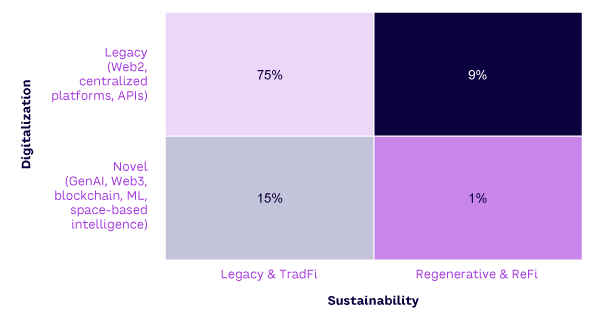

ReFi and the application of digital technologies to achieve sustainability are globally increasing trends.15 Figure 1 provides an anecdotal (and somewhat subjective) distribution of attention and investment of businesses to the quadrants of sustainability and digitalization. The percentages are only indicative; they are estimates based on our extensive expertise in the digital sustainability space, the reading of many sustainability reports of publicly listed companies, and more than 70 conversations with venture capitalists interested in areas such as climate tech, fintech, nature tech, and sustainability as a field of investment.

To distinguish the four quadrants, we use a simple rule to identify a company’s dominant sustainability design.16 When the majority of a company’s sustainability activities or interests can be interpreted as reducing negative impact, we categorize it as “legacy & TradFi.” When the business has a clear set of activities that focuses on the creation of positive impact, it is classified as “regenerative & ReFi.” To make our digital classification, we focus on the types of digital tools used by the company. Companies that explicitly mentioned activities or experimentation with novel digital technologies were categorized as “novel,” and the rest were categorized as “legacy.”

The top-left quadrant is the domain where most legacy sustainability investment and attention is situated, representing the established incumbents in the voluntary carbon market and ESG space, as well as the companies servicing them using legacy digital technology.

The dominant investment focus is on reducing or avoiding negative environmental externalities, improving data tracking using Web2 approaches, and collecting data for sustainability reporting. Data collection often takes place in a manual and self-reporting way, as with the Carbon Disclosure Project. Similarly, most carbon-offset projects are verified through manual expert sampling following bureaucratic methodologies and registered on a centralized registry (e.g., Verra or Gold Standard).

Energy-efficiency and energy management systems are used by thousands of companies to better track energy consumption (and thus carbon emissions). ESG reporting tools like brightest.io are using Web2 tools to digitalize existing sustainability standards and facilitate data collection and decision-making. ESG ratings like MSCI, Sustainalytics, EcoVadis, and B Corp rely extensive self-reporting and human sense-making to evaluate the ESG credentials of companies and award them some form of recognition.

Traditional green bonds are issued by companies with a commitment to achieving specific environmental objectives, often related to carbon reduction. These bonds may come with built-in enforcement mechanisms, such as the obligatory purchase of carbon credits if targets are not met, or they may simply offer a more cost-effective way to finance sustainability investments.

The second most common quadrant is the bottom-left, where legacy sustainability approaches are combined with disruptive technologies from the Web3 space to improve data credibility, exchangeability, and transparency. Companies in this space tend to deploy blockchain and other Web3 technologies to make an existing practice more efficient, credible, or transparent.

In a simple form, this could be the tokenization of data or assets from a centralized registry (e.g., Verra) that are converted into blockchain-based tokens (e.g., through Toucan Protocol, Hedera Hashgraph, or TYMLEZ) for tracking and trading.

Singapore’s SP Group is one of the first mainstream energy companies to combine blockchain and Internet of Things (IoT) sensors to track energy consumption in real time to add credibility to the market for renewable energy certificates. Orobo seeks to innovate ESG reporting by focusing on the complexities of data collection in manufacturing supply chains, adding intelligence to regulatory frameworks from the EU using blockchain and artificial intelligence (AI). OpenESG aims to advance ESG ratings by creating an open, AI-powered rating system to provide more independent assessments of companies’ ESG performance. New standards like OxCarbon, and companies like Pachama and Kumi Analytics, are leading the way to make D-MRV essential to credible carbon offsets. Finally, various companies have used blockchain platforms like so|bond and GFT to issue tokenized green bonds with performance tracking happening on-chain. These approaches all seek to provide better-quality, more accessible, more transparent data to inform financial decisions within a TradFi approach.

The third most popular quadrant, top-right, contains approaches where regenerative sustainability and ReFi are reliant on Web2 technologies but are geared toward developing new business models in which new sources of value capture are tied to achieving regenerative sustainability.

Donation platforms like B1G1 help companies donate to trusted NGOs and benefit from tax deductions. Voluntary regeneration standards like 1% for the Planet, launched by regenerative pioneer Patagonia, help companies spend 1% of revenue on nature positive contributions. Beyond fostering a sense of moral responsibility, companies with the 1% for the Planet logo may benefit from more loyal employees and customers.

Rather than buying carbon offsets, AstraZeneca has embraced carbon onsetting by committing to planting 200 million trees across six continents by 2030 to support the World Economic Forum’s Trillion Tree Campaign.

Alipay’s Ant Forest is a gamified loyalty program that rewards users with energy points that can be converted to digital (and then real) trees. It is by far the most impactful corporate reforestation program in the world.

These centralized ReFi approaches pave the way for companies to capture value from restoring earth’s natural resources. Ant Forest has proven to be the most impactful loyalty program imaginable, ensuring that users use the app daily, often as one of the first things they do after waking up, to avoid friends stealing their energy points.

The fourth quadrant is the least populous but arguably the most ambitious and most aligned with the ReFi principles highlighted above. Within this quadrant, digital enterprises harness disruptive technologies to facilitate a more nuanced understanding and valuation of natural ecosystems. This enhanced comprehension is not an end in itself but serves as a cornerstone for value creation through the generation of positive-impact assets.

For example, Upright Platform, a German start-up, uses AI to analyze thousands of sustainability reports from the world’s largest companies to evaluate their global impacts using 19 different metrics (by giving a dollar value). Its metrics and assessments are publicly accessible.

EcoMatcher has evolved from a pure tree-planting organization into a disruptive digital company that uses AI-powered chatbots to let customers chat with trees and blockchain to track and tokenize each tree planted. Similarly, Plastic Bank has developed a blockchain platform to better track all the plastic its communities remove from the ocean and what happens with the plastic afterward, providing ocean-to-product traceability.

Finally, Handprint is a digital infrastructure that merges Web2 and Web3 to help companies capture value by creating a global positive impact across all 17 of the United Nations Sustainable Development Goals (UN SDGs). Handprint orchestrates space-based intelligence for impact visualization (with OpenForests), carbon estimation (with Kumi Analytics), biodiversity estimation (with Gentian), blockchain-based transparency (with multiple partners), and Web3-based funding for ecosystem restoration, all the while transferring impact ownership to its clients and allowing portability in the spirit of openness.

Conclusion

ReFi posits a revolutionary framework for the governance of global common-pool resources. However, this assertion is mitigated by myriad challenges, both technological and conceptual, particularly the feasibility of decentralized governance structures. These impediments persistently act as barriers to widespread adoption, inhibiting progress toward planetary health.

For instance, can decentralized governance structures be implemented in a way that meets both the efficacy and legitimacy criteria? Is improving the credibility, exchangeability, and transparency of nature and climate data and information sufficient to herald a change in deeply entrenched business models in which environmental externalities remain unpriced?

Advocates praise the transformative potential of emerging digital technologies with respect to decentralization, data credibility, and transparency, but it is prudent to question whether such innovations can truly disrupt existing paradigms absent a more comprehensive reconceptualization of corporate value creation and capture. The problems plaguing our current transactional systems (e.g., bureaucratic lags, opacity, and inefficiencies) are unlikely to magically dissipate with the adoption of novel digital technologies.

These problems could metamorphose into new forms of challenges, obscured beneath intricate layers of cryptographic algorithms, ML complexities, and the cybersecurity vulnerabilities inherent in IoT sensors and decentralized ledgers. This is often evident when disruptive ReFi organizations try to collaborate with financial incumbents — they face conflicts in underlying business principles that make collaboration almost impossible.17

Moreover, blockchain technology’s purported ability to catalyze innovative, participatory forms of governance embodies a paradox. The principle of decentralized, collaborative decision-making holds democratic appeal, but it simultaneously exposes the system to risks, such as fragmentation, diminished accountability, and potential subversion by technologically sophisticated actors.

Nevertheless, the exigencies of our planetary condition demand that both corporate and governmental entities radically reimagine their operational paradigms to reverse the trajectory of environmentally extractive practices. The conventional approach to sustainability, preoccupied as it is with minimizing detrimental impacts (footprints), is manifestly inadequate.

A more urgent, forward-looking paradigm is called for — one that shifts the discourse from culpability and remediation to opportunity and value creation (handprints). Imperfect as it may be, ReFi is perhaps the most viable conceptual innovation at our disposal for mitigating ongoing environmental degradation.

References

1 Boehm, Sophie, and Clea Schumer. “10 Big Findings from the 2023 IPCC Report on Climate Change.” World Resources Institute, 20 March 2023.

2 “Summary Report, 3–19 December 2022.” International Institute for Sustainable Development (IISD), accessed September 2023.

3 Anderson, Philip, and Michael L. Tushman. “Technological Discontinuities and Dominant Designs: A Cyclical Model of Technological Change.” Administrative Science Quarterly, Vol. 35, No. 4, December 1990.

4 Schillebeeckx, Simon J.D., and Ryan Merrill. “Regeneration First.” Handprint, 25 August 2023.

5 “What Is 30x30?” Conservation Corridor, accessed September 2023.

6 Hardin, Garrett. “The Tragedy of the Commons: The Population Problem Has No Technical Solution; It Requires a Fundamental Extension in Morality.” Science, Vol. 162, No. 3859, December 1968.

7 Ostrom, Elinor. “Coping with Tragedies of the Commons.” Annual Review of Political Science, Vol. 2, June 1999.

8 Porter, Michael E., and Mark R. Kramer. “Creating Shared Value: How to Reinvent Capitalism — and Unleash a Wave of Innovation and Growth.” Harvard Business Review, January–February 2011.

9 Schletz, Marco, et al. “Blockchain and Regenerative Finance: Charting a Path Toward Regeneration.” Frontiers in Blockchain, Vol. 6, July 2023.

10 Belenky, Lucas, et al. “Digital Monitoring, Reporting, and Verification Systems and Their Application in Future Carbon Markets.” The World Bank, 1 June 2022.

11 Blockchain and Climate Institute, et al. “Blockchain for Sustainable Energy and Climate in the Global South: Use Cases and Opportunities.” United Nations Environment Programme (UNEP)/Social Alpha Foundation (SAF), 2021.

12 Schletz, Marco, et al. “Nested Climate Accounting for Our Atmospheric Commons — Digital Technologies for Trusted Interoperability Across Fragmented Systems.” Frontiers in Blockchain, Vol. 4, January 2022.

13 Hsu, Angel, and Marco Schletz. “Digital Technologies — The Missing Link Between Climate Action Transparency and Accountability?” Climate Policy, August 2023.

14 George, Gerard, Ryan K. Merrill, and Simon J.D. Schillebeeckx. “Digital Sustainability and Entrepreneurship: How Digital Innovations Are Helping Tackle Climate Change and Sustainable Development.” Entrepreneurship Theory and Practice, Vol. 45, No. 5, January 2020.

15 George, Gerard, and Simon J.D. Schillebeeckx. “Digital Sustainability and Its Implications for Finance and Climate Change.” Macroeconomic Review, April 2021.

16 Anderson and Tushman (see 3)

17 Schillebeeckx and Merrill (see 4).