AMPLIFY VOL. 36, NO. 10

Mass production and mass consumption are critical to the linear economy. However, they have led to mass wastage and pollution and are testing the limits of ecological systems and planetary boundaries. This is the primary reason that responsible consumption and production is one of the United Nations 17 Sustainable Development Goals (UN SDGs).

The buzz around the circular economy (CE) is not new, but the pandemic and climate change have led to more serious discussions and activities. Companies like Apple have been at the forefront of recycling and reuse, using robots like “Daisy” for recycling old iPhones and trade-in programs for a variety of products. Clothing company Patagonia promotes repair and reuse for its customers through its “Worn-Wear” program. Home furnishing and goods store IKEA has committed to using more recycled and renewable materials in its products and now runs a store selling only used products. Unilever, Coca-Cola, Nike, and many more have set ambitious goals for supporting the circular economy and have pledged increased use of recycled products in their products or packaging.

The entrepreneurial ecosystem around the circular economy has also taken giant strides. Start-ups like Grover (Germany), Back Market (France), Everphone (Germany), Danggeun Market (South Korea), Swappie (Finland), Cashify (India), refurbed (Austria), Rheaply (US), Upway (France), Attero (India), Neeman (India), Cartlow (UAE), Reebelo (Singapore), FloorFound (US), Refurbi (Colombia), Again (UK), Recycle Jar (Bangladesh), Cyrkl (Czech Republic), Fjong (Norway), Ecovia (India), GiveAway (Belarus), Bekia (Egypt), Repurpose (the Netherlands), recircular (Spain), and Flip.ro (Romania) provide examples of an emerging CE-based enterprise ecosystem.1

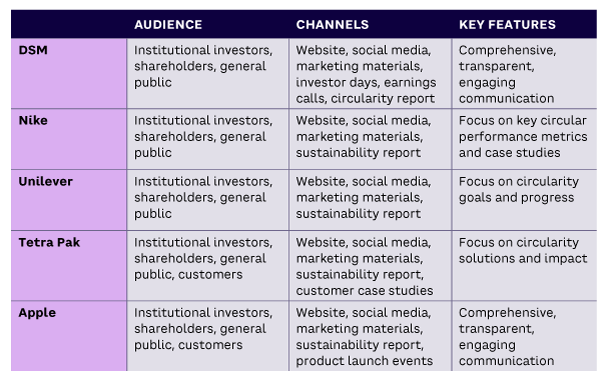

Given their large carbon footprints, innovation ability, and market share, large companies should be leading from the front and communicating their progress (see Table 1). Apple is, once again, a good example with its “Environment|Mother Nature” video featuring CEO Tim Cook and actress Octavia Spencer (playing Mother Nature).2

Another organization at the vanguard in communicating circular performance to a variety of audiences is health and nutrition company DSM (established in 1902 by the Dutch Government as Dutch State Mines). It has been committed to circularity for many years, and in 2017 set a goal to become a fully circular company by 2030. It releases a yearly circularity report for the public, institutional investors, and shareholders and reports on its circular performance through its website, social media channels, and marketing materials. It also participates in industry events and conferences to disseminate its learnings and experiences about its circularity journey. In 2022, DSM was named the “Circular Economy Company of the Year” by Circular Economy Club (CEC); World Economic Forum and the Ellen MacArthur Foundation (EMF) have also recognized the company for its leadership.

Too often, circularity and sustainability reports lack substantive financial information, and this frequently leads to charges of greenwashing. The reason lies in the complexities of financing and accounting in relation to circular business models. The CE transition will require not only new financing models, but also a novel approach to accounting practices for CE products and services.

Accounting Complexities in a Circular Economy

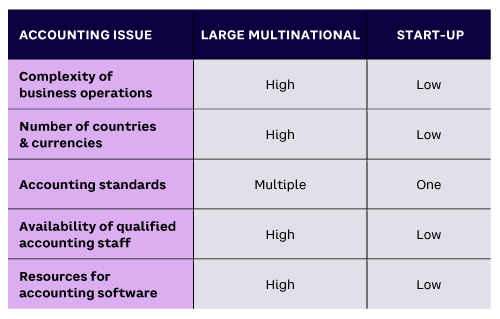

The business models prevalent in the circular economy are not well suited to traditional accounting methods because tracking the flow of products and value addition to account for costs and pricing is a complex process. Table 2 shows the advantage that large corporations have in dealing with the complexities of circularity: they have a structure in place and the resources to tweak existing structures. However, multinationals must overcome the inherent rigidness of their existing organizational structure, which tends to resist change.

Patagonia, an American outdoor recreation clothing retailer operating in more than 10 countries, has been at the forefront of circularity and sustainability since its inception in 1973. Its commitment to circularity can be seen on its website, where it tells the public it believes “being carbon-neutral is not enough” and in its iconic 2011 ad campaign “Don’t Buy This Jacket,” which urged customers to practice circularity and sustainability.

According to Patagonia, it is moving toward 100% recycled or organic materials and has a repair service and take-back program for all its products. After 50 years of operation, Patagonia aims to become carbon-neutral by 2025, demonstrating the role that resource constraints can play in a corporate sustainability and circularity mission.

In contrast, Unilever, an almost 100-year-old company, announced its focus on circularity in 2014 and plans to become net-positive by 2030. As stated in its “Sustainable Living Plan,” Unilever has reduced the waste impact per customer by 34% since 2010 for its products and has achieved around 96% reduction in total waste per ton since 2008 for its manufacturing concerns and uses 52% reusable plastic in its packaging.3 Despite the large scale and late commitment, Unilever aims to achieve its commitment within 15 years. Clearly, large multinationals can leverage their organizational structure and resources to advance toward a more circular business model at a faster pace.

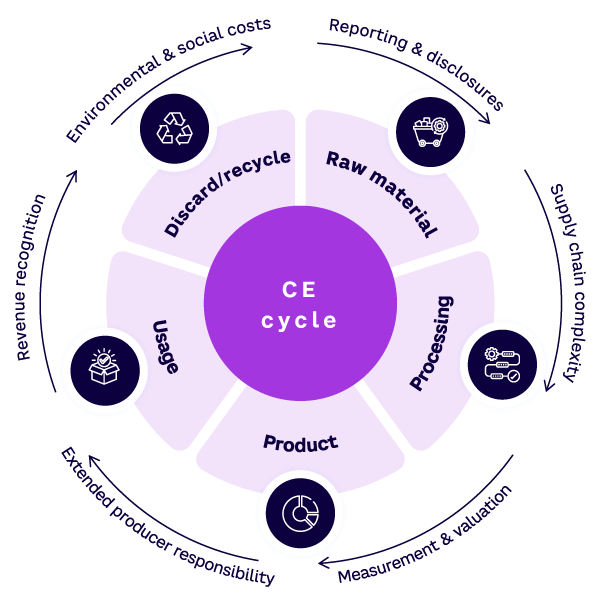

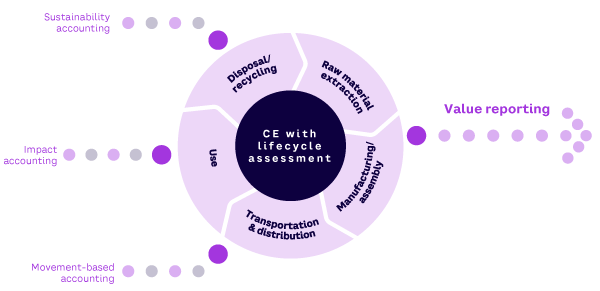

Another complexity stems from the lifecycle of a product/material in a circular economy, which may involve multiple companies and jurisdictions (see Figure 1).

The accounting complexities associated with the circular economy stem from:

-

Supply chain complexity. The circular economy often involves complex supply chains with multiple stakeholders, including suppliers, manufacturers, distributors, and consumers. Tracking and accounting for the movement of materials, products, and byproducts across the supply chain can be complicated, requiring robust systems to capture data on material flows, product lifecycles, and environmental impacts at various stages. Reverse logistics and closed-loop product systems involve the flow of products and materials back through the supply chain from the customer to the manufacturer (or another party) for reuse, recycling, or disposal, a process that’s difficult to manage and creates accounting challenges. Similarly, it’s hard to account for the value of returned products and materials. Returned products may be damaged or defective, which can reduce their value, and the value of recycled materials often fluctuates based on market conditions. Steps include:

-

Traceability of products/materials. Companies must be able to track the flow of products and materials throughout their lifecycles to accurately assess their environmental impact. This movement of discarded products and materials is often long and may be circuitous, making it challenging to track. This leads to difficulties in assessing the economic value of a product or material through various flow points. For example, valuation of a metal scrap from a discarded car might be based on its intrinsic value (the type and condition of the metal) or its extrinsic value (its recycling or upcycling potential).

-

-

Measurement and valuation. Accounting systems inculcate linear business models in which inputs transform into outputs. In the circular economy, the focus is on creating inputs out of outputs. Accounting for the value of reused or recycled materials, refurbished products, or extended product lifecycles is challenging. Determining appropriate dynamic valuation methods and accurately measuring the economic benefits of circular activities require careful consideration. For example, old furniture may have a low valuation (and price) in a linear economy. In a circular economy, old furniture may be highly valued as a way to reduce the need to cut down trees. Considerations include:

-

Valuing products/materials. Products and materials used in the circular economy often have different values than those in the linear economy. For example, a product designed for easy disassembly and recycling may have a lower value than one designed for disposal after use. The problem of price discovery/value is even more complex, as the value is subjective and is often at the potential buyer’s sole discretion.

-

-

Extended producer responsibility (EPR). In many jurisdictions, EPR regulations require producers to take responsibility for managing the entire lifecycle of their products, including their collection, recycling, or disposal. EPR models often involve financial obligations and reporting requirements. Accounting for the costs associated with product take-back, recycling infrastructure, and related liabilities requires careful consideration to comply with regulatory requirements.

-

Revenue recognition. In the circular economy, revenue generation may occur through various models, such as product leasing, remanufacturing, subscription services, or product-as-a-service arrangements. Companies like Phillips and Michelin have used such models for lighting, health equipment, and tires. These models may require different approaches to revenue recognition compared to traditional sales-based models. Accounting for revenue recognition in such scenarios can be complex, especially when the revenue generation extends over a long period. For example, it’s difficult to determine the valuation of repaired/refurbished products because the material and functional values (e.g., strength or safety) of the product undergo changes.

-

Environmental and social costs. The circular economy addresses environmental and social challenges by reducing resource consumption and minimizing waste. Accounting for environmental and social costs like carbon emissions, water usage, or social impact requires appropriate measurement and reporting frameworks. Identifying relevant indicators and developing appropriate methodologies to assess and account for these costs are challenging. Companies need to be able to report on their environmental impact to comply with regulations and meet the expectations of stakeholders, but the environmental impact of the circular economy is often difficult to quantify. For example, multiple reuse of a conveyor belt may create new environmental challenges as the product undergoes changes in its material properties and may have different waste streams and pollution impacts.

-

Reporting and disclosures. As the circular economy gains prominence, stakeholders such as investors, customers, and regulators are increasingly interested in the sustainability performance of organizations. Companies may face the challenge of developing meaningful metrics, reporting frameworks, and disclosures that accurately communicate their CE initiatives and outcomes. Emerging reporting standards and frameworks such as the Global Reporting Initiative and the Sustainability Accounting Standards Board (SASB) are still not able to capture the different cycles of the circular economy.

Addressing accounting complexities in the circular economy requires organizations to adapt their accounting systems, develop appropriate measurement methodologies, enhance data-collection processes, and ensure compliance with relevant regulations and reporting standards. It may also involve collaboration with other stakeholders to establish common accounting principles and frameworks specific to CE activities.

Despite these challenges, there are several benefits to accounting for the circular economy. By tracking the flow of products and materials, companies can identify opportunities to reduce waste and pollution. Additionally, by valuing products and materials differently, companies can create new markets for recycled and upcycled materials and products. Finally, by reporting on their environmental impact, companies can build trust with stakeholders and promote the transition to a more sustainable economy.

Addressing Accounting Complexities

Here are some tools and mechanisms that can help address the accounting complexities of the circular economy:

-

Lifecycle assessment (LCA). LCA can be used to assess the environmental impact (through emissions) of products throughout their lifecycles. This information can be used to identify emission hotspots in the value chain, helping managers decide on alternative materials/products/processes and act on their product design, manufacturing, and disposal. For example, Adidas is adopting waterless, bio-based dyes for its t-shirts that will reduce both water consumption and emissions from post-use waste.

-

Impact accounting. If one can track the flow of products and materials, the associated impact on various stakeholders (employees, customers, environment) can also be measured and accounted for. The objective is to have a positive, sustainability-driven impact rather than a finance-driven one. Traditional accounting methods should complement the approach, and optimization may also be sought on financial resources.

-

Movement-based accounting. The value proposition driven by tracking the flow of materials and products may allow for a better assessment of the impact on the organization and other stakeholders. This also enables organizations to assess the value addition at each flow junction and properly account for it. The value derived in movement-based accounting often depends on physical and social dimensions of the product/material, such as perceived usefulness, condition, or location. For example, a bicycle may be perceived as a poor man’s mode of commuting in a rural area but as an elite health item in cities. The value of the bicycle thus depends on its social-acceptance dimension and where it is located, and the bicycle’s condition, usage, and usefulness may alter its valuation. Its valuation may also change within a company’s supply chain and in the CE cycle of reuse and recycle.

-

Sustainability accounting. When we talk about the circular economy, the nature of businesses can differ widely, and the focus can differ from the 3R framework (reduce, reuse, and recycle)4 to the 9R framework (refuse, reduce, reuse, repair, refurbish, remanufacture, repurpose, recycle, and recover energy).5 Clearly, a one-size-fits-all approach in a circular economy will not work. Instead, we need a novel accounting approach that creates a system to monitor and manage resource transfer across the value chain. There is a further need to develop a full range of dynamic metrics to assess the size of impact and circularity and integrate socioeconomic and environmental loops to measure value and impact for both sustainability and finances (see Figure 2).

Academic research suggests the possibility of a new accounting standard that can capture the essence of a circular economy and account for it financially.6,7 Accounting standards bodies like SASB are developing new standards that are better suited to the circular economy, and the concept of value reporting is taking center stage in today’s business environment.

Emerging indicators for circularity, such as those developed by EMF and the World Business Council for Sustainable Development (WBCSD), can also support new accounting standards. First, they can help identify and measure the circularity of an organization’s activities. This information can be used to develop accounting standards that accurately reflect the circularity of an organization’s financial performance. Second, they can raise awareness of the importance of circularity and the need for new accounting standards. This should encourage accounting standards-setters to develop new standards that support the transition to a circular economy. Third, they can be used to develop pilot accounting standards that can be tested and refined before being widely adopted.

EMF’s Circulytics platform and WBCSD’s Circular Transition Indicators provide measurable frameworks for identifying CE activities. Indicators such as the percentage of materials that are recycled or reused, the percentage of energy that is renewable, the amount of waste that is generated, the percentage of revenue generated from circular products and services, and the percentage of materials that are sourced from recycled or renewable sources can help in measuring financial materiality of CE items and, thus, developing a more inclusive accounting framework for companies engaging in CE activities.

New standards and accounting approaches will help companies promote transparency and sustainability and help them become more responsible and responsive to all stakeholders. Emerging technologies such as blockchain, machine learning, artificial intelligence, robotic process automation, Industry 4.0, 5G, big data analytics, and natural language processing will contribute to a comprehensive framework that can track the flow of products and materials, value them appropriately, and report on their environmental impact.

CEC, World Economic Forum, EMF, SASB, and other agencies focused on CE must create a platform designed to create awareness among organizations, regulatory bodies, and other stakeholders about the need for CE indicators and metrics in future accounting standards.

Traditional accounting methods and tools may not be able to capture the evolution of the CE model, hindering the achievement of SDGs and the transition to net zero. Businesses need standards and indicators that can be used globally but are flexible enough to work across developing economies, industry sectors, and product categories. Accounting policies and practices must evolve to help us build a more sustainable future, and all stakeholders, no matter how large or small, have a vital role to play.

References

1 “Top 10 Waste Reuse Startups.” Recycling Startups, 29 September 2023.

2 “Environment|Mother Nature.” Apple, accessed October 2023.

3 “Unilever Sustainable Living Plan 2010 to 2020: Summary of 10 Years’ Progress.” Unilever, March 2021.

4 Prieto-Sandoval, Vanessa, Carmen Jaca, and Marta Ormazabal. “Towards a Consensus on the Circular Economy.” Journal of Cleaner Production, Vol. 179, April 2018.

5 Van Buren, Nicole, et al. “Towards a Circular Economy: The Role of Dutch Logistics Industries and Governments.” Sustainability, Vol. 8, No. 7, July 2016.

6 Mayer, Andreas, et al. “Measuring Progress Towards a Circular Economy: A Monitoring Framework for Economy-Wide Material Loop Closing in the EU28.” Journal of Industrial Ecology, Vol. 23, No. 1, September 2018.

7 Jacobi, Nikolai, et al. “Providing an Economy-Wide Monitoring Framework for the Circular Economy in Austria: Status Quo and Challenges.” Resources, Conservation and Recycling, Vol. 137, October 2018.