CUTTER BUSINESS TECHNOLOGY JOURNAL VOL. 31, NO. 1

Seán Nevin and Rob Gleasure discuss the rise in popularity of a new form of crowdfunding — initial coin offerings (ICOs). They believe the hype surrounding ICOs will continue through 2018 but will level off when crowdfunding platforms and traditional funding players become involved. Ultimately, as the authors suggest, legislative change like that imposed on traditional crowdfunding will need to be extended to cover the ICO market.

Since the global financial crisis, individuals are taking more control over their personal finances and investments. Investors are now looking for alternative opportunities outside of traditional investment strategies. With the passing in the US of Title III of the Jumpstart Our Business Startups (JOBS) Act, equity crowdfunding was made available to the general public. Equity crowdfunding enables almost anyone to act like a venture capitalist, allowing people to invest in private startups in return for a stake or equity in the company. The crowdfunding market has been growing steadily in recent years. In 2012, total crowdfunding volume was US $2.7 billion, rising every year to $34.4 billion in 2015.

The year 2017 saw the extraordinary growth of a new form of crowdfunding, initial coin offerings (ICOs). ICOs, also known as token sales or crowdsales, are a funding mechanism where a virtual coin or token (cryptocurrency) is sold to investors to raise capital for a new company. Depending on the terms of the ICO, the token sold can represent either an investment security or a form of currency within a company’s application. Like a crowdfunding campaign, an ICO takes place over a given period, and anyone can buy the coins or tokens in question in exchange for other cryptocurrencies such as Bitcoin or Ethereum.

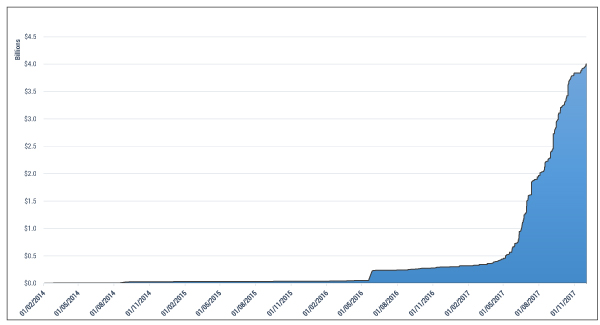

The rise of ICOs has been rapid and unprecedented (see Figure 1), far exceeding that of crowdfunding. According to Coinschedule, 46 ICOs raised a total of $96 million in 2016, while in 2017 there were more than 230 ICOs raising more than $3.5 billion, with projects such as Filecoin ($257 million) and Tezos ($232 million) contributing to ICO growth. In just one year, ICOs have raised more than the most popular crowdfunding platform, Kickstarter, has in its eight-year history.

We are already seeing well-established crowdfunding platforms pay attention to ICOs. Indiegogo, a successful rewards-based crowdfunding platform, announced it would begin offering services to blockchain-based projects that seek to undertake an ICO. Indiegogo’s size and influence in the crowdfunding ecosystem will be a huge benefit to companies looking to undertake ICOs. Significantly, Indiegogo will handpick projects and help startups comply with SEC regulations.

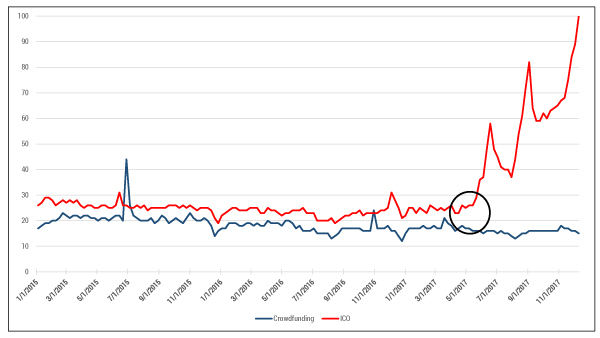

As shown in Figure 2, there has been a significant shift in interest in the two forms of alternative funding. Toward the end of May 2017, interest in crowdfunding decreased slightly, while interest in ICOs rapidly rose. During this time, ICOs were happening frequently, and with much more success than they had previously enjoyed. According to Coinschedule, there were 98 ICOs in 2017 that raised over $10 million, with 83 of them taking place after May of that year. In comparison, there were only five traditional crowdfunding campaigns in 2017 that raised over $10 million, with only one finishing funding after May, and four still ongoing.

Maecenas, a London-based fine art investment platform, provides an example of this move in interest. In April 2017, Maecenas launched a crowdfunding campaign with Seedrs, with a target of £400,000, giving 12.4% equity to the crowd, but the campaign was not funded, and the project failed. However, in September, Maecenas released a white paper and began funding through an ICO. Within a month, with the ICO complete, Maecenas had raised over 50,000 Ether, with a value of $15.5 million. So a crowdfunding campaign that failed to raise £400,000 on Seedrs was able to raise 30 times that amount through an ICO only a few months later, while also giving away less equity.

The upward trend of popularity in ICOs after May 2017 is quite interesting. As Figure 2 illustrates, when interest in ICOs rose, there was a slight decrease in interest in crowdfunding. This suggests that ICOs may be capturing some of the crowdfunding market, with crowdfunding investors moving to fund blockchain-based startups.

Another interesting trend over time relates to the peaks of highs, followed by a drop in interest, which line up with the percentage of ICOs that reach their funding goal. As reported by Architect Partners, there was a peak of interest in June 2017, which also saw 92% of all ICOs reach their funding target. A dip in interest followed in August, which showed a funding success rate of 46%.

In the short term this trend looks likely to continue, with ICOs going through periods of hype followed by a phase of low interest. These oscillations are likely to continue into 2018, as periods of hype encourage investors to move away from crowdfunding in favor of ICOs. However, in the long term, ICOs are likely to grow in tandem with crowdfunding. This complementary growth will be achieved only when crowdfunding platforms and traditional funding players become involved. This is already starting to happen, with crowdfunding platforms such as Indiegogo, Republic, and AngelList having expanded into the ICO market. With venture capitalists also coming onboard, the experience and expertise of these traditional actors will help weed out projects that don’t have what it takes to succeed or that may be fraudulent.

As the year progresses, we expect to see several hype-fueled projects fail to meet expected deadlines. This will drive traditional crowdfunding investors back to the more stable and reliable crowdfunding platforms, where levels of success and failure are spread among large numbers of companies. Crowdfunding investors will return to ICOs when regulation is put in place and demonstrably trustworthy intermediaries become involved.

The clustering of intermediaries among ICOs has allowed the paradigm to grow rapidly while also meaning that oscillations in public interest are inevitable. The ICO market will ultimately require legislative change like that imposed on crowdfunding. Further into 2018, we will see that ICOs will no longer be able to get funding with only a white paper. Investors will no longer blindly fund any ICO but will instead demand business plans and high levels of transparency.