CUTTER BUSINESS TECHNOLOGY JOURNAL VOL. 30, NO. 9

In this article, Andreas Zolnowski and Markus Warg go deep into the technology platforms necessary to deliver enhanced customer experiences. Their work enables the objectives described by those calling for personalized, customized, client/service-centric insurance policies, procedures, processes, and products. The authors focus on the evolution of technology platforms from the monolithic ones used by large, traditional insurers. They acknowledge that incumbent insurers build their business on long-term customer relationships and require “the implementation of a comprehensive technological service platform that integrates legacy and modern infrastructure.”

Exploiting the opportunities of digital technologies is a key challenge for most companies and a driver for digital transformation. While insurtech startups establish innovative customer-centered solutions based on disruptive technologies without having to build on any other software or systems, incumbent insurers must deal with existing, stable, but non-agile legacy systems and cultural barriers. In contrast to startups, however, incumbent insurers have built their businesses on long-term customer relationships, enabling them to rely on huge amounts of historical data about their customers and specific capabilities in the insurance business (e.g., knowledge of legal requirements, supervision, risk management, process capabilities, and professional competence).

To respond to the opportunities of the market and to exploit the existing data treasure, incumbent companies must combine traditional and modern capabilities and technologies to foster service innovation. Especially important in this endeavor is the implementation of a comprehensive technological service platform that integrates legacy and modern infrastructure. In this article, we reflect on the experiences gained in the digital transformation of a traditional insurance company in Germany.

Insurtechs and Incumbents: Capabilities Compared

Dramatic changes in technology and customer behavior have led to manifold challenges as well as opportunities in the insurance industry. Taking advantage of these changes, insurtech startups are entering the market and are competing for market share with incumbents.

Although long-term relationships and trust characterize the insurance industry, the changes initiated by insurtech seem to be pushing the market forward. As in other industries, startups mostly enter the market without traditional viewpoints. Instead, they question the existing structures and try to establish new, innovative solutions. This openness is one of insurtech’s most important advantages and does not exist only with regard to existing structures. Increasingly, insurtech startups are showing an openness toward customers and consistently aligning their business with their customers and their needs. With this service mindset, startup companies question existing processes and focus on examining how customers behave.

With the ubiquity of technology and connectivity, customer behaviors have changed significantly. Customers tend to expect real-time services that encompass context-specific interaction. In concrete terms, this means that customers expect an individual approach that addresses each customer and his or her specific situation.

To meet this expectation, startups apply modern technologies that allow real-time processing of customer behavior and data. This technology is purpose-designed and rightfully aligned to the actual requirements of the solution. Startups run lightweight IT that is affordable, scalable, and flexible. This lightweight design makes it possible to proceed iteratively, and thus better meet customer requirements step by step, as they evolve.

Although startups outperform incumbent insurance companies in their flexibility and innovation, incumbents have significant advantages over startups. As mentioned earlier, incumbents have been in the market for decades and have created a broad customer base. They are frequently in contact with the customer and enjoy a great deal of trust that they have built up over time. Moreover, they have a lot of experience with legislation and regulation, have necessary licenses, and retain sufficient capital resources. Most important, however, are incumbents’ existing contracts and trust. Since insurance contracts sometimes have very long terms, it is not possible to switch carriers quickly. For example, obstacles in the German insurance industry, such as age-dependent premiums when taking out insurance policies, make it costly to change health or life insurance carriers. Moreover, insurance companies build on the trust of their customers and, as a result, customers feel strongly dependent on them. In addition to their broad customer base, incumbents have strong internal capabilities as well. Over the years, incumbents have built up process and professional competence that ensures efficient, effective, and legally compliant operations.

Due to long-term relationships and existing contracts, incumbents have significant data on their customers. Insurers can apply this data to design customer-specific solutions. However, many incumbents have difficulties using that data in a real-time environment. To cope with the disruption of digital transformation, an incumbent should combine its advantages with those of insurtechs, including openness regarding customer needs, new technical innovations, and a service mindset.

As we observed in our German case company, incumbents have three main challenges:

-

An incumbent must deal with legacy infrastructure.

-

An incumbent should adopt a service mindset that allows it to develop customer-oriented solutions.

-

An incumbent should derive benefits from its existing data and knowledge of the customer.

In the following sections, we examine these aspects in more detail.

Integrating Legacy and Modern Infrastructure in an SDA-Based Platform

Incumbents face a complex legacy IT that has built up over decades and consists of an enormous amount of different applications, databases, and systems. All components of this legacy IT are integrated into the company’s business processes, and thus all ongoing operations are dependent on it. Considering the challenges of modern customer solutions, legacy IT is not able to meet the requirements for agile and flexible design. Instead, legacy IT is regularly characterized by monolithic applications that are specialized for defined purposes and installed on dedicated servers or mainframes. Also, all development projects for new business functions are planned thoroughly and carried out in long-term projects with a defined output.

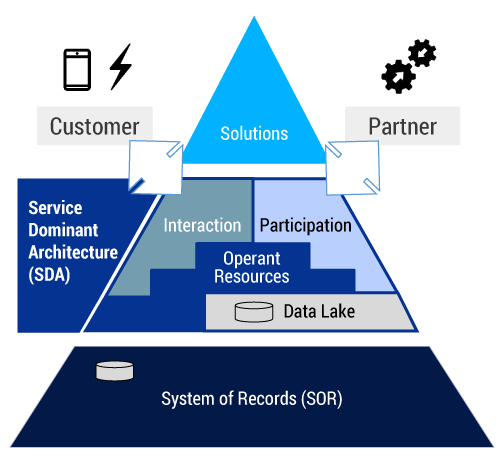

To overcome the challenges of legacy IT, “companies have to establish agile, flexible, and collaborative processes and structures, and to execute this transformation without affecting ongoing operations.” To do this, incumbents must build on insurtech’s complementary capabilities. One possible way to integrate the complementary capabilities of incumbents and insurtechs is the realization of a two-speed IT. For the realization of a two-speed IT, our case study company implemented a Service Dominant Architecture (SDA). The SDA operationalizes concepts from service science in an architectural blueprint for the implementation of a service platform (see Figure 1). Within its two-speed IT, our case company implemented a service platform on top of the legacy infrastructure, adding important complementary capabilities to its legacy IT.

Figure 1 — The Service Dominant Architecture. (Adapted from Warg, Weiß, Zolnowski, and Engel.)

The SDA, as the architectural blueprint of the service platform, enables the integration and orchestration of capabilities and other resources (e.g., processes, data, applications, and functions) into agile, flexible, and collaborative services in real time. To generate customer-centric solutions, the SDA implements necessary technical systems to capture (i.e., integrate all relevant capabilities and resources and enable the participation of different partners with relevant capabilities and resources in value creation), exchange (i.e., facilitate the interaction between customer and provider to co-create value), and orchestrate relevant capabilities and resources. In this way, the service platform facilitates the implementation and development of new, customer-centric solutions.

Based on the theoretical foundations of service research, SDA comprises three technical service systems as well as a data lake. The first of these systems is the system of interaction, which allows interaction with the customer and thus enables cocreation, as with the interactive relationship between a provider and a customer during value-creation processes. Within these processes, a customer can interact with the service provider via a variety of different interfaces. Examining the interaction, the service provider can then identify the customer’s needs and requirements and, based on this knowledge, implement customer-specific solutions.

Since different capabilities and resources are needed to realize solutions, the second technical service system is the system of participation. This system allows the integration of any partner into a fixed or loosely coupled system in which capabilities and resources for the development of new value propositions are orchestrated. The third technical system, the system of operant resources, provides existing capabilities and resources from legacy IT of the company. Here, resources from legacy IT (also known as the “system of record”) are transformed into dynamically applicable information resources.

A supplementary data lake enables the application of all information in real time. It introduces new IT artifacts, related data structures, and management techniques, as well as related data management capabilities such as big data approaches and techniques (e.g., Hadoop, machine learning, artificial intelligence, and algorithms).

A service platform like the SDA enables a company to do the following:

-

Accelerate the capabilities in customer-centric areas.

-

Achieve useful collaboration and cocreation.

-

Deepen data-based customer understanding.

-

Create networks of partners and other external service providers.

In this way, the insurer integrates the necessary capabilities and resources to realize flexible and customer-centric solutions.

However, as we observed in our case study, implementing a service platform on top of legacy IT is not sufficient. Legacy IT consists of manifold applications and databases essential to the company’s survival that serve existing processes and customers, so these applications must continue to operate. At the same time, existing applications, data, and infrastructure that were designed for traditional IT environments limit the incumbent’s ability to maneuver.

Mastering this challenge requires a radical shift in legacy IT toward a target of more modularity and flexibility. In our case study, this target was achieved in two major steps. The first step involved developing new services for existing applications and databases, encapsulating existing application processes and data, and facilitating the modularization of the legacy components. (Modularization is an essential element for a more flexible use of existing applications and data.)

The second step involved reengineering the insurer’s existing applications. This reengineering is necessary for several reasons. First, existing applications are built-in monolithic structures that are optimized for operations on mainframes. Second, these applications are based on traditional programming languages like COBOL, for which there are fewer and fewer people with corresponding programming skills. Third, there are a variety of different specialized applications, the number of which need to be reduced. In our case study example, the company has more than 10 applications for preparing insurance offers because of the historical development of the company’s business. To reduce this application landscape size over time, the company is striving for one integrated application for all offers.

In general, the goal of all activities is the integration of traditional capabilities on the service platform, thus combining advantages of the incumbent insurers (e.g., experience with regulation and a base of existing clients) with advantages from insurtechs, including customer centricity, flexibility, and simpler structures.

The Need for a Service Mindset

Thus far, our case company has focused on its insurance products and product details (e.g., coverage, premiums, and terms). In addition to the implementation of a comprehensive service platform and considering the current market evolution, a change in the corporate culture and mindset was necessary. Triggered by changes in customers’ behavior and inspired by the SDA, top management in the company developed a unified understanding of service as a target for the entire company. This understanding has been spread throughout the organization and is used as a common perspective for organizational development.

As an examination of customer behavior shows, the client’s essential needs do not change. Insurance industry customers mainly seek protection, asset growth, and risk management. Simultaneously, offerings need to be convenient and, hence, understandable and fair. Even if the needs of the customers do not change, their behaviors do. Customers are already accustomed to new technical possibilities and innovative value propositions, resulting in modified behavior characterized by the use of various communication channels between customer and company. Clients also are broadly involved in value-creation processes and thus are used to personalized or individualized offerings, and they are used to communicating and sharing with modern technology.

In general, changes in customer behavior lead to new requirements that IT and its organization must fulfill. IT must enable fast and dynamic interactions between the company and the customer, support real-time communication, and be consistent across all communication channels.

As illustrated in the case study, driven by these requirements, incumbents must implement a more flexible organization with flexible processes. The target of the organizational change is to change the traditional culture and to establish a modern and empowering culture. To achieve a modern culture at our case insurer, an agile project culture was successively introduced in new projects. This gave employees greater responsibility, more flexibility, and increased proximity to the customer.

This greater proximity to the customer, with a focus on customers’ needs and requirements, was key to achieving customer-centric solutions. Customer-centric design approaches (e.g., Design Thinking) and agile project structures enabled our case company to achieve a comprehensive integration of the customer and thus enabled complementary capabilities that previously have been associated only with insurtechs.

Increased Exploitation and Use of Data

To better understand the customer and to be able to design customer-centric solutions, incumbents need more proximity to the customer. However, it is difficult to integrate the customer into business processes. One way to better understand the customer is through data about that customer. In our case company, the service platform facilitates the capabilities for storing and processing customer data, which was a basic requirement for a better understanding of the customer. Specifically, the service platform — and particularly the data lake — acts as a central space for any relevant data. This includes all data from legacy IT, data obtained directly from the customer, and data from other partners.

A key challenge in implementing the data lake is integrating existing data from legacy IT. As we observed in our case study, accessing data held in different systems and databases is very complex, especially in incumbents with historically grown IT structures. Hence, we recommend a step-by-step integration of available data. Due to the amount of data, the data lake is not supposed to map the data from the legacy databases completely. Instead, a relevant subset of frequently required data is identified and implemented.

Data the customer provides is important and equally necessary to better understand the customer’s current situation. At first, the case study company implemented rather easy prototypes that tracked the interaction of the customer with the website. In more sophisticated prototypes, the case study company intends to incorporate mobile phones or fitness trackers to gather customer data.

Data from other partners is useful as well, complementing the insurer’s existing data and enabling a more comprehensive view of the customer. For example, by adding statistical data about the place of residence, the insurer can derive additional information about the customer.

The consistent collection and use of data results in the implementation of an event-driven architecture. An event-driven architecture is characterized by reacting to defined events and carrying out appropriate actions. This enables the insurer to offer the customer a tailor-made service.

In general, knowledge about the customer is becoming increasingly important. This knowledge enables customer-specific solutions that correspond to the actual customer’s problems and delivers added value to the customer. This customer focus is particularly necessary for competition with insurtechs, which are characterized by high customer orientation.

Changing Business Models of Incumbent Insurers

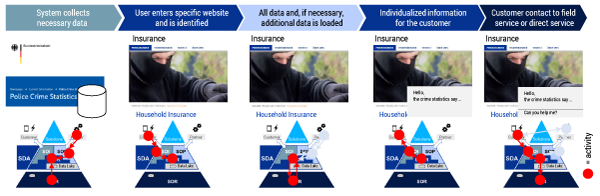

Changing customer expectations and the competitive pressure insurtechs are exerting are propelling changes in existing insurance companies’ business models. One example from our case study illustrates how an insurer can adapt and extend an existing value proposition and business model. In this example, a prototypically implemented use case reveals how additional information about the customer can improve the customer approach (see Figure 2).1

Figure 2 — Individualized information on a website: a use case. (Source: Zolnowski and Warg.)

In this case, individualized information appears on the insurance website as a starting point for additional offers. Our case study company implemented this feature on its website as a result of the capabilities and resources it collected on the service platform.

The prerequisite in this case is that the visitor is an existing customer and has previously visited the website’s login area. During the login process, a cookie was written on the visitor’s computer that helps to identify the customer for future visits.

The first step of the use case starts before the customer accesses the website, with the identification and collection of all necessary data. In our case study, this data was defined during the implementation of the solution, so it can be loaded to the data lake if required. Preloading data enables individualized responses even when the data source is no longer available. In this instance, local crime statistics were identified as necessary data and loaded to the data lake. Additional data specific to the customer was identified in legacy IT as well and transferred to the data lake. By copying all necessary data to the data lake, it is now possible to identify the customer and offer additional information in real time.

In the next step, the customer enters the website’s household insurance area. The customer connects to the service platform and the cookie identifying the customer is submitted to the platform. In this step, the system recognizes the customer’s identity and, based on this knowledge, the service platform loads all necessary data about the customer, including information on the customer’s current insurance contracts. At the same time, the service platform loads the crime statistics from the cache and, if required, any additional data from the insurance company’s partners. The platform can now provide the customer with individualized information; in this case, the crime statistics for the customer’s address.

As a last step, the customer may want to contact the insurance company. The customer can contact the service platform and is forwarded either to the direct service center or to an external partner.

In this example, the service platform is a central element for innovative solutions by the incumbent organization. The integration of all necessary resources and capabilities in a comprehensive platform facilitates a customer-centric approach with situationally relevant information. The insurance company can create and offer a customer-specific customer benefit, and thus a value proposition that was not possible before, signaling a comprehensive change in the business model. As a solution provider, the insurance company can offer a value proposition that goes beyond household insurance. It can position itself as an expert in home security and offer additional services, such as a new alarm system.

By implementing a service platform, our case study company combined complementary capabilities and resources from its existing business with insurtech capabilities — an essential part of the digitization of the insurance company.

Summary

Incumbents seeking to digitize their businesses need to combine traditional and modern capabilities and technologies. Implementing a service platform is one possible approach to address this issue. This platform facilitates the development and integration of all necessary capabilities and acts as the nucleus for innovative solutions.

Capabilities and technologies are not everything, however. Creating customer-centric solutions also requires an open service mindset, which helps to develop a comprehensive understanding of the customers’ needs and behaviors. To achieve this understanding, incumbent organizations need to analyze and collect data on their customers. By achieving a comprehensive understanding of customers and adopting a service mindset, companies can react to customers’ changing behaviors and thus develop customer-centered solutions.

1 Zolnowski, Andreas, and Markus Warg. “Conceptualizing Resource Orchestration — The Role of Service Platforms in Facilitating Service Systems.” Proceedings of 51th Hawaii International Conference on System Sciences, forthcoming January 2018.