AMPLIFY VOL. 36, NO. 10

Larry Fink, CEO of BlackRock — the world’s largest asset manager — emphasizes the significance of investing in the circular economy (CE). Such investments not only address pressing environmental challenges, such as climate change, resource scarcity, and biodiversity loss, they can also foster higher economic growth and deliver favorable financial returns.1

In recent years, the CE field has attracted increasing investment interest from a variety of actors. One notable example is the EU, which is proactively implementing several funding schemes to facilitate the transition to a CE.2 The European Investment Bank contributed €3.4 billion (about US $3.7 billion) between 2018 and 2022 to support 118 CE projects across several sectors.3 The world-leading photochemical etching company, Precision Micro, invested £5 million (about US $6.3 million) in reconfiguring its processes to significantly improve its material recovery and reuse rates.4

Although the importance of CE investments is undeniable, the overall size and level of investment remain relatively low.5 To effectively expand the scale of CE investments, it is imperative to embrace diverse perspectives and implement a wide array of new practices.

For this article, we conducted a systematic literature review of studies of CE investments. We performed a thorough literature search in the Web of Science and Scopus databases, using keywords relevant to CE investments. From the initial pool of research papers, we carefully screened 38 articles based on their content’s relevance. The primary goal was to identify practical CE investment insights from the perspective of various stakeholders. We completed both a manual and automated content analysis of the studies. The automated content analysis of our research used chatbots, employing both ChatPDF and TianGong GPT tools concurrently. This dual approach produced a comprehensive literature analysis.

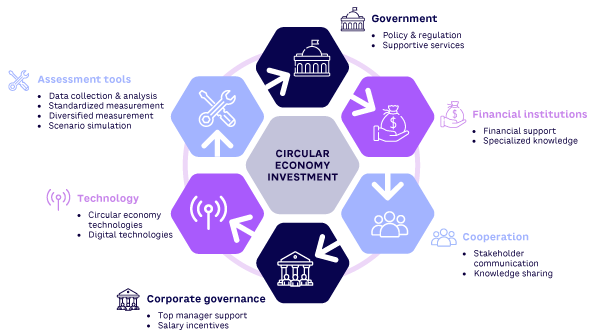

Our analysis yielded insights on several key aspects of CE investments (summarized in Figure 1). Six topics of practical interest arise from the literature, including concerns and roles related to: (1) government, (2) financial institutions, (3) cooperation, (4) corporate governance, (5) technology, and (6) assessment tools. There are interrelationships among these topics, but we will focus on each separately.

Government

Governments play a crucial role in promoting investment within the CE field, including developing policies and strengthening regulations/guidance. CE projects often involve substantial capital investments, requiring governments to formulate fiscal policies and provide funding to support them.

For instance, the government of Alberta, Canada, announced a CAD $58 million (about US $42 million) fund for a series of public and private CE projects. A significant portion of this funding, up to CAD $10 million, has been invested in the region’s plant protein processing emission reductions and water sustainability project, exemplifying one of the many forward-thinking CE projects the government has undertaken.6

Measures including tax breaks, subsidies, and special funding programs can reduce the cost pressure and risk associated with CE investments. This support can attract more investors. Because CE investments typically involve multiple stakeholders and operate within a complex market environment, clear and fair regulation is imperative. Governments should ensure CE program compliance, improve transparency requirements, and maintain market order and fairness.

For example, in November 2021, the Capital Markets Board of Turkey issued a guideline for green bonds and green lease certificates. The guide includes a list of projects related to the transition to a circular economy, including wastewater management, product eco-involvement, and pollution prevention and control. The guide’s release is meant to boost investor confidence in transparency and external validation while promoting diverse investment opportunities in sustainable development projects.7

Governments also can help investors build expertise and capabilities. Knowledge, technology, and tools related to the field of CE investments (some of which are discussed later) can be extremely beneficial. Governments can increase publicity and education efforts to enhance public awareness about CE, stimulating demand for investments in this domain. For instance, since 2019, Valladolid, Spain, has been organizing a “Circular Weekends” network to facilitate communication between various companies and other organizations to work together on CE projects.8

By supporting R&D and CE technology implementation, governments can drive technological innovation, leading to more innovative products and services in the CE investment market, which can attract more investors.

Governments also should establish more harmonized indicators and standards for assessing the alignment of investments with CE objectives.9 For example, the Metrics Working Group of the Australian Circular Economy Hub introduced principles for CE metrics across Australia’s states and territories, businesses, and communities. These principles emphasize metrics based on a sound conceptual framework, encompassing the entire lifecycle and all aspects of CE and consistency with accepted data standards.10 These metrics can inform community or private investment.

Financial Institutions

Institutional investors can offer financial support and expertise to propel CE growth. Asset management firms, mutual funds, university endowments, and pension funds can allocate substantial financing in favor of projects and businesses aligned with CE principles.

For instance, the Impact Bridge fund, which supports Spanish businesses engaged in CE investments, has launched a €150 million impact fund (about US $157 million). Notably, this initiative garnered support from institutional investors, including the European Investment Fund (€30 million), MicroBank (€10 million), and pension funds.11 These investors become key drivers in facilitating the transition from traditional linear investment approaches12 to more sustainable full-circular investment models.13

Institutional investors attract private capital for the CE space. Private capital, in addition to providing essential financial support, fosters dynamism within CE investments. Its flexibility, commitment to transparency, support for innovation, and expertise in specific industries make it particularly valuable to small businesses and early-stage companies that are driving CE.14

Private capital can unlock a plethora of CE investment opportunities and support diversity in investment. For example, the Circulate Capital Ocean Fund I-B operates as a private equity investment vehicle, directing a substantial sum of US $50 million toward addressing the pressing issue of plastic waste in the regions of Southeast Asia and South Asia.15

Cooperation

Communication and knowledge sharing among stakeholders (government, enterprises, third parties, and research institutions) contribute to effective resourcing for CE. Effectively integrating various stakeholder resources, expertise, and technologies contributes to improving market-demand evaluation, identifying CE investment opportunities, promoting technological innovations, and ensuring risk mitigation.

For instance, the EU launched the Circular Economy Finance Support Platform in 2017. It gathers and presents good practices in the CE domain from various types of business to guide aspiring participants in CE investments.16 Another notable case is the Inter-American Development Bank, which invested US $4 million and collaborated with Circulate Capital to address the pressing issue of waste plastic in the oceans of Latin America and the Caribbean.17 Each group involved multiple stakeholders — a transdisciplinary effort.

Corporate Governance

Corporate governance factors play strategic roles in CE investment and sustainable development. Corporate executives significantly influence the strategy and magnitude of investments. According to a recent survey, about 70% of supply chain leaders plan to invest in the CE.18 This is an admirable number but implies that executive knowledge and support are necessary. The top management team (as in most strategic situations and decisions that filter down to operational actions) is integral for corporate development and top-down CE strategies.

Governance requires developing policies and procedures that standardize circularity understanding, performance measures, and practices across the organization. Salary incentives tied to CE or sustainable performance can play a positive role in promoting the shift to investment in the CE field. The issues can be complex to manage, and the Organisation for Economic Co-operation and Development (OECD) has published a useful checklist for governance for the circular economy for organizations.19

Technology

CE investments are influenced by a variety of emergent technologies. Staying informed and being proactive about aligning investment strategies with evolving trends help organizations capitalize on the transformative potential of these technologies, fostering a more efficient and impactful CE.20

CE technology innovations encompass a wide range of sectors, including materials production, waste management, reuse, recycling, resource conservation, and energy efficiency.21 The current limited level of circularity presents promising opportunities for new technologies to contribute significantly to achieving circularity. CE investments should prioritize these forward-looking solutions to push the boundaries of CE technologies. This approach encourages the exploration of emerging solutions and disruptive innovations, potentially generating long-term benefits for investors.22

Investing in digital and artificial intelligence (AI) technologies is of particular importance. These technologies enable real-time monitoring and data exchange, leading to heightened resource efficiency and reduced waste;23 they also can help monitor returns on CE investments. Data analysis can provide a deeper understanding of market demand, enabling more intelligent and precise CE investments. Investment risks can be mitigated with these technologies and can facilitate well-informed CE decision-making. Embracing and leveraging digital and AI tools propel CE toward greater efficiency and sustainability, making it a win-win proposition for businesses and the environment.

Assessment Tools

CE investment challenges can be mitigated through more objective and comprehensive tools for assessing CE investments.24 These tools help investors optimize resource allocation, quantify potential impacts, and assess CE investment feasibility. Big data and data-driven analysis can provide decision support for investors.

CE investments often involve new technologies, new business models, and uncertain market environments. Assessment tools can support risk assessment and management, reducing investment risks to support the likelihood of successful CE investments. The following assessment tool types show promise:

-

Data collection and analysis tools. Comprehensive, reliable data sources can support more informed CE investment decisions.25 Data must include resource inputs, waste production, emissions, energy consumption, economic returns, and social impacts. Data analysis tools can organize, process, calculate, and analyze data to support CE investment decisions. For example, European banking group Intesa Sanpaolo is considering CE’s de-risking effect and integrating and adjusting its risk assessment tools, methodologies, and credit-rating models to consider CE.26

-

Standardized measurement tools. These tools can enable seamless comparisons between CE projects across diverse regions and industries.27 They also can foster resource allocation. Standardized metrics serve as a common language, facilitating effective communication and cooperation among stakeholders, including investors, governments, and nongovernmental organizations. These measurements can drive continuous improvement, incentivize best practices, and combat greenwashing practices.

-

Diversified measurement tools. These tools encompass lifecycle assessments, environmental and social impact evaluations, technology-specific assessments, and comprehensive cost-benefit analysis.28 Lifecycle assessments provide a holistic understanding of projects from inception to end of life, while environmental and social impact evaluations gauge their ecological and societal consequences.

-

Technology-specific assessments. These ensure the viability of circular solutions, and comprehensive cost-benefit analyses help decision makers assess risks and potential benefits from both short- and long-term perspectives. For example, the Cradle to Cradle closed-loop lifecycle approach helped Switzerland’s Forster Rohner Textiles make investment decisions that included a product called “Climatex” that eventually represented a third of Rohner’s revenues.29

-

Scenario-simulation tools. Given the multitude of factors influencing CE investments, such as technological advancements, policy changes, market fluctuations, and internal organizational adjustments, the investment landscape can be complex. Scenario modeling involves constructing potential scenarios for various futures, helping investors assess feasibility and benefits under varying circumstances.30 These investment-planning tools help CE investors anticipate risks, prepare responses, and iterate and refine planning. They also incent business model innovation, ultimately fostering more informed decision-making. Embracing scenario-simulation tools empowers CE investors to navigate uncertainties with confidence and chart a course toward successful, sustainable investments.

Conclusion

Exploring future directions in the field of CE investments requires new insights and actions. Both internal and external organizational practices play a role in CE investments. External practices include government policies, regulations, financial incentives, and support from financial institutions. Internal factors include organizational governance and managerial behavior.

Embracing and leveraging emerging technologies, including those specifically designed for CE activities and data analytics, and other innovative tools for assessing and measuring CE performance, can be indispensable in fostering CE investments. Last but not least, effective communication, cooperation, and knowledge sharing among diverse stakeholders are vital in driving CE investments forward and creating a collective impact.

References

1 “The World’s Largest Investor Embraces the Circular Economy: BlackRock.” Ellen MacArthur Foundation, 23 September 2021.

2 “Financing the Circular Economy.” EU, accessed October 2023.

3 “Circular Economy Overview 2023.” European Investment Bank (EIB), May 2023.

4 “Investments into Circular Economy Reached New High in 2022.” Resource Media, 15 May 2023.

5 Schröder, Patrick, and Jan Raes. “Financing an Inclusive Circular Economy: De-Risking Investments for Circular Business Models and the SDGs.” Chatham House, the Royal Institute of International Affairs, July 2021.

6 “Alberta Announces $58 Million for Circular Economy Projects Worth $528 Million in Public and Private Investment.” Emissions Reduction Alberta, 13 February 2023.

7 Yalçin, Döne, and Arcan Kemahli. “Turkey’s CMB to Issue More Green Bonds and Green Lease Certificates.” CMS, 22 December 2021.

8 “Ten Cities Leading Their Way in Circular Economy — European Hub.” The Circular Collective, 19 August 2021.

9 Dewick, Paul, et al. “Circular Economy Finance: Clear Winner or Risky Proposition?” Journal of Industrial Ecology, Vol. 24, No. 6, June 2020.

10 “Principles of Circular Economy Metrics.” Australian Circular Economy Hub, 8 September 2022.

11 “InvestEU: Impact Bridge Launches €150 Million Impact Fund with the Support of the European Investment Fund and MicroBank.” European Commission, 15 June 2023.

12 “Financial Sector Presents Roadmap to Circular Economy.” De Nederlandsche Bank, 7 February 2022.

13 Dewick et al. (see 9).

14 “Why Consider a Circular Economy?” JPMorgan Chase & Co, accessed October 2023.

15 “Circulate Capital Ocean Fund I-B.” International Finance Corporation (IFC), accessed October 2023.

16 EU (see 2).

17 “IDB Lab Partners with Circulate Capital to Combat Ocean-Bound Plastics.” Inter-American Development Bank (IDB), 25 October 2021.

18 “Gartner Survey Shows 70% of Supply Chain Leaders Plan to Invest in the Circular Economy.“ Press release, Gartner, 26 February 2020.

19 “The Circular Economy in Cities and Regions.” Organisation for Economic Co-operation and Development (OECD), accessed October 2023.

20 Ibrahim, Abubakar. “Experts Say Nigeria’s Economy Needs National Policy, Technological Transfer to Scale Up Investment.” Business Day, 17 November 2022.

21 Lu, Shirley, and George Serafeim. “How AI Will Accelerate the Circular Economy.” Harvard Business Review, 12 June 2023.

22 Resource Media (see 4).

23 “The Circular Economy as a De-Risking Strategy and Driver of Superior Risk-Adjusted Returns.” Ellen MacArthur Foundation/Bocconi University, July 2021.

24 “Banks Opening Up for Circular Business.” Innovation in Textiles, 5 June 2023.

25 “Financing the Circular Economy.” Ellen MacArthur Foundation, accessed October 2023.

26 Ellen MacArthur Foundation/Bocconi University (see 23).

27 “Closing the Loop: Responsible Investment and the Circular Economy.” Principles for Responsible Investment (PRI), 4 October 2022.

28 Geng, Yong, et al. “Measuring China’s Circular Economy.” Science, Vol. 339, No. 6127, March 2013.

29 Larson, Andrea, and Jeff York. “Rohner Textiles: Cradle-to-Cradle Innovation and Sustainability.” Darden Case No. UVA-ENT-0085, Darden Business Publishing, 21 October 2008.

30 Yu, Xianyu, et al. “Exploring the Investment Strategy of Power Enterprises Under the Nationwide Carbon Emissions Trading Mechanism: A Scenario-Based System Dynamics Approach.” Energy Policy, Vol. 140, May 2020.