AMPLIFY VOL. 37, NO. 4

In the not-so-distant future, thoughtful and strategic environmental, social, and governance (ESG) disclosures will be at the heart of sound business practices for companies of all sizes. Yet anti-ESG sentiment and heightened scrutiny make disclosing ESG factors rife with challenges. In the vast, complex land of ESG reporting, how can companies avoid political backlash and reap the many benefits of touting their ESG impact?

Two decades after the United Nations (UN) Global Compact coined the term “ESG” in a paper titled “Who Cares Wins,” the notion of institutional investors using ESG factors to gauge corporate performance has become a political tinderbox. A firestorm of bills, regulations, and boycotts has swept through state legislatures, prompting many companies to back away from publicly promoting their ESG initiatives.

But that doesn’t mean ESG is dead. Rather, the anti-ESG wave presents an opportunity for companies to pause, assess their ESG strategy, and shift their approach from a check-the-box compliance requirement to a strategic initiative centered on creating tangible value for stakeholders while mitigating market risk.

With a variety of regulatory bodies pushing for complex disclosures and transparency around performance and targets, it is only a matter of time before companies of all sizes in all geographies will be required to shift from voluntary to mandatory reporting on their impact across various ESG factors, including climate-related risks. Although being required to disclose will likely be the catalyst for many companies to act, those who wait until the requirement deadlines arrive will be forced to play catch-up with their peers. Why?

-

Employees are keenly interested in understanding how their organizations address the social and climate issues that matter to them.

-

Procurement teams are increasingly requiring transparency in areas such as a company’s diversity profile, environmental impact, and supplier relationships.

-

Institutional investors are making decisions based on factors like corporate governance, climate risks, and workforce diversity.

-

Environmental risk is being recognized as financial risk. Politics aside, it is impossible to ignore the potential impact on the financial and operational performance of businesses across virtually all industries, including the effect of natural disasters on the insurance industry and of water shortages on manufacturing operations. The World Economic Forum projects the global cost of climate damage per year could range from US $1.7 trillion to $3.1 trillion by 2050.1

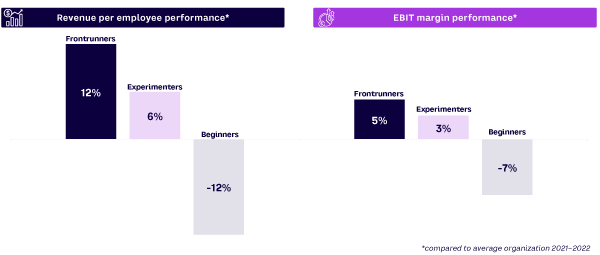

An effective sustainability strategy can serve as a powerful tool to showcase a company’s competitive advantages, shape positive perceptions among stakeholders, and support financial performance (see Figure 1).2 In contrast, poorly executed strategies put companies at risk of being accused of misrepresenting ESG claims (“greenwashing”) and/or delivering mixed messages.

So what’s the recipe for doing it right when it comes to sustainability disclosures and communications? From our experience, the best of the best take an approach that delivers on the three hallmarks explored in this article.

1. Anchor Actions to a Comprehensive ESG Strategy with a Scalable Foundation

Start by aligning your ESG goals with your corporate strategy. Articulate how ESG considerations integrate into your company’s strategic planning to manage risk and create growth opportunities. This exercise will be different for every organization, but climate-transition planning, carbon footprint reduction, employee health and safety, supply chain due diligence, and cybersecurity risk management are among the common priorities.

To identify which ESG areas are top priorities for your company, conduct a materiality assessment, peer benchmarking study, or gap analysis. Standards from the International Sustainability Standards Board (ISSB), International Financial Reporting Standards (IFRS) Sustainability Disclosure Standards, and Sustainability Accounting Standards Board (SASB), as well as the Corporate Sustainability Reporting Directive (CSRD) and the UN Sustainability Development Goals (SDGs), can be a great starting point.

Many companies will uncover a significant level of ESG activity already underway and can identify high-risk ESG areas that may have been historically under-resourced and could benefit from prioritization. For each item, management and the board should identify, develop, and disclose the actions being taken to manage risks and opportunities.

Investing in a scalable foundation ensures your team has the needed resources to advance ESG efforts effectively and with a strong ROI. Characteristics of a scalable foundation include:

-

Oversight and accountability at the board and management level

-

An ESG task force with cross-functional representation (e.g., legal, finance, investor relations, HR, supply chain, marketing) and sponsorship from an executive leadership team member to help shepherd the effort

-

Adequate resources to support the in-house team (may include training to enhance ESG expertise or adopting a digital platform for collecting, aggregating, and validating ESG-specific data)

When it comes to a well-constructed, fully embedded ESG strategy, Trane Technologies gets a gold star.3 The company’s sustainability strategy is clear the moment you land on its corporate website and includes clear commitments, goals, and progress across the ESG issues that the company has identified as critical risks and opportunities.

Another exemplar, hailing from the much-criticized apparel industry, is Adidas.4 The company has done an impressive job of formulating a well-defined sustainability strategy that takes a clear position and is supported by actions around the issues that matter to its most important stakeholders: its customers. The company’s commitment to increasing its use of recycled and reused materials, extending the wearable life of its apparel, and reducing its environmental footprint has been applauded by consumers and serves as a competitive advantage.5

2. Tell a Cohesive, Integrated ESG Story

Crafting a message that captures the full breadth of your ESG strategy and related activities is a complex undertaking. An integrated approach that includes dynamic content helps you connect with your stakeholders, respond to disclosure requirements, and enhance your impact.

Select your words thoughtfully. Take the time to debate internally whether your efforts are best referred to as “impact,” “ESG,” or “sustainability.” These terms mean different things to different people, and what is most appropriate for your company will depend on many factors, including how your program is structured, which audiences are most important to your company, and what messages you are trying to communicate.

Amid the recent anti-ESG backlash, more companies are using terms like “sustainability,” “impact,” or even “ESG impact.” When delivering your message to investors, consider how the terminology varies across sustainable investment categories like socially responsible investments (value-based), ESG-themed investments (value-based), and impact investments (outcomes-based).6

In your narrative, identify the ESG factors that matter most for your company. A particularly effective tactic is to use a pillar construct to define your focus areas. Your pillars should link to your strategy, showcase your culture and brand, and speak to your key stakeholder groups. You can add depth and context to your disclosures through key performance indicators (KPIs) and accompanying case studies and stories. KPIs offer quantifiable metrics to assess performance, while case studies contribute qualitative insights that illustrate the real-world impact of your initiatives.

Taking a “report card” approach to disclosures by providing milestones and periodic updates can help establish credibility and trust. Chesapeake Energy provides a nice example of this with its “Net Zero Roadmap,” which lays out key actions the company has taken and shows future milestones that will help it deliver on its goals.7

Disclosing ESG achievements and targets is serious business and should be treated as such. All metrics must be validated, and all targets must be real (not just rhetorical). Consider setting science-based targets to add a layer of precision and enhance the credibility of your efforts. You might also engage a third-party auditor, which not only adds credibility but has been shown to improve results. Recent research by the Massachusetts Institute of Technology (MIT) Sloan School of Management, based on data from sustainability tech platform Clarity AI, demonstrated that “companies that verify their emissions by third-party auditors initially demonstrate higher carbon emissions (13.7%) and intensities (9.5%) — but ultimately make more reductions in the future — than those that do not externally verify their data.”8

Not vetting claims or releasing goals without plans to support them can result in greenwashing accusations, increased legal scrutiny, and reputational damage. In 2023, Nestle, Coca-Cola, and Danone made headlines when they were accused by European consumer organization BEUC and two environmental groups of promoting misleading recycling claims.9

Companies that do it right make sustainability an integral part of their long-term strategy, not an afterthought. This becomes apparent when an ESG narrative is seamlessly integrated across communications platforms. The ideal mix depends on several factors, including where you are in your ESG journey, what stakeholder groups are top priority, your budget, and your timeline. A sustainability report is often the first place to start. If you are early on in the journey, it may be best to start with a sustainability section on your website. Incorporating the message across other content (your annual report and proxy, employee communications, and investor presentations, among others) demonstrates your commitment. Design elements like imagery, infographics, and callouts help break down complex concepts. You might also consider viewer-friendly content like visual fact sheets, brochures, and videos.

One company that delivers on strong ESG communications is Dick’s Sporting Goods. The company’s sustainability strategy hinges on creating enterprise business value with a focus on topics identified through a prioritization assessment. Dick’s defines its sustainability strategy through four brand-forward pillars: “Leveling the Playing Field,” “Clearing Hurdles,” “Raising the Bar,” and “Protecting the Home Court.” Within each pillar, the company identifies specific goals, provides metrics to quantify progress, outlines key initiatives, and acknowledges where it has more work to do. The company has an impressive integrated communications package, including a visually compelling sustainability report (its “Purpose Playbook”), a user-friendly sustainability website, and a comprehensive one-page sustainability summary.10

3. Engage Stakeholders Proactively & Regularly

Taking a proactive, creative approach to stakeholder engagement can amplify the impact of your ESG communications and generate feedback to enhance your plan and actions. Although the board should ultimately oversee ESG strategy as part of overall risk management and accountability, keeping management and the board updated through frequent ESG briefings is an important element of your engagement strategy.

Engaging investors beyond your sustainability report and public disclosures is important as well. This can include one-on-one meetings with portfolio managers, analysts, and stewardship teams. You also can identify and target funds that might take a position in your company based on your ESG strategy. ESG investor briefings (sometimes called ”Sustainability Days”) are an efficient way to allow a range of investors to engage with management and subject matter experts on sustainability efforts. These events can be virtual, in-person, or hybrid and can focus on your overall ESG strategy or drill down into actions of particular interest to your investors.

Your employees can be the best ambassadors of your ESG initiatives, especially if you engage with them and allow them to contribute. Providing channels that empower their participation in and influence on your program is key. This can include funding employee resource groups, offering frequent employee surveys, and getting creative with contests and competitions for employees to drive ESG initiatives important to them.

Customer engagement varies widely depending on the nature of your business. If you have a B2C model, for example, integrating ESG into your marketing, email campaigns, and social media can be very effective.

Procurement teams have increasing responsibility for building de-risked, robust, diversified supply chains. For this reason, it is important to consider a strategy for keeping key customers’ procurement teams informed about your ESG efforts.

Although it is typically not advisable to allow your strategy to be dictated by third-party rating agencies (e.g., Institutional Shareholder Services [ISS], Glass Lewis, or Morgan Stanley Capital International [MSCI]), it remains important to ensure proxy advisors and rating agencies understand — and give credit for — your ESG efforts. To that end, it’s important to ensure your ESG profile is up to date and accurate on each of their platforms and to engage with them directly when warranted.

As you work toward delivering on your long-term goals, proactive stakeholder engagement helps you demonstrate progress, gather feedback, identify issues, and course correct as needed.

The Bottom Line

When linked to risk mitigation and value creation and amplified by strategic, transparent, and compelling communications, an ESG strategy can be a meaningful competitive advantage and an essential enabler of responsible business. Investors consider ESG in investment decisions, regulators require ESG disclosures, consumers are motivated by ESG-related actions, procurement teams are considering ESG practices in purchasing decisions, and employees are demanding ESG strategies and actions. By focusing on strategy, transparency, accountability, and performance, companies can demonstrate the value-creating impact of key ESG efforts on their business.

References

1 “Climate Change Is Costing the World $16 Million per Hour: Study.” World Economic Forum, 12 October 2023.

2 Capgemini Research Institute financial analysis of 660 organizations (n = 52 “frontrunners,” 384 “experimenters,” and 224 “beginners”) for fiscal year 2021–2022; frontrunners = better progression against three dimensions of value chain processes, sustainability enablers, tech accelerators; experimenters = low maturity in either one or two of the above three dimensions; beginners = low maturity along the three dimensions; see: “A World in Balance: Heightened Sustainability Awareness Yet Lagging Actions.” Capgemini, 2023.

3 “Changing Our Industry, and the World, Begins with Us.” Trane Technologies, accessed April 2024.

4 “Planet.” Adidas, accessed April 2024.

5 Birch, Kate. “How Adidas Is Innovating to Make Sportswear More Sustainable.” Sustainability Magazine, 27 February 2024.

6 Siwo, Andrew. “Disentangling the Value of ESG Scores and Classification of Sustainable Investment Products.” Harvard Law School Forum on Corporate Governance, 22 March 2024.

7 “Our Strategy for Achieving Net Zero.” Chesapeake Energy, accessed April 2024.

8 MIT Sloan Office of Communications. “Without the Use of Third-Party Auditors in Carbon Reporting, Companies Report Lower, But Unreliable, Emissions.” MIT Sloan School of Management, 26 March 2024.

9 Cox, Amy. “Coca-Cola, Nestlé, and Danone Face Legal Scrutiny for Misleading Recycling Claims.” Sustainability News, 7 November 2023.

10 “2022 Sustainability Performance Summary.” Dick’s Sporting Goods, November 2023.