AMPLIFY VOL. 36, NO. 9

Food systems play a significant role in global greenhouse gas (GHG) emissions, with agricultural activities accounting for more than 80% of these emissions. Approximately 30%-40% of all food produced globally is wasted at various supply chain stages from production to consumption.1 This squanders valuable resources (including water, land, energy, and labor) and is a lost opportunity to alleviate food insecurity. Addressing these challenges is critical for environmental sustainability and keeping pace with a projected global population of 9.7 billion by 2050.2

Traditional supply chains, characterized by rigid structures and slow response times, are ill-equipped to meet the evolving demands of consumers and the challenges posed by climate change. Inefficiencies in these supply chains contribute to significant food waste and unnecessary GHG emissions.

Food waste has severe economic, social, and environmental consequences. Economically, it represents a loss of investment and resources for producers, retailers, and consumers. Socially, it exacerbates food insecurity and hunger, particularly in regions with limited access to food. Environmentally, decomposing food generates methane, a potent GHG.

Smallholder Farmers: Key Actors in Sustainable Agriculture

Smallholder farmers constitute about 70% of the global farming population and play a crucial role in global food production and security.3 Despite their significant contributions, smallholder farmers face numerous challenges in traditional agri-food supply chains, including limited market access, financial constraints, and lack of resources and technology. Limited market access, combined with information asymmetry and lack of trust, leads to farmers selling their products to a few trusted buyers at lower prices. This hinders their ability to maximize profits, expand their businesses, and access fair pricing mechanisms.4

Smallholder farmers often lack market intelligence, such as real-time information on demand, pricing, and consumer preferences. This leads to oversupply as farmers struggle to align their production with market needs.5 Consequently, a significant portion of the food produced by smallholders goes to waste, reducing environmental sustainability.

The Need for Dynamic & Efficient Supply Chains

We need dynamic, responsive systems to address waste-reduction challenges and increase efficiency in agri-food supply chains.6 Dynamic supply chains embrace flexibility, agility, and responsiveness. They can sense, respond, and adapt to changes in demand, enabling more efficient resource allocation, reducing waste, and optimizing overall supply chain performance.7

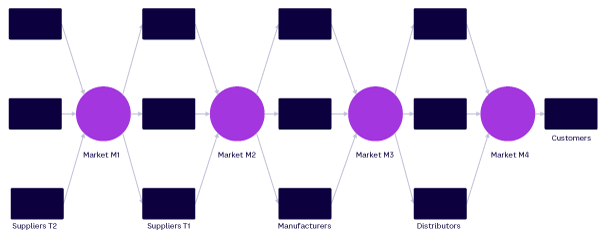

A key aspect of dynamic supply chains is the ability to leverage real-time data and market intelligence to make informed decisions. With access to timely and accurate information on consumer preferences, market trends, and supply chain dynamics, stakeholders can optimize their operations, reduce oversupply and waste, and align their production with market demand (see Figure 1).8

In the dynamic supply chain in Figure 1, there is a market between suppliers T2 and T1. Similarly, there is a market between suppliers T1 and manufacturers. This trend continues until the product is transferred to the customers.

In agri-food supply chains, there are many similar markets, such as:

-

A market between agri-input providers and farmers

-

A market between farmers and buyers

-

A market between buyers and retailers

-

A market between buyers and transport providers

-

A market between buyers and consumers

Traditionally, instead of having open competitive markets between players in the agri-food supply chain based on preestablished trust, rigid supply chains get formed. These work well if the supply, demand, transport, and storage needs remain the same. But when those needs change, rigid supply chains find it hard to adjust, resulting in the waste mentioned earlier.

These markets should be dynamic, efficient, and responsive. Additionally, trust plays a crucial role in enabling dynamic markets, since the farmers and buyers who respond to certain market demands can be unknown to each other and have no preestablished trust between them.

The Role of Trust & Social Capital in Agricultural Markets

Trust is a crucial aspect of human lives. It is defined as the “willingness of a party to be vulnerable to the actions of another party based on the expectation that the other will perform a particular action important to the trustor, irrespective of the ability to monitor or control that other party.”9 The trustor is the person who places him or herself in a vulnerable position under insecurity. The trustee is the person on whom the trust is placed and has the advantage of the trustor’s vulnerability.10

Trust enables transactions/exchanges between parties, and it functions as the bedrock for fair transactions in agricultural markets by mitigating risks and information asymmetry. A survey among smallholder farmers in the Nuwara Eliya district in Sri Lanka revealed that farmers are in a small trust bubble with a small number of trusted buyers. These farmers often choose trusted buyers to sell their harvest, even if their rates are low. They sell their harvest to unknown buyers only if they receive payment on the spot, due to the risk of not getting paid. This situation limits their options to reach buyers who offer competitive prices.11

Digital markets have enabled farmers to reach many buyers by removing time and location constraints, but they have increased the need for trust. A smooth buyer-seller relationship depends on contractual trust and competence trust. Contractual trust implies that promises will be kept. Competence trust refers to self-confidence in the ability of the trading partner to complete the task.12

In today’s digital world, most transactions happen in an e-commerce environment. Transaction trust in e-commerce depends on the trust placed in the counterparty (party trust) who engages in the transaction, trust in the control mechanism (control trust), potential gain, and the risks associated with the transaction.13 The control mechanism defines the procedures and protocols that monitor and control the successful performance of a transaction.

Blockchain technology is an exemplary mechanism to implement contractual and competence trust, with smart contracts based on a tamper-proof history of transactions. A tamper-proof history can enable a network of community relationships that facilitates trust, motivating purposeful action, known as “social capital.”14

How Trust Relationships Generate Social Capital

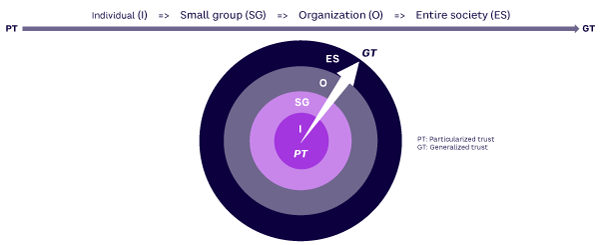

In the context of social relations, trust can be distinguished as particularized trust and generalized trust.15 Particularized trust exists in a specific domain with a narrow circle of familiar individuals. A trustor relies on past and present interactions and broader networks to measure a trustee’s motivations and trustworthiness. The broader network refers to the social environment in which both the trustor and trustee are embedded.16

Accumulated relationship experience can be used to find cues in the trustee’s expected behavior.17 Future interactions depend on how much the trustee values the relationship between the trustor and trustee and wants to maintain it.18 If the trustee has a reputation for success in his or her field, he or she is more inclined to be trustworthy to maintain his reputation.19 Note that using reputation systems for trust building has been shown to be a reasonable choice that can be justified.20

Generalized trust enables a wide array of activities at the societal level among a broader circle of unfamiliar individuals. As seen in Figure 2, a trustee’s trust radius begins in a particular domain where the particularized trust exists and expands to highly generalized trust with intermediate steps.21 However, the radius in each circle is indicative only, and there is no definite limit for each trust radius.

Although a smaller trust radius might indicate an individual success outcome, a larger radius might specify civic outcomes like community engagement. Communities are built on trust, most notably the generalized trust established on voluntary regulation of interpersonal relations between unknown individuals.22 These individuals perform actions without knowing the reciprocal actions of others, believing that positive communal relationship development will reward their altruistic behavior.23 The reward emerges as a specified social value to an individual, which is apparently the social capital.24 The more that social capital is used, the more trust, association, and civic engagement are strengthened, engendering the collective well-being of the community.25

Digital Trust Transformative Market Model

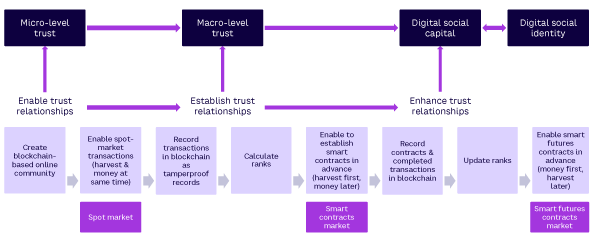

The Digital Trust Transformative Market (DTTM) model offers a robust solution to the challenges faced by traditional agri-food supply chains. By leveraging blockchain technology to foster trust among supply chain actors, DTTM enables the creation of dynamic, efficient, sustainable supply chains.

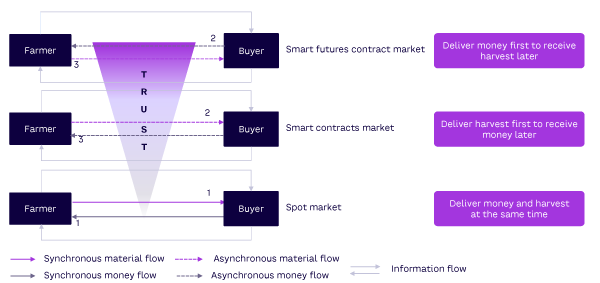

A supply chain in which various actors are connected through an efficient market mechanism can rapidly adjust to varying conditions. Among other factors, the ability to establish trust among previously unknown parties is a key requirement for an efficient market. DTTM consists of three market mechanisms with various levels of trust for its operation: spot markets, smart contracts markets, and smart futures contracts markets (see Figure 3).

Actors can start trading with a market mechanism that requires a low level of trust and, over time, transit into mechanisms that require a higher level of trust. The market models that require a higher level of trust provide higher economic benefits, such as support for automatic aggregation, enabling economies of scale.26

The spot market, which requires the least amount of trust, helps farmers trade their harvest after negotiating a price with buyers. Transactions are recorded in the blockchain, ensuring non-repudiation, reliability, and immutability, thus enabling trust in the market model. This tamper-proof data is used to generate ranks for the farmers, buyers, and farmers’ communities, generating trust indicators for them.

Over time, DDTM enables the smart contracts market, where farmers can sell their expected harvest in advance to buyers who offer competitive rates. These transactions are recorded in the blockchain to update the ranks, improving the trust relationships between them. The improved trust relationships enable engagement in the community, influencing stronger social networks, increased cooperation, and enhanced collective well-being, generating social capital.

This social capital enables the smart futures contract market, where the farmers can sell their expected harvest in advance and request an up-front payment using social capital as collateral. The farmers can use this payment to apply high-quality inputs and modern technology to produce high-quality harvests that attract higher prices. The process of trust and social capital development in the DTTM model is shown in Figure 4.

With enhanced trust levels, DTTM enables dynamic behavior in the market, since the buyers and sellers do not need preestablished trust to perform transactions. They can sense and respond according to the market requirements, since the risk of not getting paid or not receiving the products is minimized. This helps them allocate resources optimally, reducing waste and improving efficiency.

Additionally, DTTM optimizes transportation by enabling better coordination and planning. With real-time market intelligence and demand information, logistics can be optimized to minimize empty trips, reducing fuel consumption and lowering transportation-related GHG emissions.

DTTM in Action: Digitalizing Village Fruit & Vegetable Market

We have applied the DTTM model to create a digital version of village fruit and vegetable markets, creating significant benefits for market participants, establishing price stability, enabling better supply and demand balance, and reducing waste.

These markets are common in semi-urban areas and villages in most countries, and they played a crucial role in ensuring food security during the pandemic when long food supply chains got disrupted.

However, the limited number of buyers and sellers associated with physical markets leads to significant price fluctuations and over and undersupply situations, resulting in substantial waste and unsatisfactory outcomes for market participants.

We studied the behavior of buyers and sellers in these markets, looking at price discovery, trust establishment and exchange mechanisms, and how these factors change over time. A new buyer who comes to the market will first walk around, checking prices (the price-discovery phase). Over time, the buyer will make connections with a few sellers and mostly buy from them, significantly reducing the time spent on buying items during subsequent visits. To establish these connections, the sellers have provided quality items at competitive prices (spot market and initial trust establishment phase in DTTM).

In time, the buyer can ask trusted sellers to provide a fixed quantity of items at regular intervals. If the buyer is purchasing in bulk, for example, for a restaurant or for resale in a shop elsewhere, he or she can establish contracts with many vendors. This reduces the buyer’s transaction and transport costs and ensures timely supplies. If sellers know about future orders, they can better plan, reducing potential waste. The buyer and the sellers can use the contract market model now in DTTM to support these exchanges.

If transacted quantities are high, many farmers can aggregate their produce to meet buyers’ requirements. This community selling requires trust among the farmers, in addition to trust between buyers and sellers. Trust among farmers is very important; they collectively need to take responsibility for the quality to maintain a healthy trust relationship between the community of farmers and the buyers. When high trust levels are achieved, farmers can ask for advance payments, transforming the market mechanism to a futures market. We have observed that at this level of trust and income stability, farmers can get loans to buy items like tractors, harvesters, and solar-powered water pumps at competitive interest rates from banks focusing on agriculture and rural development.

Logistics was a challenge we had to solve when creating the digital version of the village market. With buyers and sellers at two locations, we had to replace the simple face-to-face exchanges of a physical market with a more complex exchange mechanism that includes logistics. By aggregating order details, we were able to create a very efficient way to transport purchases from supplier to buyer by using trucks that come empty after taking various goods from cities to villages (in logistics, this is known as “backhauling”).

We partnered with a farmer-focused development finance bank in Sri Lanka to establish collection centers in villages and managed the finances necessary for the DTTM model using their banking network and ATMs. We used WIDYA (an agri-tech start-up in Australia) to implement the technology and a major logistics provider in Sri Lanka to provide backhauling and last-mile delivery to consumers.

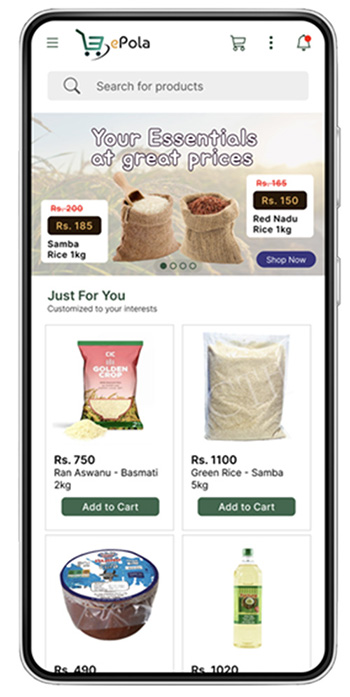

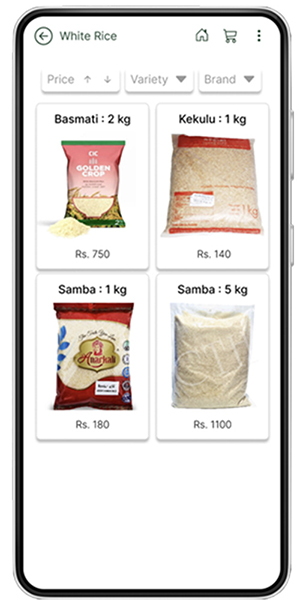

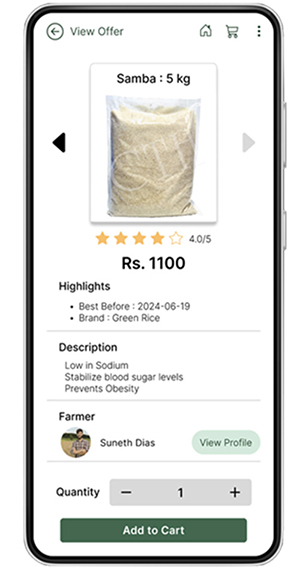

Consumers can search for a product and see farmers that are offering that product as well as the various prices (see Figures 5 and 6). Based on the information provided about the product and the farmer, the consumer can decide which farmer’s product to buy and place an order (see Figure 7). The farmer can decide the selling price and the price set by other farmers for the same product. A farmer being able to set the price and sell directly to the consumer without an intermediary is a key feature that mimics physical village markets. This approach puts the responsibility of maintaining the quality on farmers if they want high rankings and repeated sales.

Once the order is placed, the system holds the payment and asks the farmers to deliver the product to the village collection center. During this process, the farmers receive 50% of the agreed-upon price. The aggregated orders are sent to the distribution centers in the cities. At the distribution centers, the items going to the same locations are grouped and handed over to a last-mile delivery service.

Once the item is delivered to the customer, the farmer receives the balance of the price, less service fees and delivery costs. Due to the economies of scale achieved through efficient aggregation and coordination, the service and delivery costs are very low compared to traditional supply chains that have intermediaries.

Successful completion of orders, ratings, and reviews helps farmers establish trust among themselves as well as with consumers.

Conclusion

The DTTM model offers a transformative solution to the challenges faced by traditional agri-food supply chains. By leveraging blockchain technology and fostering trust among supply chain actors, the model has the potential to enable dynamic, efficient, sustainable supply chains.

Through spot markets, smart contracts markets, and smart futures contracts markets, DTTM facilitates transactions, enhances market intelligence, and enables better matching of supply and demand. By addressing the lack of trust among farmers and buyers, DTTM expands the market activities of smallholder farmers, reduces waste, and promotes socioeconomic sustainability.

The successful implementation of the DTTM model in our example demonstrated its ability to reduce waste, optimize logistics, and achieve sustainable outcomes. By embracing this model, the agri-food industry can create a more sustainable future, ensuring efficient resource use, reduced GHG emissions, and improved livelihoods for smallholder farmers.

References

1 Vermeulen, Sonja J., Bruce M. Campbell, and John S.I. Ingram. “Climate Change and Food Systems.” Annual Review of Environment and Resources, Vol. 37, November 2012.

2 Department of Economic and Social Affairs. “World Population Prospects: Key Findings and Advance Tables.” United Nations (UN), 2015.

3 “Small Family Farmers Produce a Third of the World’s Food.” Food and Agriculture Organization of the United Nations (FAO), 23 April 2021.

4 Kumarathunga, Malni, Rodrigo Calheiros, and Athula Ginige. “Technology-Enabled Online Aggregated Market for Smallholder Farmers to Obtain Enhanced Farm-Gate Prices.” 2021 International Research Conference on Smart Computing and Systems Engineering (SCSE). IEEE, 2021.

5 Ginige, Athula, et al. “Digital Knowledge Ecosystem for Achieving Sustainable Agriculture Production: A Case Study from Sri Lanka.” 2016 IEEE International Conference on Data Science and Advanced Analytics (DSAA). IEEE, 2016.

6 Ginige, Athula. “Collaborating to Win — Creating an Effective Virtual Organisation.” Proceedings from the 2004 International Workshop on Business and Information (BAI 2004), Taipei, Taiwan, 2004.

7 Ginige (see 6).

8 Ginige (see 6).

9 Mayer, Roger C., James H. Davis, and F. David Schoorman. “An Integrative Model of Organizational Trust.” The Academy of Management Review, Vol. 20, No. 3, July 1995.

10 Laeequddin, Mohammed, et al. “Trust Building in Supply Chain Partners Relationship: An Integrated Conceptual Model.” Journal of Management Development, Vol. 31, No. 6, June 2012.

11 Kumarathunga et al. (see 4).

12 Sako, Mari. Price, Quality and Trust: Inter-Firm Relations in Britain and Japan. Cambridge University Press, 1992.

13 Tan, Yao-Hua, and Walter Thoen. “Formal Aspects of a Generic Model of Trust for Electronic Commerce.” Decision Support Systems, Vol. 33, No. 3, July 2002.

14 Bourdieu, Pierre. “The Forms of Capital.” In Handbook of Theory and Research for the Sociology of Education, edited by John Richardson. Greenwood, 1986.

15 Yamagishi, Toshio. Trust: The Evolutionary Game of Mind and Society. Springer, 2011.

16 Schilke, Oliver, Martin Reimann, and Karen S. Cook. “Trust in Social Relations.” Annual Review of Sociology, Vol. 47, July 2021.

17 Larson, Andrea. “Network Dyads in Entrepreneurial Settings: A Study of the Governance of Exchange Relationships.” Administrative Science Quarterly, Vol. 37, No. 1, March 1992.

18 Poppo, Laura, Kevin Zheng Zhou, and Sungmin Ryu. “Alternative Origins to Interorganizational Trust: An Interdependence Perspective on the Shadow of the Past and the Shadow of the Future.” Organization Science, Vol. 19, No. 1, February 2008.

19 Schilke, Oliver, et al. “Interorganizational Trust Production Contingent on Product and Performance Uncertainty.” Socio-Economic Review, Vol. 15, No. 2, November 2017.

20 Räisänen, Jaana, Arto Ojala, and Tero Tuovinen. “Building Trust in the Sharing Economy: Current Approaches and Future Considerations.” Journal of Cleaner Production, Vol. 279, January 2021.

21 Tan and Thoen (see 13).

22 Bressler, Stacey E., and Charles E. Grantham, Sr. Communities of Commerce: Building Internet Business Communities to Accelerate Growth, Minimize Risk, and Increase Customer Loyalty. McGraw-Hill Professional, 2000.

23 Putnam, Robert D., Robert Leonardi, and Raffaella Y. Nanetti. Making Democracy Work: Civic Traditions in Modern Italy. Princeton University Press, 1994.

24 Kumarathunga et al. (see 4).

25 Geleta, Esayas Bekele. The Microfinance Mirage: The Politics of Poverty, Social Capital and Women’s Empowerment in Ethiopia. Routledge, 2015.

26 Kumarathunga, Malni, and Athula Ginige. “Business Model Transformation with Technology-Enabled Social Capital in Agriculture Domain.” Proceedings of the 2022 Australasian Conference on Information Systems (ACIS). Australasian Association for Information Systems (AAIS), 2022.