AMPLIFY VOL. 36, NO. 11

The recent tribulations in the carbon offset (CO) markets are unlikely to affect the long-term prospects for increased demand.1 Organizations implementing programs to reach net zero must play the long game with strategic intent.

We’ve seen the challenges experienced by those selling offsets (“suppliers”) and those looking to offset their emissions (“emitters”). Issues vary by asset type but must certainly be addressed if growth is to resume. For example, issues facing forest-based carbon assets include double counting, permanency, additionality, inaccurate measurement and lack of transparency, inaccurate accounting, disregard for ecological and land stewardship considerations, population displacement, and a deficient rule of law for ownership.

Most of these markets are no more than a couple decades old, unlike those based on fossil fuels, which started trading well over a century ago. Thus, any effective strategy must be long term but flexible enough to accommodate changes in the technical and business environment, enabled by informed decision-making.

BloombergNEF distinguishes between behavioral demand and fundamental demand for COs.2 Behavioral demand comes from marketing campaigns or first-time corporate initiatives; fundamental demand comes from departments or entire organizations treating offset purchases as a cost of business. It was behavioral demand that led to some large corporations claiming they had achieved net zero, without technical basis, resulting in reputational damage and exposure of offset-offerings deficiencies, potentially tainting the entire offsets market.

Kyoto, CARB & COP

The concept of COs was established under the Kyoto Protocol in the United Nations Framework Convention on Climate Change (UNFCCC) to enable countries to meet their emissions targets using the UN Clean Development Mechanism (CDM). The Kyoto Protocol gave rise to the compliance carbon market, including the EU Emission Trading System (EU ETS), the California Air Resources Board’s (CARB) Cap-and-Trade Program, the Regional Greenhouse Gas Initiative (RGGI), and China’s National Emissions Trading Scheme (ETS). Compliance markets are managed by government agencies, with compulsory participation by certain entities such as electric utilities.

The 2015 United Nations Climate Change Conference (COP21) in Paris enabled the use of market mechanisms and created a voluntary offset market. The compliance market now stands at around US $1 trillion; the voluntary market is around $1 billion.

The 2021 United Nations Climate Change Conference (COP26) in Glasgow introduced rules to reduce double counting or overestimation of offsets and improve the quality of credits offered in the market, and a net zero expert group was commissioned to issue recommendations to increase integrity in net zero commitments, with guidelines on how COs should be applied.3

Complexity, Risk & Controversy

CO application is fraught with complexity, risk, and controversy, which some think is undeserved.4 Sarah Leugers, Gold Standard’s chief growth officer, was quoted saying, “It’s frustrating that such energy is being used to criticize people doing something, when the people doing nothing are often let off the hook.”5 COs are seen as an attractive option because they are inexpensive and consistent with the appeals for immediate action at COP26, albeit as an imperfect, emerging mechanism.6

Emitters compensate emissions with emissions avoided (“credits”) or removed elsewhere (“removals”). The assumption is that emissions are global, so it doesn’t matter where they happen. However, the cost of compensating an emissions event can vary enormously depending on location. This lets traders take advantage of a cost differential or arbitrage to come up with the most economical compensating transactions, and because there has been no pressure toward quality or transparent offerings, it has become a race to the bottom.

For the purposes of this article, a CO unit represents the effect of removing one ton of greenhouse gases (GHGs) from the atmosphere, usually measured in CO2 equivalents (CO2e). This sequestration can take place as carbon stored in the biomass of a growing forest or through CO2 direct air capture. A carbon credit represents the avoidance of the emission of one ton of GHG through an industrial process (e.g., substitution of coal with natural gas or wind or solar energy for electricity generation), installing high-efficiency stoves, or through forest-preservation programs.

Currently, most carbon credits are traded in the compliance market, and most COs are traded in voluntary markets, although there is some cross-feed. A compliance market participant short on allowances can purchase them as offsets from voluntary carbon markets, and a voluntary market participant can generate credits from emissions-avoidance programs. Most of the criticism of compliance markets is leveled at voluntary markets, which are largely unregulated, self-regulated, or regulated by nongovernmental entities.7

Considerations for Applying Carbon Offsets

The controversy around COs and credits arises from issues of permanency, additionality, and accounting for both sequestered carbon in offsets and avoided emissions in credits.

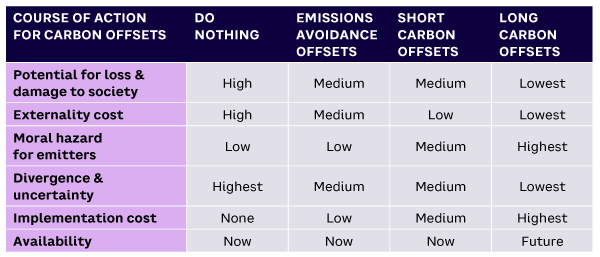

Table 1 shows a decision matrix for incorporating COs into a GHG and climate-mitigation strategy. Each column shows a course of action for the entity: do nothing, select CO instruments based on emissions avoidance, use short (impermanent) carbon, or use carbon in long-term storage. Note that each consideration may involve outcomes that impact external parties.

“Divergence & uncertainty” in Table 1 refers to the spread between negative and positive outcomes among market participants due to the inherent externalities of emissions. The emitting entity may end up reaping enormous benefits if the externality cost is borne mostly by society, but this has the potential (albeit small) to result in backlash, penalties, stifling regulation, or a long-term negative business environment. “Moral hazard for emitters” comes from the de-risking (i.e., license-to-pollute) effect of COs.

The “externality cost” refers to the cost borne by society due to the emitter’s operations. COs are a mechanism to internalize externalities: at least part of the cost of emissions is accrued to the entity, either via market mechanisms through the purchase of offset instruments or by regulatory entities through carbon taxes or credits.

Outcomes for externality costs are essentially the reciprocal of moral-hazard outcomes. Externality cost is lowest and moral hazard is highest when pricing signals make emissions immediately expensive.

It’s important to remember the CO market’s low maturity level. Before Henry Ford established the assembly line method for manufacturing, there were dozens of manufacturers, each with a handcrafted offering, made with individually manufactured parts. Vehicle owners had to be expert mechanics (or hire one) to maintain and repair their vehicle. Similarly, current CO offerings are one of a kind, making it difficult to compare offerings.

Purchasers are left to assess offerings and develop risk strategies. For most offset buyers, this work is a distraction from their main mission, and entities that manage this due diligence usually find that doing so delivers no respite from allegations of offset shortfalls or greenwashing (because the goalposts keep moving).

There is a complex supply chain behind every CO offering with an opaque value-added chain — and any system is vulnerable to exploitation when participants don’t know where profits are made.8 In addition, the carbon mass in a tree changes over time. Trees grow, get harvested, and can be affected by fire and other natural disasters, yet offset transactions are treated as a one-time, permanent construct.

The impermanency of the underlying asset cannot compensate for the permanency of emissions that can persist for hundreds of thousands of years. That means emissions liabilities must be registered in a permanent record. If the balancing offset is disturbed by some event, additional assets should be assigned for rebalancing, in a transaction not unlike a margin call.

CARB’s compliance market sets aside a buffer pool of forests held in reserve that cannot be negotiated to make up for potential future shortfalls. This program has been criticized as insufficient.9 The main issue is that this allocation is static and can’t factor in change. More precise, dynamic allocations might be possible with better data.

The Need for IT in Carbon Management

A recent International Energy Agency (IEA) report states that existing technologies could deliver 80% of the emissions reductions necessary by 2030.10 The report is referring to technologies like renewables, efficiency improvements, and methane-emissions reductions, but there is a foundational technology hiding in plain sight: information technology (IT).

IT can be used to maintain a real-time inventory of carbon assets, perhaps through a digital twin model as described in the following section. Any carbon-inventory shortfall would be immediately noted and corrected using predefined policies. If the underlying assets are trees, they grow, and this growth could be accounted for in the offsetting ledger.11

Researchers are advancing the notion that forestry assets can make a quantifiable contribution to GHG mitigation, even when they are less than permanent.12 The current practice of equating forestry assets to claim net zero is insufficient because the emissions are permanent, but the offsetting asset is not. Permanency can be achieved (at least from a statutory perspective) through the assignment of backup assets or policies to bring in replacement assets to make sure the liability is covered during the statutory period.

For the CARB compliance market, this period has been set for 100 years. This dynamic suggests that emissions liabilities never truly go away, especially when offsetting is done with impermanent assets. The need for permanent, reliable records that live beyond the organizations that created them demonstrates the need for an advanced IT infrastructure.

IT-Based Carbon-Trading System

Let’s look at how IT could be used to create a system designed to meet specific GHG mitigation goals. Here are some relevant considerations:

-

No technological breakthroughs are assumed that would impede immediate deployment. All functional blocks and services are available in-house or can be outsourced as part of normal corporate IT practices.

-

Assembly or integration may be needed for certain capabilities, but the components are readily available.

-

The cloud service ecosystem can be architected to present a unified, consistent view to users accessing heterogeneous resources.

-

IT enables complex strategies, such as building targeted portfolios like asset swaps under Oxford University’s recommended offsetting policies or meeting permanency requirements by serially substituting impermanent assets.13

In the remainder of this article, we use the Scalable Carbon Offset Open Platform (SCOOP) specification under development at my company, OptimiLabs, for illustration. SCOOP instances are composites of preexisting cloud services joined through application programming interfaces (APIs).

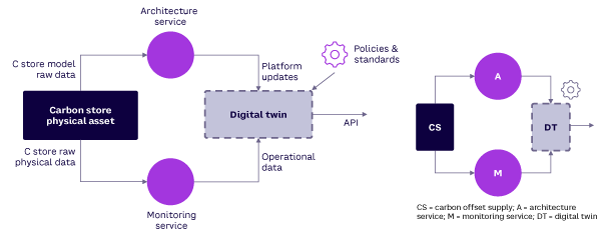

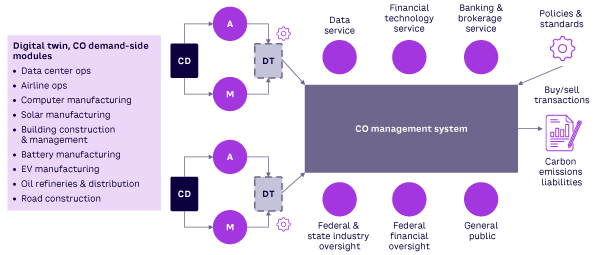

The foundational component of a SCOOP-based carbon-trading system is a carbon store or a carbon supply subsystem (see Figure 1). In most cases, the physical entity is not directly observable. Data from these sensors needs to be cleaned, correlated, and derated to specific policies to factor in permanency and additionality. Also, storage must be provided to keep a historical record, and a mathematical model must be integrated to produce forecasts if needed. These capabilities, including introspection, are encapsulated within a digital twin, essentially a computer model of the physical system.

Digital twins are developed by expert teams familiar with relevant carbon-storing processes in the target physical system and the associated metrology. They can be deployed in-house or by a third-party provider. In either case, the model must comply with applicable policies and standards and is subject to monitoring and audits by regulatory agencies for accuracy and transparency.

Digital twins are revised and updated regularly under a preestablished protocol or after certain events. For example, if the underlying carbon store asset is a forest tract, its digital twin keeps track of the biomass in that tract, along with GPS coordinates, as a mechanism to detect and prevent double counting.

The model uses logic to estimate carbon stored in biomass and the soil based on multimodal measurements from drones or aircraft and in-person physical measurements. Growth models for the mix of vegetation in the tract are integrated to enable growth forecasts.

Operational and event data collection are handled by a monitoring service provider, ideally a non-interested third party. In-house data collection may be admissible following policies and with appropriate safeguards.

The carbon inventory can be queried through an API. The data provided by a digital twin must meet legal requirements to serve as a foundation for financial securities.

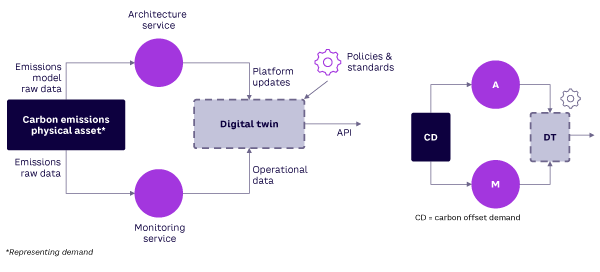

In the SCOOP model, carbon store and carbon emissions (carbon demand) subsystems are represented with the same physical asset/digital twin structure, except that the emissions subsystem now represents emissions physical assets (e.g., data centers) instead of a carbon store (e.g., a forest) — see Figure 2. (Going forward, we use the abbreviated version of the diagrams to make the larger-scale subsystems easier to read.)

The dashed border on the digital twin blocks represents nonphysical, cyberspace, or cloud entities defined by IT. The circles represent business functions or capabilities. Historically, these functions were implemented in-house, but with the cloud becoming ubiquitous, they are increasingly outsourced to third-party providers. These providers bring deep, specialized knowledge and expertise in their fields that operating entities would have trouble fulfilling. They also bring a professional reputation that builds trust into the system, enhanced by the participation of independent standards and financial-oversight agencies (private and state agencies with statutory mandates).

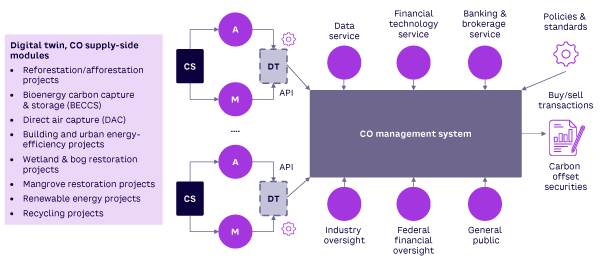

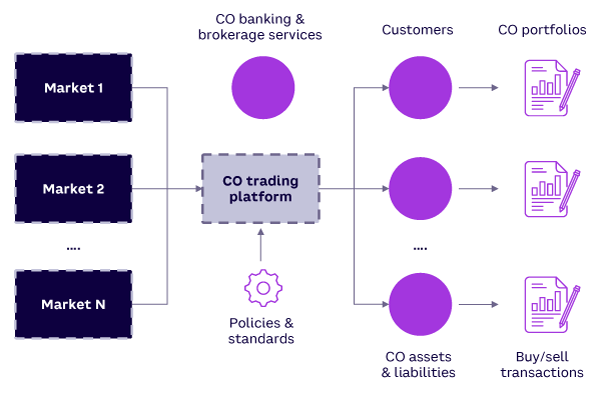

SCOOP is scalable in the sense that multiple carbon stores can be integrated in any number and combination into a carbon market through a CO management system, shown in Figure 3 along with examples of possible industry verticals. Carbon stores within a given market segment may have a common architecture to maximize reuse value.

In general, CO suppliers seek revenue from placing their offsets in their carbon market of choice while demand-side entities seek to discharge their carbon liabilities by: (1) paying a premium buying offsets to discharge or retire their carbon liabilities or (2) paying a broker to carry out the discharge on their behalf. More complex strategies are possible as markets evolve, including futures strategies or fixed-price contracts.

This type of carbon market becomes an ecosystem that allows one-of-a-kind suppliers to plug in their platform and access a much larger market. It also enables horizontal participation in which emitters seeking to compensate their emissions aren’t distracted from their main mission by the need to assess offerings and develop risk strategies. The market also facilitates pooling offerings from several smaller suppliers to satisfy large purchases.

This type of system is agile, modular, and resilient: small changes don’t trigger extensive rearchitecting, and the separation of policy from implementation makes it easier to track shifting requirements. As a particular industry gets closer to net zero, certain classes of assets or transactions may be disallowed and new policies introduced (e.g., a requirement that offsets can be applied only to Scope 3 emissions),14 to prevent the moral hazard of using cheap offsets to continue business as usual.

A similar arrangement exists for the demand side (see Figure 4). Of course, the details for the emission subsystems will be particular to the industries involved. Instead of CO securities, this market can issue paper to trade carbon emissions liabilities or purchase carbon-liability policies akin to those in the insurance industry.

The last component in the trading ecosystem is a CO trading platform accessing multiple instances of markets shown in Figures 3 and 4, enabling emitters and suppliers to participate in a global carbon market (see Figure 5).

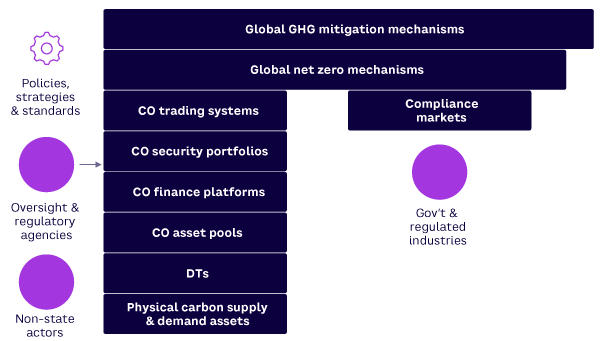

Global Integration

How does a SCOOP-based trading ecosystem fit into the UNFCCC Clean Development Mechanism and Paris Agreement Article 6 strategies? It establishes a formal linkage between carbon stores, carbon sources of emissions, and trading mechanisms toward global net zero goals. This can be seen by representing the concepts in Figures 1-5 as a voluntary market stovepipe (see Figure 6). The system can keep track of stores and emissions even if they have been retired, facilitating accounting toward net zero. Transaction records persist even if the original trading partners become defunct.

The stovepipe on the left of Figure 6 applies mainly to voluntary CO markets. Policies are needed to discourage abusive practices seen to date in CO markets. The policies are specific to a region/country and may disallow certain transactions, such as offsetting a large percentage of Scope 1 emissions to prevent offsets being used as a license to pollute or an oil company claiming to be carbon neutral because the emissions from burning the oil produced are assumed to be Scope 3 emissions borne by the buyers.

Next Steps

Critics of CO markets (especially voluntary markets) say they are unlikely to be a long-term mechanism for mitigating GHG emissions, but it’s important to remember that COs are just one mechanism toward net zero.

The concept of COs being applied to mitigate global warming has been around since the Rio Conference in 1992, but the concept of net zero only gained traction after a relatively successful COP21 and following a disappointing 2009 COP15. “Net zero” as a concept is still interpreted differently across different regions and will continue to evolve. The same is true for COs.

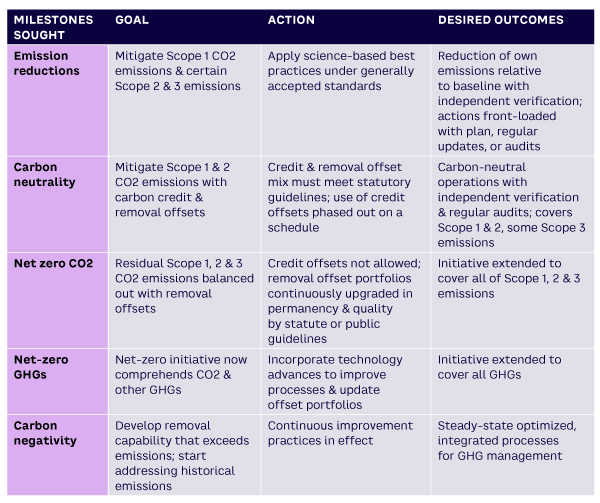

Corporations must approach this as they would any strategic-planning exercise in the presence of unknowns and risk. Table 2 shows a template for such a plan, inspired by milestones described in “Untangling Our Climate Goals: What’s the Difference Between Carbon Neutral and Net Zero?”15 by the Energy & Climate Intelligent Unit (ECIU). Implicit in this table are decisions such as disallowing the use of credits for Scope 3 mitigation. These items can be changed easily to accommodate local regulations. All actions are integrated with line-of-business activities to make sure the quality of the offsets matches the needs of the application.

Also implicit in Table 2 is the notion of progression toward more stringent milestones in the bottom rows. As the world progresses toward net zero, it can be assumed that most emission-reduction credits will have been taken and that entities that have emissions reductions in their portfolio that were initially acceptable may be obligated to replace them with higher-quality removal assets as recommended by the Oxford Principles. A SCOOP-based IT system can be used to provide a scoreboard to inform and track these corrective transactions.

References

1 “Long-Term Carbon Offsets Outlook 2023.” BloombergNEF, 18 July 2023.

2 BloombergNEF (see 1).

3 “Integrity Matters: Net Zero Commitments by Businesses, Financial Institutions, Cities and Regions.” High-Level Expert Group on the Net Zero Emissions Commitments of Non-State Entities, United Nations (UN), accessed November 2023.

4 Gabbatiss, Josh, et al. “In-Depth Q&A: Can ‘Carbon Offsets’ Help to Tackle Climate Change?” Carbon Brief, 24 September 2023.

5 Chapman, Angus, and Desné Masie. “Are Carbon Offsets All They’re Cracked Up to Be? We Tracked One from Kenya to England to Find Out.” Vox, 3 August 2023.

6 “Scientists Appeal for Immediate Climate Action at COP26.” Phys.org, 11 November 2021.

7 Song, Lisa, and James Temple. “The Climate Solution Actually Adding Millions of Tons of CO2 into the Atmosphere.” ProPublica, 29 April 2021.

8 Dunne, Daisy, and Josh Gabbatiss. “Infographic: How Are Carbon Offsets Supposed to Work?” Carbon Brief, 24 September 2023.

9 Badgley, Grayson, et al. “California’s Forest Carbon Offsets Buffer Pool Is Severely Undercapitalized.” Frontiers for Global Change, Vol. 5, August 2022.

10 Fernández, Araceli, et al. “Net Zero Roadmap: A Global Pathway to Keep the 1.5°C Goal in Reach.” International Energy Agency (IEA), September 2023.

11 Matthews, H. Damon, et al. “Accounting for the Climate Benefit of Temporary Carbon Storage in Nature.” Nature Communications, Vol. 14, No. 5485, September 2023.

12 Parisa, Zack, et al. “The Time Value of Carbon Storage.” Research Square (preprint), 16 March 2022.

13 Allen, Myles, et al. “The Oxford Principles for Net Zero Aligned Carbon Offsetting.” University of Oxford, September 2020.

14 In a nutshell, Scope 1 emissions from an entity are direct emissions from operations, such as in-company combustion of fossil fuels. Scope 2 emissions are indirect emissions from purchased energy, including electricity, heat, or steam. Scope 3 emissions are other indirect emissions in supply chains and outsourced activities. For more information, see: “Greenhouse Gas Protocol.” World Resources Institute, accessed November 2023.

15 Lang, John. “Untangling Our Climate Goals: What’s the Difference Between Carbon Neutral and Net Zero?” Energy & Climate Intelligence Unit (ECIU), accessed November 2023.