Clear, transparent, reliable carbon accounting makes good business sense, improving a company’s reputation and trustworthiness while providing an opportunity for market differentiation. In this Advisor, we describe the seven essential practices of a cross-industry generally accepted carbon accounting principles (GACAP) system.

1. Interoperability Across Sectors

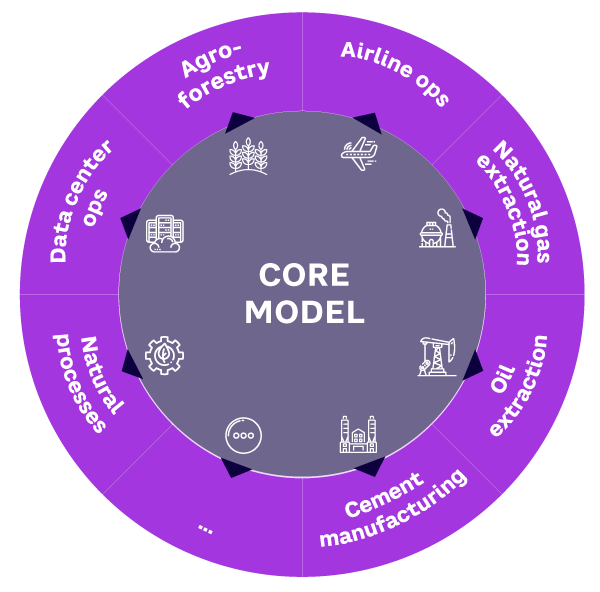

A global carbon accounting system requires interoperability between industry sectors and verticals. We can represent emission sources as pie slices, with each source accounting for its emissions or natural removals and developing measurement technologies applicable to their specific processes (see Figure 1).

Of course, the sectors do not exist in silos; all emissions go into Earth’s one atmosphere. Thus, a federated system is needed, one that accounts for carbon exchanges (emissions or removals) and applies to interactions with the atmosphere and with other industries. A carbon accounting interaction between sectors and various types of emitters and removers introduces the notion of carbon offsetting as a carbon accounting application.

These carbon accounting transactions are included in a GACAP model that applies to all industries, similar to the way traditional business accounting (GAAP) takes place. This model enables distributed, decentralized (yet standardized) carbon accounting, in which each industry sector performs industry-specific scientific or engineering measurements.

Merging or integrating data from multiple streams from various sources is efficient, but it requires multimodal measurement in which implementers can balance less expensive, less precise data sources with more expensive, more precise sources. A high-value tract, such as a forest with centuries-old hardwood trees, may require measurement on actual specimens or time- and physical-based measurement by ground crews or Internet of Things (IoT) sensors. (Note that the selection of measurement modality, whether event-based or modeling-based, would be determined by policy and affordability.)

2. Measuring Externalities

The main externality for fossil fuels is global warming through combustion (other externalities include contamination from plastic pollution or oil spills from tankers or pipeline breaks). The first step in managing externalities is measurement, formally known as “measurement, monitoring, reporting, and verification” (MMRV). This is required at every stage of a supply chain. For example, supply chain stages for fossil fuels might include exploration and extraction, transportation, refining, distribution, and consumption. Carrying out MMRV at every stage enables carbon-flow assessment and attribution, as well as assignment of emissions liabilities and credits for every player in the supply chain.

One challenge is the impermanence of carbon stored in physical spaces, such as in the agroforestry industry. Improvised mechanisms such as buffer pools are in use in agroforestry-backed compliance markets. Credits from these pools are used after a contingency to restore the credits lost. This mechanism is not foolproof, as losses can be higher than the reserve (e.g., with wildfires), leaving no recourse. As we describe below, various technical verification mechanisms can help with the need to measure externalities.

3. Verifiability: Digitally Twinning Underlying Assets

Digital twins make audits and tracebacks possible by providing measurement metadata (e.g., timestamps and geolocation). Access to this data should be possible at any moment for technical or legal needs. Stakeholders must be able to track their carbon assets and/or examine the pedigree of any asset being assessed for a transaction.

For example, the impermanence of forest assets could be treated as variable-price commodities. This would require real-time MMRV, including event-based measurement augmented with historical and predictive growth models.1 Data-sampling frequency must be based on the underlying business processes. In practice, this means assessing biomass at different intervals depending on the tool (e.g., IoT sensors, light detection and ranging equipment, or satellite infrared remote sensing).

4. Decentralization: No Single Point of Failure or Influence

A concentration of carbon accounting data or services at any point in the supply chain would not be in the interest of participating entities, due to single points of failure or potential bias. Instead, measurement events must be visible across entities as liabilities and assets are transferred by recording them in a permanent, immutable ledger (blockchain). Additionally, smart contract–enabled blockchains would allow decentralized autonomous organizations to manage the system. Although this blockchain implementation is distinct from cryptocurrency, the high-energy, high-carbon costs of blockchain would need to be included on the liability side of the ledgers.

5. Privacy: Protecting Rights of Counterparties & Asset Holders

Carbon accounting data sets must be designed to facilitate audits by participating agencies and entities while preserving the privacy of the underlying asset holder. Cryptographic methods include selective attestation (e.g., authorizing a transaction without revealing the identities of the transacting parties or certain details of the transaction), zero-knowledge proof (e.g., doing a task that reveals the existence of knowledge but not the actor’s identity), attribute-based credentials (disclosure of verifiable attributes like location or carbon-asset dimensions, without revealing the disclosers’ full identity), and homomorphic encryption (performing calculations on data without decrypting it).

6. Scalability

Global warming affects the entire planet, so the scope of a carbon accounting system should be as broad, with accounting across all sectors. An ability to incorporate most industry sectors, actors, and transaction volumes without restriction would require the implementation of nearly all the factors (interoperability, traceability, decentralization, verification, and privacy).

In addition, scale, in the form of market participation, spreads entities’ market risk. High levels of participation signal that the market has confidence that the underlying traded assets are reliable.

7. Traceability

Supply chains are complex, interconnected systems. They can represent physical materials (e.g., oil or cement in the construction industry), abstract materials (e.g., carbon credits), or both. Transparency and visibility across the supply chain are two of the most pernicious issues plaguing today’s opaque, voluntary carbon-offset markets. With such complexity, visibility into component parts of a carbon offset coming from different origins or processing streams may be difficult. Meanwhile, a participant might be less transparent about an asset whose value is precarious if there were no repercussions to its changing after the sale.

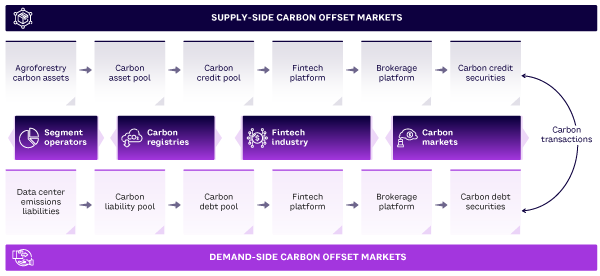

Figure 2 shows a carbon supply chain applicable to the agroforestry industry, with carbon removals (credits) and carbon emissions (debits) for data centers. In this example, each stage in the supply chain represents a data type and an industry actor managing the data type.

Following the agroforestry supply chain stages from left to right, a landowner deals with the forested land, forming the basis for carbon capture in the form of biomass. A carbon consolidator makes the biomass estimates and converts them into bulk carbon figures. A carbon registry takes the carbon figures and issues carbon credits on them. A fintech firm takes the carbon credits to a financial platform to securitize the carbon credits, which are passed to brokerage companies that sell the financial instruments to investors. A similar process can be defined for the data center supply chain (see bottom of Figure 2).

Figure 2 connects both carbon emitters and carbon-capture entities to financial markets, eventually bringing them together. Blocks of carbon emissions or removals can be split and/or combined on exchanges. Carbon records can be pooled or sliced into tranches the same way mortgage-backed securities are today.

Note

1Event-based measurement means the data comes from measurements on the actual assets or some component thereof, not from abstract statistical estimates.

[For more from the authors on this topic, see: “Robust Carbon Accounting for Corporate Sustainability Strategies.”]