AMPLIFY VOL. 37, NO. 2

In the next 10 years, global space spending is expected to double.1 Higher global demand will drive increased pressure on the US space-related supply chain. Companies are pivoting to high-rate production for critical national space capabilities, making supply chain efficiency more critical than ever. Other global market sectors (e.g., auto, medical device, gaming, and cloud storage industries) are competing with the US space enterprise for many of the same components, commodities, and rare earth elements.

These factors are driving the need for comprehensive, up-to-date, trusted information to expose problems in US space supply chains. Unfortunately, no trusted system exists for pulling together and disseminating the information needed to evaluate risk and inform decisions. This is particularly challenging considering the expanding diversity of the space supply chain stakeholder community, which comprises policy makers, procurement specialists, buyers and sellers of products and services, technologists, and security experts.

This article proposes a topology to aggregate and dynamically update space supply chain information, providing time-sensitive reporting along the lines of the Waze mapping application. For example, Waze has helped the US Federal Emergency Management Agency (FEMA) know where to dispatch fuel trucks to address urgent needs during disasters and has informed authorities and the public about open shelters and evacuation zones.

The space enterprise is a long way from having Waze-like solutions for space supply chains. That said, the Space supply chain Topology for Assessing Risk (STAR) would connect people, processes, and technologies via information-sharing partnerships, secure cloud-based platforms, and distributed ledger technology (DLT).2 We recognize that stakeholders are already making connections, establishing information-sharing partnerships, and using DLT. These standalone approaches could be linked within STAR to provide a common nexus for all stakeholders in the space supply chain community.

This project will involve significant hurdles. To dynamically collect the necessary information, STAR needs buy-in from key stakeholders across the global supply chain. It would require cloud and related technologies to compile, process, and turn vast amounts of dynamically collected data into near-real-time decision support. This article does not suggest the best way to overcome these hurdles or recommend who should tackle which tasks. Our objective is to establish a community vision for STAR, stimulate discussion, and motivate the community to begin working toward it.

Kinks in the Global Space Supply Chain

The space enterprise is transforming from producing a modest number of custom-made space systems commissioned by government organizations to an ecosystem in which many companies produce large quantities of space systems using assembly line production.

Managing the availability and delivery of large quantities of components to build these space systems is a challenge given the volume of data that must be tracked and the lack of visibility of that data. Incomplete data collections paint a fragmented picture for supply chain stakeholders. Blind spots manifest as risks for government organizations and companies; those risks are compounded by the fact that space-system component availability is affected by geopolitics, global economics, and competition from industries outside the space sector.

For example, growing demand and geopolitical crises have disrupted the supply of noble gases (neon, xenon, and krypton). Russia’s illegal annexation of Crimea in 2014 disrupted Ukraine’s steel industry, which was the source of as much as 90% of the global neon gas supply.3 Effects of the pandemic and the 2022 expansion of the Ukraine-Russia war further interrupted production. Neon gas scarcity affected Taiwan Semiconductor Manufacturing Company Limited (TSMC) and others involved in semiconductor manufacturing since neon is a key input in the semiconductor manufacturing process. So, in addition to the space sector, the neon shortage affected auto industry access to semiconductor chips, illustrating the global scope of the problem.4

The Need for Innovative Supply Chain Tracking Topology

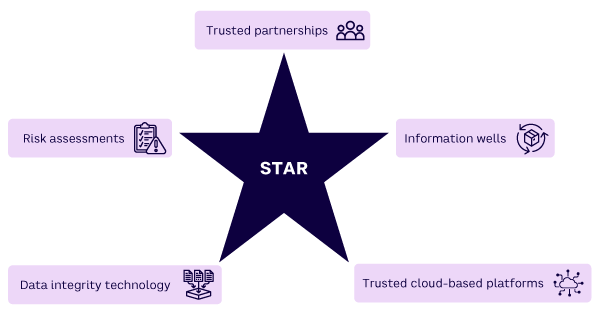

The US space enterprise can benefit from a trusted, global, dynamically updated, enterprise view of the space supply chain. As mentioned, STAR’s objective is to connect people, processes, and technologies via information-sharing partnerships, secure cloud-based platforms, DLT, automation, and evolved analytical techniques.5

Once established, STAR would rely on trusted partners to provide data stored in what we call “information wells.” Hosted by vetted stakeholders using cloud-based platforms, information wells would leverage technology to ensure data integrity and allow access only to authorized users. Data would be collected and processed to inform risk assessments, a primary reason for STAR.

In essence, STAR would be a network of networks. Figure 1 shows the five main elements of STAR; each element is described in more detail below.

1. Trusted Partnerships

Trusted partnerships among multiple stakeholder organizations could be formalized with information-sharing agreements that include exchanging agreed-upon types of data and applying common approaches to using it. Options for sharing could include anonymizing the data to protect the business cases of the contractors involved. Trusted partnerships could be facilitated by nondisclosure agreements and through employee contract stipulations.

Since setting up agreements can be time-consuming, we recommend starting with the more straightforward task of ingesting publicly available data into information wells and then assimilating the data that members are willing to share and use. This might include business-sensitive data consistent with vetted stakeholder data access and sharing agreements. Once established, partners would be able to routinely provide data and extract information through automated or manual processes.

Useful partnership models include the Space Collaboration Council, the NASA Electronic Parts Assurance Group, and the Space Information Sharing and Analysis Center (Space ISAC). Potential STAR sponsors and participants include Space ISAC member organizations.

Other partner-based models include Microsoft’s Supply Chain Platform, Amazon Supply Chain, and Google’s Supply Chain Twin.6-8 Microsoft’s platform enables organizations to use artificial intelligence, collaboration capability, security protocols, and software-as-a-service applications. Amazon’s cloud application unifies data and provides machine learning for insights, collaboration, and demand planning. Google’s capability allows organizations to build digital representations of their supply chains.

Another model is Supply-chain Levels for Software Artifacts (SLSA), which is led by a cross-organization, vendor-neutral steering group. SLSA comprises Google, Citibank, VMware, and others, maintaining a checklist of standards and controls to prevent tampering and improve integrity.9 The Internet Engineering Task Force (IETF) has a working group called Supply Chain Integrity, Transparency, and Trust that creates industry standards for software bills of materials.10

The space enterprise can benefit from commercial know-how to help STAR gain maximum insight into the dynamics and risks associated with space supply chains. Once established, STAR would enable participants from supply chain analysts to CIOs to work together more efficiently up and down the chain to facilitate information flow about a specific space mission.

The barriers to building partnerships and information sharing include concerns related to sharing proprietary information and the risk of exposing potentially damaging information. Per the US federal government’s 2023 National Cybersecurity Strategy, allies and partners should be included to ensure global supply chains for information and communications technology are secure, reliable, and trustworthy.11 International partnerships may be constrained by International Traffic in Arms Regulations (ITAR) and other export controls. Therefore, sharing information in a trusted environment is critical. Technologies such as secure cloud-based platforms and distributed ledgers contribute to building and maintaining trust.

The economic benefits to information sharing can outweigh the costs. For example, information sharing is a major lever for increased performance and competitiveness. Sharing information promotes production responsiveness, innovation, codevelopment, and robust risk management. Analyzing data from a single organization limits these advantages. Collaboration promotes coordination and trust between partners that may be geographically, organizationally, and/or informationally distanced. As in the Waze example, the sharing of data between connected tiers or partners can help all parties improve processes and make informed decisions in response to a crisis.

It may seem counterintuitive for an organization to willingly share information that could compromise commercial advantage, but business leaders increasingly understand the degree to which increased performance follows from information sharing.12

2. Information Wells

Information wells provide secure, traceable, transparent data management environments that promote trust by letting partners leverage a broad array of structured and unstructured data (see Appendix for a list of example data sets). Information wells would provide a holistic view of the supply chain across the space system lifecycle (design, development, distribution, deployment, and operations). Bills of materials and inventory risk report data would enable end-to-end awareness of component availability. Data would inform the search for alternative components when needed, and aggregated data would inform the detection of trends and risks.13

3. Trusted Cloud-Based Platforms

A network of cloud-based platforms would host information wells and enable secure processing of data shared among partners across the space enterprise. Data collected from information wells would be dynamically ingested from multiple providers into the information wells residing on STAR’s cloud-based platforms.

Supply chain data would be encrypted into a “hash” that is secured and distributed in a private blockchain. The information would be made available for secure sharing to various levels of user stakeholders and partners based on vetted protocols. Representative commercial cloud platforms include AWS Cloud or Microsoft Azure.

Decision support on availability for a given need at a given time and location would be informed by risk assessments based on calculations using aggregated data on how much of a commodity (e.g., krypton) is needed to meet global demand, coupled with the aggregate quantity of supply.

Eventually, the data in information wells could be analyzed using automated tools. Once these tools are developed, stakeholders would be able to run assessments to pinpoint single points of failure, such as sole-source suppliers that could affect production of multiple space systems.

4. Data Integrity Technology

STAR’s fourth element is data integrity technology, most likely via trust-based partnerships using trusted cloud platforms that leverage trusted private DLT (e.g., blockchain for exchanging information and providing visibility into demand signals).

DLT enables data accountability by authenticating member identity and auditing data consent, access, and sharing. A key benefit of DLT is that data cannot be altered without detection. If one node is hacked, copies can provide verification of data consistency. The addition of data that violates established consistency is rejected, and data from primary sources cannot be altered. Data integrity can be traced to the primary source, where the primary source is verified and authenticated. With the use of robust cybersecurity controls and data encryption with secure sharing protocols, data privacy is protected and the risk of unauthorized access to the data is reduced.

5. Risk Assessments

The framework calls for STAR supply chain risk assessments to be enabled by the other four STAR elements. Risk assessments indicate weak areas in space supply chains (business or technical) where malicious actors could disrupt the supply chain via access to hardware, software, or transportation vectors.

Near-real-time data would enable risk assessments of priority items, helping to mitigate uncertainty. When disruptive events occur, information well data could be updated to immediately inform rapid analysis of risks and impacts to space operations, including identifying alternative supplies. For example, although xenon provides the best performance of noble gases for ion thrusters, krypton is an acceptable alternative if a design change is made early enough in the development cycle.

STAR’s 4 Risk Assessments

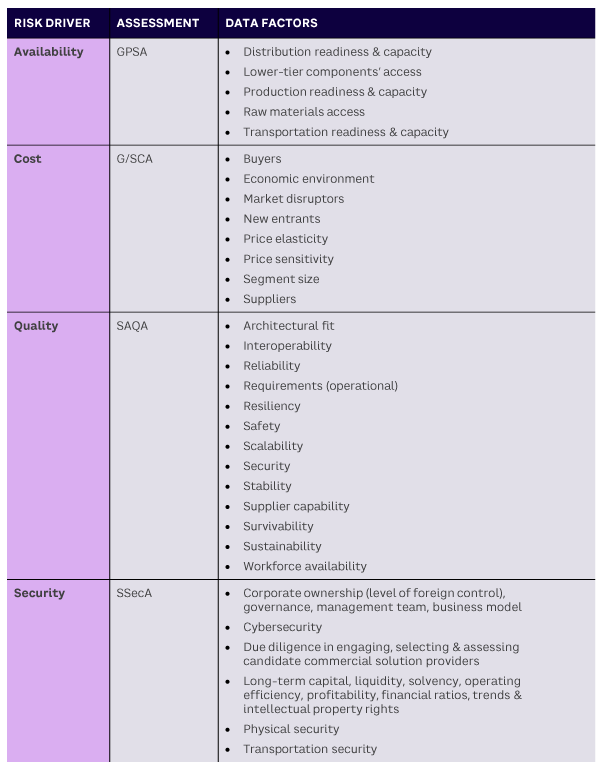

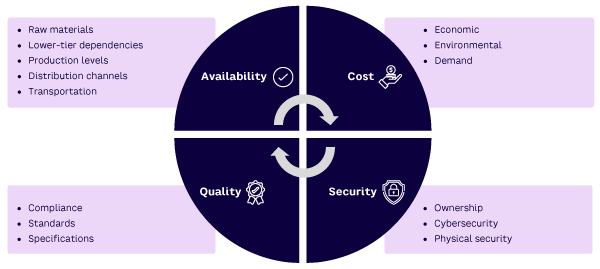

STAR’s risk assessment element maps the key risk drivers of availability, cost, quality, and security, as shown in Figure 2 and discussed below. Assessments on these areas (identified through research and interviews with experts) need to be conducted on a rolling window basis, due to the dynamic nature of changes in both demand and supply.

The information must be calculated on an ongoing basis to provide decision support in time to course correct for impact to specific supply chain components and consumables. STAR participants would conduct multi-parametric, multi-variant analyses using data provided by partners, stored in information wells, processed in cloud platforms, and secured using data integrity technologies. The following sections describe each of the four correlated risk assessments.

1. Availability: Global Production & Supply Assessment

Global Production and Supply Assessment (GPSA) addresses availability. Using trends data on production levels and distribution channels as key metrics, GPSA analytics would extend beyond traditional availability modeling focused on next-tier components. For example, it could establish the probability of component availability according to specified space enterprise mission timelines. The results would inform decisions on mitigation plans, such as anticipating limitations of xenon gas availability to meet propulsion requirements so that a spacecraft provider can shift to use of krypton for ion thrusters.

2. Cost: Global Demand & Space Sector Cost Assessment

Global Demand and Space Sector Cost Assessment (G/SCA) addresses risk related to cost. G/SCA would assess all market segments to provide insight into differentiation, switching costs, speculation, future roadmaps, and projections. For upstream buyers, this assessment would consider a variety of factors, including price elasticity due to fluctuations in supply and demand over time and viability of market players given the viability of broad market segment. For the space sector, an additional low tier would be added for systems in the context of global demand. G/SCA assessments of space market segmentation identify the effects on demands associated with tailoring requirements for space systems. Requirements include quality assurance, testing, and related characteristics for a specific component to meet demands for space systems.

G/SCA assessments inform confidence in, and risk of sourcing from, trusted producers and providers in the global marketplace. For example, current global xenon production is 10 million liters,14 of which Ukraine produces 30% or 3 million liters.15 The space market uses approximately 36% of this global xenon supply or 3.6 million liters.16 So, if the supply from Ukraine is disrupted, the remaining 7 million liters of xenon of varying grades (not all are appropriate for use as propellent) will be in demand by competing market segments. G/SCA will be useful for highlighting price escalation amid geopolitical conflict.17

3. Quality: Space Applications Quality Assessment

Space Applications Quality Assessment (SAQA) addresses risk assessments related to quality. SAQA would assess the degree to which components meet quality standards and specifications for operational needs. The assessment can be reviewed to prevent issues, such as the effects of using subpar gas if xenon/neon quality does not meet space system needs. For example, purification processes for neon, krypton, and xenon gases used in semiconductor manufacturing require a technical threshold, and the Russia/Ukraine conflict has affected Ukraine’s ability to deliver it.18

4. Security: Supply-Side Information for Space Systems Security Assessment

Supply-Side Information for Space Systems Security Assessment (SSecA) addresses security. SSecA would assess multiple dimensions of security for a specific supply-side product or service. Security challenges include situations where the provider’s financials infer limited ability to sustainably provide components for the duration needed or that the company has owners or investors from countries that pose national security concerns. For example, production of xenon and neon was affected by pandemic-related policies in China.19

Current risk assessment tools include MITRE’s System of Trust Framework,20 which addresses concerns and risks related to suppliers, supplies, and service providers.

Conclusion

As the number of space systems increases, so does competition for the raw materials and components needed to produce them. Supply chain information is important to sustain the production of nationally important space-based missions and services. The US and partner space organizations need information that is current, accurate, and trusted to manage supply chain risks. Recognizing these needs, this article envisions a topology called STAR to shine a light on dynamically evolving risks.

This article is intended to serve as a springboard for community dialogue to establish, build confidence in, and operationalize a STAR solution for the space enterprise. Other sectors, including the automotive and aircraft industries, have complex global supply chains with similar needs, and their experience in supply chain tracking could serve as exemplars for the space sector.

Our vision for STAR includes an approach for trusted, near-real-time risk assessments. These risk assessments can be enabled by harmonizing multiple elements. As described, STAR could be implemented through a coordinated set of community actions, such as building partnerships, pooling data in information wells hosted on cloud platforms, and applying DLT to ensure data integrity.

As the space enterprise begins producing thousands of spacecraft for deployment into low Earth orbit, the time has come to overcome policy, legal, technical, and nontechnical barriers. Secure, sustainable space supply chains are a matter of national security and economy because a chain is only as strong as its weakest link.

Acknowledgments

The authors would like to thank The Aerospace Corporation’s Barbara Braun, Joe Cheng, Michael Fortanbary, Susan Hastings, Aimee Hubble, Jeff Juranek, Kimberly King, Steve Lutton, Barik Monasterio-Smith, Coreen Moncrief, Leslie Munger, Mclinton Nguyen, Scott Niebuhr, Wayne Thompson, Catherine Venturini, and Allyson Yarborough; Space ISAC’s Hector Falcon, Joel Francis, Whitney Jones, and Erin Miller; Guidehouse’s Meg Maloney; Maxar’s Steve Radloff; and other experts, officials, and colleagues who contributed to the foundation and review of this article. We also extend our gratitude to Michael Gleason for his valued editorial support and advice.

References

1 Johnson, Christopher D. “Private Actors in Space.” Secure World Foundation, June 2019.

2 In this article, we focus on a private or permissioned blockchain and use the definition of blockchain proposed by NIST: “Blockchains are tamper evident and tamper resistant digital ledgers implemented in a distributed fashion (i.e., without a central repository) and usually without a central authority (i.e., a bank, company, or government). At their basic level, they enable a community of users to record transactions in a shared ledger within that community, such that under normal operation of the blockchain network no transaction can be changed once published.” See: Yaga, Dylan, et al. “Blockchain Technology Overview.” National Institute of Standards and Technology (NIST) Internal Report 8202, October 2018.

3 Kaminska, Izabella. “Noble Gases Are Suffering from Putin’s War in Ukraine.” Bloomberg, 19 May 2022.

4 Shortages result in nonsymmetrical impacts across a product portfolio. If a producer must raise prices significantly while reducing volume of output, it may consider shifting the mix of outputs, possibly by refocusing on goods with limited consumer elasticity such as chips the customer must buy (even at higher prices) or by looking to provide only the most highly value-added, high-demand products (where numerical scarcity is expected and material inputs represent a trivial percentage of final cost). In these cases, absorption of supply costs has a marginal effect on overall demand.

5 Simchi-Levi, David, and Edith Simchi-Levi. “Building Resilient Supply Chains Won’t Be Easy.” Harvard Business Review, 23 June 2020.

6 Lamanna, Charles. “Introducing the Microsoft Supply Chain Platform, a New Approach to Designing Supply Chains for Agility, Automation and Sustainability.” Microsoft, 14 November 2022.

7 “AWS Supply Chain.” Amazon Web Services (AWS), accessed February 2024.

8 Bernard, Allen. “Google Cloud Announces New Supply Chain Twin Offering.” TechRepublic, 14 September 2021.

9 SLSA website, accessed February 2024.

10 “Supply Chain Integrity, Transparency, and Trust (SCITT).” Internet Engineering Task Force (IETF) Datatracker, accessed February 2024.

11 “Fact Sheet: Biden–Harris Administration Announces National Cybersecurity Strategy.” The White House, 2 March 2023.

12 Gafni, Noa. “Why We Need to Redefine Trust for the Fourth Industrial Revolution.” World Economic Forum, 20 December 2019.

13 The space enterprise is experiencing growing interdependencies for both upstream and downstream segments. The upstream segment includes future research, design, manufacture, launch, and operational support of spacecraft, satellites, and payloads. The upstream segment enables applications of downstream markets in navigation, munitions guidance, communications, agriculture, banking, and power supply — all critical to military and civilian users worldwide. Impacts to these will ultimately affect availability and slow supply chains. These all rely on microelectronics, for example, with neon as a component.

14 Emsley, John. “Elements: Xenon.” Royal Society of Chemistry, 31 December 2008.

15 Wijffelaars, Maartje, and Erik-Jan van Harn. “Ukraine War Poses a Threat to EU Industry.” Rabobank, 12 April 2022.

16 “Xenon Market Size, Share & Covid-19 Impact Analysis, by Type (N3, N4.5, and N5), by Application (Imaging & Lighting, Satellite, Electronics & Semiconductors, Medical, and Others), and Regional Forecast, 2022–2029.” Fortune Business Insights, August 2022.

17 “Neon Gas Needed for US Semiconductors May Be Stuck in the Russian-Ukrainian Conflict, Experts: Chinese Technology Is Mature.” iMedia, 9 February 2024.

18 iMedia (see 17).

19 Jie, Yang, and Aaron Tilley. “Apple Makes Plans to Move Production Out of China.” The Wall Street Journal, 3 December 2022.

20 ”System of Trust Framework.” MITRE, accessed February 2024.

Appendix