AMPLIFY VOL. 36, NO. 7

Investors in public companies should be able to get accurate data about long-term corporate risks so they can make well-informed decisions about their investments. With interest in corporate social responsibility increasing, many investors are asking for public disclosures about environmental, social, and governance (ESG) issues to assess potential risks. Yet risks associated with ESG reporting do not usually show up in earnings statements or annual reports.

For this reason, regulators are putting greater emphasis on the disclosure of nonfinancial ESG information. At the same time, employees and partners increasingly seek companies that demonstrate a commitment to addressing environmental concerns. Likewise, consumers are growing more concerned about the environment and prefer brands with values that align with their own.

Investors who value the long-term health of corporate America support greater corporate disclosures on environmental impact as a financial safeguard against undue risk. Not surprisingly, most regulated organizations have signaled their intentions to achieve net-zero emissions by 2050, if not much sooner.

In a recent Honeywell/Futurum Research survey, sustainability goals were ranked as the top corporate priority by 75% of respondents.1 Sustainability beat out digital transformation initiatives (56%), financial performance (47%), and event market growth (47%). The leading types of corporate environmental initiatives included energy efficiency, recycling, and circularity. The leading types of corporate environmental initiatives included energy efficiency, recycling, and circularity.

Sustainability, including how companies align their ESG objectives with supplier management decisions in the supply chain, is a topic of particular interest for regulators and investors. As a result, many companies are working to adopt a more sustainable approach to procurement.

By gaining a clearer picture of their business relationships, manufacturers can choose suppliers based on how well they measure and track their ESG metrics and their willingness to collaborate on improvement plans. Suppliers that show real progress toward meeting sustainability, data privacy, labor, and corporate governance rules are increasingly being prioritized as partners by many organizations. Companies that lag in meeting ESG standards may face a negative backlash from investors, employees, and consumers, potentially impacting growth prospects and limiting their ability to attract top workforce talent.

Scoping Out GHGs in the Value Chain

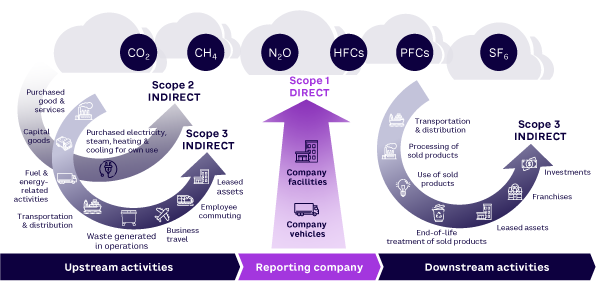

One of the most challenging aspects of environmental reporting involves calculating greenhouse gas (GHG) emissions. This issue stretches back to at least 2001, when the Greenhouse Gas Protocol organization set out a framework for business standards on carbon reporting. The simple system classifies emissions as Scope 1, 2, or 3.

Scope 1 involves GHGs stemming from the direct production of goods and services; Scope 2 involves emissions from indirect energy consumption, such as office electricity. Most organizations have become steadily more effective in how they measure and mitigate emissions from their Scope 1 and Scope 2 sources.

Scope 3 sources (GHGs produced by external suppliers and customer activities) represent the largest opportunity to lower emissions, making up at least 70% of overall emissions for most industries.2 As such, companies that are serious about minimizing their carbon footprint must focus strongly on Scope 3 (see Figure 1).

For example, computer peripheral maker Logitech says Scope 3 emissions make up 99.8% of its current global GHG emissions.3 That overwhelming percentage is due to the company reportedly reducing its Scope 1 and Scope 2 emissions to “negligible” levels.

Logitech plans to cut its Scope 3 emissions in half or more by 2030 by refurbishing more products for resale and incorporating lower-carbon materials into production.4

Despite the obvious environmental and financial benefits of reducing emissions, only 47% of companies currently include Scope 3 planning in their efforts to reach net-zero emissions by 2050.5 This situation stems from the fact that gauging emissions from external suppliers, let alone reducing them, is much more difficult than creating internal programs to measure and reduce emissions from in-house processes and systems. Scope 3 requires proof that emissions in a business’s extended supply chain be reduced, something that can’t be done without the active contribution of suppliers and customers.

The path to reduce emissions requires an inside-outside approach. Internally, organizations need to become more efficient in managing resources, energy, manufacturing plants, and transportation systems. Business leaders must analyze where and how their organizations are most wasteful and develop action plans for mitigation. For IT departments, this includes scrutiny of interrelated factors like data center energy use, cloud adoption, enterprise architecture sustainability, end-user-device decarbonization, and deploying environmental-monitoring software.

Externally, organizations must become more collaborative in how they work with suppliers to drive mutual gains in meeting targets. Most emissions reductions will come not from selecting different suppliers, but from continuous improvements and innovations developed by (or jointly with) suppliers. Organizations that build the most collaborative relationships with suppliers will have an opportunity to realize a long-term competitive advantage in their markets.

To address the Scope 3 challenge, companies must closely align their efforts across all supplier networks. Working together, partners can develop structural innovations that will allow them to share, lease, reuse, repair, refurbish, and recycle existing materials as a way of reducing their overall environmental impact. This collective approach serves as the basis for a longstanding strategy known as a “circular economy.”

Closing the Circle on Emissions Reporting

Think of a circular economy as an industrial system that is restorative or regenerative by design. After use, the circular model returns products to be reused, recycled, or repurposed. This approach differs from a linear model of turning raw materials into products that are only used once before being wastefully discarded.

In a circular economy, things are made and consumed in a way that minimizes the waste of natural resources and lowers carbon emissions. A circular economy recaptures “waste” as a valuable resource to manufacture new materials and products. Organizations using this model reduce material consumption by redesigning materials, products, and services to be less resource-intensive. A circular economy can include material harvesting, repackaging, reusing, and recycling to efficiently reduce a company’s waste footprint and thus close the circle on circular economics.

To achieve a circular economy, companies must first develop a comprehensive view of emissions data across their extended supply chain. Developing such a baseline at the supplier and category level is essential to identifying the greatest opportunities and developing an effective action plan.

Companies then leverage data provided by suppliers and third-party data sources. Independent data is needed to gauge supplier sustainability, verify the impacts of emissions on ESG and compliance goals, and provide estimates when suppliers lack the knowledge to provide accurate, detailed carbon data. One respected data source is EcoVadis, which provides business sustainability ratings for public and private enterprises to monitor and improve the sustainability performance of their trading partners. Other sources provide category-level estimates of carbon emissions.

This effort must include sub-tier suppliers, where the bulk of an organization’s immediate suppliers’ emissions are likely to be generated. This adds complexity, as it greatly extends the number of suppliers involved and likely includes small suppliers that have looser controls and little or no ability to calculate carbon emissions.

Baselining carbon emissions remains a difficult, imperfect process. This is compounded by suppliers’ challenges assessing their own carbon emissions and that of their suppliers. To maximize baseline accuracy while minimizing effort, companies should focus on larger suppliers of more carbon-intensive and heavily purchased categories. This reduces strain on procurement staff as well as suppliers.

With a verification framework in place, many large companies have made impressive strides toward reaching net-zero emissions. For example, luxury goods maker Moët Hennessy estimates that Scope 3 emissions make up 93% of its total carbon footprint. Moët Hennessy has launched a project called “Golden Seeds” to ensure that liquids extracted in its harvesting processes can be reused and recycled across other operations.6

Similarly, auto manufacturer Volvo reuses surplus green hydrogen from its steelmaking process to power filling stations and hydrogen-fueled vehicles. Volvo has several active partnerships for battery-charging and hydrogen infrastructure projects across the US and Europe to increase the adoption of hydrogen power and reduce carbon emissions.7

Meanwhile, Safran, a key aerospace and defense supplier to the US, now recycles 60% of raw materials used in its titanium and nickel alloys. Safran achieved this milestone in France, at the first European manufacturing plant to successfully adopt recycling in the production of aeronautical grade alloys. The plant employs a clever circular economy by producing new titanium ingots wholly from scrap metal collected from the company and its subcontractors.8

Upstream Scope 3 emissions are, on average, 11.4 times higher than direct emissions.9 In the raw materials sector, they average less than 30% of total emissions, but in the finished good sector, they often contribute more than 75%. For example, 83.3% of Nestle’s emissions are generated by the supply of ingredients and packaging. The production of Apple’s products with suppliers accounts for 70% of its emissions.10

Measuring Supplier Emissions: Trust, but Verify

These examples reveal the power of a circular economy strategy to broadly lower Scope 3 emissions across various industry groups. In addition to reducing the costs of materials and production, this strategy can help safeguard against long-term financial or legal liabilities while ensuring an organization keeps pace with its more innovative competitors.

However, all emissions records must be scrutinized, so it is up to companies to build systems for reliable reporting across their supply chains. This is a demanding task due to the need to assess the accuracy of each individual supplier’s inputs and fill gaps between supplier data and independent data sources. Systems must be designed with sufficient flexibility to accommodate new sources of data and formulas as market data improves over time and regulations potentially evolve and become more prescriptive.

One useful benchmark is measuring the financial investments that partners make toward collaborative projects. This can include documented evaluations of transport or distribution channels and the resulting emissions they produce. Another approach involves auditable documentation of emissions stemming from materials and energy use. Broad industry coalitions and affiliations are being formed to support these efforts, such as Catena-X, a data-sharing platform used by automotive suppliers and factories. Collaborating on such platforms with competitors and partners helps alleviate the strain placed on suppliers and improves overall reporting accuracy, especially in light of the lack of clearly defined industry standards in most cases.

The watchwords for these supplier relationships should be the old saying popularized by former US President Ronald Reagan during Cold War nuclear weapon negotiations: “Trust but verify.” Emissions data gathered from partners should be made transparent and accessible to the greatest extent possible. There can be no collective accountability to shareholders and other stakeholders if the emissions data is not clearly shared across the entire supply chain as a single source of truth.

Achieving a state of mutual transparency requires a software platform for data sharing, along with dashboards and analytics engines for users to analyze trends and make course corrections. Armed with these tools, organizations can successfully execute their circular economy initiatives by building up partnerships with suppliers that meet their strict sustainability thresholds.

Scope 1 and Scope 2 goals are being successfully met by many, but Scope 3 still presents a nagging problem for most organizations. To make greater progress, it is important for leaders to bring suppliers and partners into not only the planning process, but also daily procedures and operations that may affect emissions controls. By taking a circular economy approach, companies can set clear goals, manage their efforts, and measure outcomes to ensure steady progress toward slashing Scope 3 emissions.

References

1 “Environmental Sustainability Index.” Honeywell/Futurum Research, 2023.

2 “Why It’s Time for Procurement to Drive the Enterprise Sustainability Agenda.” Spend Matters, 12 May 2022.

3 “Climate Positive: We’re Taking Action to Help Shape a Climate Positive Future.” Logitech, accessed July 2023.

4 Huber, Nick. “Tech Manufacturers Wrestle with Supply Chain Emissions.” Financial Times, 4 May 2022.

5 Murray, Alan, and David Meyer. “The Latest Fortune 500 CEO Survey Does Not Show a Lot of Optimism.” Fortune, 24 May 2022.

6 “The Race Towards Carbon Neutrality: Procurement on the Frontline.” Ivalua, accessed July 2023.

7 “Volvo Group in Fossil Free Initiative.” Volvo, accessed June 2023.

8 Ivalua (see 6).

9 EPA Center for Corporate Climate Leadership. “Supply Chain Guidance.” US Environmental Protection Agency (EPA), 17 January 2023.

10 Ivalua (see 6).