CUTTER BUSINESS TECHNOLOGY JOURNAL VOL. 30, NO. 9

Andrea Silvello examines how connectivity impacts insurance processes and products. More specifically, he describes a framework for whole new personalized product categories otherwise bundled as microinsurance. As the author argues, the traditional insurance industry has been dominated for decades by a one-size-fits-all product suite. But now, thanks largely to the availability of algorithms capable of situational underwriting in real time, clients can choose insurance instruments that best suit their needs. The author takes a bold step describing a customized, personalized, real-time insurance future.

Connected insurance, enabled by big data, the Internet of Things (IoT), and artificial intelligence (AI), is disrupting a major industry that is traditionally resistant to change. Insurance technology — or insurtech — is a vast field and incorporates the interconnected landscape of connected insurance with its three pillars: health, car, and home. Microinsurance comes as a transversal opportunity that can help close the protection gap on the one hand and allow carriers to propose customer-centric products and services aligned with client expectations and behavior on the other hand. But connected insurance is mainly about people: how to reach and engage with them in an efficient way and, at the same time, connect their risks with the insurance cover they take.

In keeping with the people strategy comes the understanding that the individual customer needs to be put at the center of every company that wants to succeed. The customer-centric approach starts from the realization that there is no “average” customer. Customers have different behaviors and preferences, and this presents rich opportunities to move past the outdated one-size-fits-all approach, even in the insurance industry.

Insurers that understand the client has to become the central point will need to put in place mechanisms and the technology to target the right customers, through the right channels, with the right messages, at the right time. This is a strategy that will drive long-term value to the business by acquiring high-value customers and keeping them coming back. Insurtech is the key to this and to other types of optimization.

The tendency is for insurance companies to become more of a 360-degree “counselor” that assists the insured in making the best decisions based on connected insurance solutions. Therefore, it’s important to understand how the three enablers — big data, IoT, and AI — work together and what their roles are in the development of connected insurance.

Back to Basics

Big data refers to massive quantities of data, both structured and unstructured, that need to pass through certain processes to become useful for a given purpose. First the data needs to be collected from various sources depending on the business or industry concerned, then the data must be filtered for abnormalities and irrelevant data. Data normalization is required for integration with the rest of the existing big data the company owns in its repositories. Interpreting such vast quantities of data can become a burden and, according to a poll by data mining and crowdsourcing firm CrowdFlower, data scientists spend around 80% of their time cleaning and preparing data.

There is a strong connection between big data and the IoT, and this lies in the very nature of connected devices and smart objects. IoT delivers the information from which big data analytics can draw the data it uses to create the insights required of it. Big data existed even before smart objects but on a smaller scale. IoT analytics solutions must adapt to the needs of rapid data ingestion and processing, and incorporate accurate and fast extraction. Anything from watches and thermostats, to cars, airplanes, and train tracks can now be connected to the Internet and gather and process data, mainly to indicate customer usage patterns and product performance. Information from IoT devices resides in big data and is measured against that data.

AI is the brain behind it all, responsible for reading and interpreting the processed data. AI is an evolved form of data analytics that is also able to adapt based on new sets of data and to learn by experimenting. In a way, machines imitate human intelligence by enabling systems to perceive, decide, act, learn, and adapt to maximize their chances of success toward specific goals.

These three enablers, which are closely tied together, have already started to change the face of connected insurance — starting from health and car to home and along commercial lines — but the major changes are still to come, as the insurance sector is changing its approach toward technology and the many ways that technology can be of use to it.

Connected Health

Connected insurance has come to play a crucial role in the health sector worldwide, but the current (traditional) role of the insurer varies immensely, depending on country-specific health and welfare policies. Health insurance could contribute to improve current conditions or even solve dilemmas, such as how to keep an ever-growing global population healthy and protected. To do that, insurers need to transition from simple “payers” to “players,” and become a reference point with an active role in all the health-related needs of their customers. This outcome has become more probable since connected insurance and wearables have started to reshape the industry. Gathering vital data from patients and sharing that data with caregivers using technology is a game changer.

“Mobile is the future,” said Google CEO Eric Schmidt in 2011. Schmidt is now chairman of Alphabet (the parent company of Google), and he understands there is no return from the smartphone “invasion.” We all live surrounded by dozens of different devices, and the smartphone screen has become the main reference for all our activities.

Customers today do not just go online, they live online. They experience an endless sequence of moments in a nonlinear balance between the online and offline worlds. So why not use this habit of living online to keep people healthy and interested in practicing physical exercise or having healthy eating habits: preventing instead of treating?

In light of the above, connected insurance (from wearables usage to mobile health [mHealth] applications) presents great potential for both the insurer and the insured. Such potential should be harnessed in a profitable way by targeting less risky clients and presenting them with an improved, better-priced value proposition. For this to happen, insurance companies will have to seek partners from both the technological innovation sphere and the medical field, keeping in mind that insurance’s role in the health system is changing from payer to player.

The “Payer” to “Player” Transformation

How can innovation in health insurance transform the insurance company from a simple payer to a proactive player in the customer health journey? Insurance covers can be differentiated by client segments, and the insurer can propose different levels of assistance based on specific tools and services (call center for emergencies; pharmaceutical products ordering and home delivery; eHealth with unique devices for specific target patients; professional medical advice via call, messaging, or video; etc.). Insurance providers can propose a discounted price for doctor visits through a preferred network of primary healthcare givers, perform online booking and payments, store medical history, and manage digital health agendas.

With the objective of promoting the adoption of healthier behavior, gamification and engagement based on wearables and tailor-made goals, alongside digital personal trainers and wellness agreements with gyms and shops, become key in setting a long-term healthy relationship with clients. In this model, insurers manage to stay profitable while taking care of and not just paying for clients’ healthcare expenses.

According to worldwide insurtech thought leader Matteo Carbone, there are five main value creation levers to take into consideration:

-

Risk selection enhances the underwriting phase with temporary monitoring based on dedicated devices. As far as the risk selection layer is concerned, connected devices can be indirectly or directly used to select risks at the underwriting stage, resulting in the acquisition of low-risk customers and a connected reduction in fraudulent intents.

-

Loyalty and behavior modification programs lead the client toward risk-free behavior. Behavioral programs are approaches that exploit information gathered about client behavior to direct clients toward less risky solutions. A reward system that stimulates safer client behavior is a key element in this evolved insurance landscape, and programs based on innovative gamification approaches are a must for keeping clients engaged. If the clients are engaged, there is a higher probability for them not to switch between insurance companies.

-

Value-added services develop client-tailored ancillary services that allow the insurer to play as an omnichannel medical concierge. Value-added services consist of proposing to clients policy-related services that have a double aim: (1) to guide clients toward desired behavior and (2) to offer perceived value through services to clients. Some ancillary services are proposed to the insured clients to exploit relevant data detected. These services could be directly supplied by the insurance company or by means of specialized partners.

-

Loss control takes a broad approach to mitigate claims. Connected insurance allows the use of data collected from customers, through the means of wearables, smartphones, and other connected devices, to limit the profit and loss (P&L) ratio. This enables the development of claims management processes that permit the insurance company to act more proactively and make the whole process faster and more efficient.

-

Risk-based pricing develops insurance policies with pricing linked to client behaviors. Monitoring the “quantity” and “level” of risk exposure during coverage periods has become possible. Risk can be calculated based on information gathered through monitoring with a direct impact on pricing applied to the individual customer. Thanks to the integration between intelligence, connectivity, and better usability, wearable devices can offer interesting opportunities in health and activity monitoring, tracking, personal notifications, and virtual assistance.

The winning insurance value proposition will be the one able to propose to its customers insurance components together with e/mHealth modular services made available in a single, easy-to-use, and complete user experience accessible via a mobile app, including wellness, medical network access, and medical services.

The Model of Vitality by Discovery Limited

To better grasp the actual benefits for clients (those who decide to get insured) and not just for insurers that adopt such an innovative approach, we should take a closer look at the South African player Discovery Limited. Discovery may be considered the benchmark when it comes to engaging and improving life quality for members and, generically speaking, national welfare. The company engages in long- and short-term insurance, asset management, savings, investment, and employee benefits through its various brands. Its Vitality shared-value insurance model system not only increases customer loyalty but improves customers’ lifestyles and overall states of health. It includes a gamification strategy, which runs with the support of an extended network of partners and with the help of wearables and smart objects, alongside the well-known smartphone.

Vitality gives customers mini-challenges — related to shopping for food, physical and sporting activities, medical checkups, and so on — that, if accomplished, are rewarded with cash back, discounts, or other types of incentives. As a consequence, individuals end up having a more active life (engaged Vitality members exercise 25% more than non-Vitality members) and, according to a study released by the company, they live longer than non-Vitality members. To be more precise, according to Discovery, the average life expectancy of an insured South African is 67 years, while the average life expectancy of an insured Vitality member is 81 years.

The implications of these results for ensuring healthy lives and promoting well-being are significant. The Discovery Vitality model should be further investigated for a fuller understanding of whether and how it could work for other populations and to see to what degree innovation — driven by insurers and technology companies — can be used to benefit people in general.

Connected Car

Insurance motor telematics is currently at different evolutionary stages around the world, with Italy leading the race and Discovery representing one of the first companies to show that insurance telematics can directly impact P&L if managed correctly.

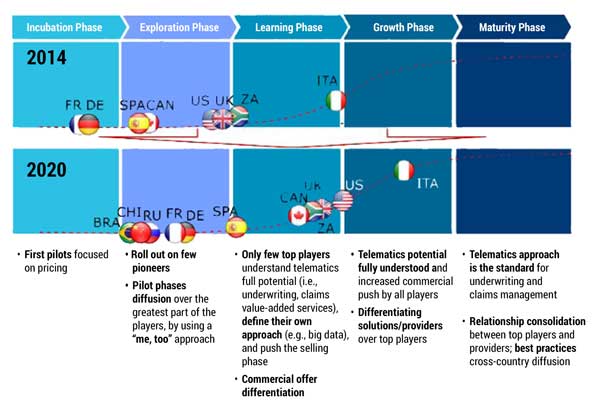

Figure 1 shows the various phases in which different countries find themselves and tries to predict the pace of adoption through 2020. Italy is still leading over the US, the UK, and South Africa. This is because of the circumstances created by Italy’s strong automotive industry and because the industry was a pioneer in working with telematics starting way back in 2002. Even though the initial stage was costly, the Italian market managed to absorb the costs due to high insurance rates at the time. In a couple of years, insurers from Brazil, China, and Russia will be coming up strong behind insurance players from France and Germany, as they will have learned from the experience of previous players and will be accelerating toward the Exploration phase.

Another key to the Italian motor telematics model, which is currently entering the Growth phase, is that the market is now able to offer low-cost, self-installing solutions for vehicles. Italy still leads the race in the 2020 forecast precisely because it had a head start facilitated by the above-mentioned circumstances and because it takes more than a couple of years for newcomers to appear on the motor telematics map and to go up the scale.

Although there is not yet any strong statistical evidence about changed or improved driving behavior in customers with telematics-based insurance policies, the data analyzed by Swiss Re in one of its studies indicates that this will be the case in the near future.

Connected Home

The last element of the connected insurance puzzle is the home insurance market. Nearly half of insurers believe that connected devices will help drive growth in the next three years. On the other hand, consumers are, for now, a bit skeptical about the technology, given the high costs still associated with home telematics and devices. Companies will have to overcome this obstacle, as has been done in motor telematics, by coming up with lower-cost solutions for the connected home. Consequently, adoption rates will start to go up slowly.

Some players are already taking steps forward. Take, for example, Octo Telematics, one of the leading players in motor telematics, which is developing projects with three insurers: Aviva, Groupama Assicurazioni, and Poste Vita. Startups are also beginning to come up with solutions at accessible prices. Even colossus Google is active in the field through its company Nest, but the partnership with insurer American Family is, for now, a mere comarketing initiative meant to test the Nest smoke detector solution on a bigger scale in the US state of Minnesota.

From the insurer’s point of view, connected homes and access to data gathered from smart sensors and devices will provide valuable insights that can lead to higher customer satisfaction, lower costs and risks, and improved efficiency and prevention. It will also allow companies to have real-time data regarding the conditions of a property prior to and after a risk alert. The advantages are numerous. The customer can also benefit, with more control over perilous events ranging from gas leaks to fire hazards or even theft. And insurance companies can offer property insurance premium discounts, based on the customer’s actions when a hazard alert occurs and on the measures the customer takes after the event to minimize the possibilities of recurrence.

Microinsurance

With particular focus on the smartphone — the main proxy of today’s customer — insurtech has introduced the concept of microinsurance: insurance policies of limited duration and contained costs available directly on the client’s smartphone with no paperwork. As an entrepreneur, I believe that this is bound to change the way in which clients interact and perceive insurance policies.

Currently, microinsurance already covers around 135 million people, which represents about 5% of the entire market potential, with an average 10% annual growth rate. The risks covered by such solutions are the typical ones of the traditional insurance market: life, health, accidental death and disability, and property insurance.

Developing countries have economies that are generally based on farming and agriculture, so they can’t manage to cover all the needs of a growing population exclusively with the goods they produce. While most underdeveloped countries are in Africa and Asia, some economies in South and Central America are also referred to as developing countries. This means that approximately 70% of the world’s 7 billion people live in poverty. In such a context there is significant demand for certain insurance products — ranging from health and life, agricultural, and property insurance, to catastrophe cover. The potential market for insurance in these countries is estimated to be between 1.5 billion and 3 billion policies.

Although microinsurance is commonly associated with poor, developing countries, it presents a different type of business potential than do microfinance and microcredit (generally considered to have originated with the Grameen Bank founded in Bangladesh in 1983). Microinsurance is not just specific risk insurance coverage at reduced cost for people in developing countries. It is an innovative way of selling insurance that is aligned with customer expectations while covering a specific need, at the right moment, at the right price, in a customer-centric approach. This type of insurance could help close the protection gap, both in developed countries and underdeveloped ones.

The role of microfinance, in contrast, is to create “a world in which as many poor and near-poor households as possible have permanent access to an appropriate range of high-quality financial services, including not just credit but also savings, insurance, and fund transfers.” Microcredit means providing credit services to those with low income. It is an extension of very small loans to impoverished borrowers who typically lack collateral, steady employment, and a verifiable credit history.

If people with low income are offered the right products, means, and knowledge, they will become effective consumers of financial services. The MicroInsurance Centre estimates that in the next 10 years or so, the microinsurance market could grow to 1 billion policyholders, representing a third of the potential projected 3 billion market.

An important point is that insurance demand should not be taken for granted. Insurance often has a negative connotation in the developing world, which stops it from reaching more people. The market needs an innovative approach based on customer education and incentives.

Insurance benefits must be clear in the minds of potential customers and, for that to be achieved, there needs to be a building of trust. This can be done through new and engaging approaches like TV and radio program plotlines, or even through literacy campaigns. To create demand, other types of incentives can also be used, including tax exemptions, subsidies, or compulsory cover. For microinsurance to function in a developing country and economy, the products and the processes to be put in place must be simple and the premiums need to be kept low. For this to be possible, insurers need a changed mindset alongside a more efficient administrative strategy and distribution channel.

Insurers will have to find the right business model and partners when approaching such markets, and should consider less common mechanisms for controlling moral hazards, adverse selection, and fraud. For example, proxy underwriting, group policies, and waiting periods mitigate adverse selection. At first, investing in microinsurance might seem a bit reckless, but the returns do exist and are gradual over time: starting with reputational gains in the short term, knowledge in the medium term, and growth in the long term.

Already more than half of the world’s population uses a mobile phone, and 34% of the total population are active mobile social users with a 50% penetration regarding Internet usage worldwide. Fewer and fewer people use fixed telephone lines as mobile phones are the dominant means of communication, even in the Third World. According to a Pew Research Center survey, in the last two years there has been a significant increase in the number of people from developing nations that declare they use Internet and own a smartphone.

Moreover, in nearly every country, Millennials (those aged between 18 and 34) are much more likely to be Internet and smartphone users than those over 35. This phenomenon is characteristic of both advanced and emerging economies. Despite these trends, fewer than 5% of people with low income have access to insurance or to covers that they need. These qualities make underdeveloped countries an ideal market for the insurance industry, and insurtech initiatives in particular, to explore because they present some great potential opportunities.

Consider a common statement regarding the industry that has proven true over decades: “Insurance purchase is not exciting; insurance is sold not bought!” The insurer must address the current context, which has dramatically changed with the arrival of mobile and then smartphone technology. Companies should get customers’ attention by using the same channels that they use and talk to them in their “language.”

Insurance should adapt to the customers’ habits and their environment. I believe the best way to do that is by selling microinsurance that has a short duration with a push approach. Then you’ll be able to provide the right insurance coverage, when the clients need it, directly on their smartphones. The trick is to avoid annoying customers with offers that do not interest them directly, at the wrong moment. To avoid that situation, insurers should use a system that can provide insight into customers’ lifestyle and preferences.

Finally, a good microinsurance solution must create a seamless digital customer experience by reading and interpreting customer behavior and emotions. The aim is to create a win-win situation for customers and insurers alike. The key to selling insurance to Millennials is to reach them with the right message, at the right time, on a device where they swipe, tap, and pinch 2,617 times a day: their smartphone. And Millennials are just the tip of the iceberg: the “connected generation,” which encompasses many more people than just Millennials, is the single most important customer segment. Empowered by technology, members of this generation search out authentic services that they utilize across platforms and screens, whenever and wherever they can.

Conclusion

The insurance industry is slowly evolving from a one-size-fits-all approach toward a personalized approach that looks at individuals and their habits, needs, and environments. As the World Health Organization predicts a worldwide deficit of nearly 13 million doctors by 2035, it’s essential that connected health and connected health insurance evolve to allow care providers to be much more versatile and flexible in reaching their patients. Insurance carriers that look at their customers as partners to whom they offer value-added services and support could reduce costs and at the same time positively influence the health state of those customers. Customers would have improved access to medical care and advice at lower cost. Primary healthcare givers could reduce the number of unnecessary medical visits and could also limit hospitalization days per person with telemedicine and connected devices.

Clearly the new paradigm in connected insurance — health, car, and home — will face several challenges posed by rates of adoption, cost barriers, resistance to change, and privacy aspects, but the potential benefits are numerous for insurance companies and customers alike. The rate of adoption of motor insurance telematics, already implemented in many countries, confirms that customers may be open to such telematics-based insurance offerings.

These three pillars of connected insurance — health, car, and home — will have to stand within an ecosystem of partners, service providers, and interconnected devices that insurance companies will have to foster in order to deliver the ultimate user experience to customers. Microinsurance, as a transversal concept that can be applied to all three pillars, provides an innovative way of selling insurance aligned with customer expectations while covering specific needs: at the right moment, at the right price, in the right place, and in a customer-centric approach.

In summary, a background system based on big data analytics that can identify patterns and provide optimized solutions based on real-time input, with a seamless, user-friendly interface up front will transform the way companies sell and communicate with policy holders.