AMPLIFY VOL. 36, NO. 11

Accelerated plans to drive decarbonization hide an uncomfortable truth: greenhouse gas emissions are increasing in many countries and sectors. Since 2020, global energy-related carbon dioxide (CO2) emissions have grown by 7.2%.1 Consequently, many nations will miss their 2030 CO2-reduction targets, including such large emitters as the US, China, the UK, and Germany.2

Despite major growth in renewables and revitalization of nuclear energy, the expansion of the hydrogen economy, and energy-efficiency gains, there is a widening gap between policies and targets. This situation is particularly acute in areas such as baseload power generation using coal/natural gas, decentralized combined heat and power generation, and industries with energy-intensive processes like chemicals, cement, iron, and steel and food processing. These emissions are proving stubbornly hard to abate, and although clean hydrogen and other sustainable fuels may offer a partial solution, it is unlikely to be widely available until well into the 2030s.

Traditional levers are not enough. To bridge the gap, we must accelerate adoption of carbon capture, utilization, and storage (CCUS) technologies to either reuse CO2 that has been produced or store it securely. This is especially true in Europe, which has some of the world’s most ambitious climate targets.

CCUS is widely accepted as a viable technology approach for decarbonization. Its potential has been recognized and endorsed by the United Nations (UN) Intergovernmental Panel on Climate Change (IPCC) as an essential part of the transition to net zero.3 Importantly, it also creates a range of transformative opportunities for businesses across the value chain.

Closing the Emissions Gap with CCUS

CCUS enables both short-term and long-term emissions reductions. It can act as an interim solution for industries like chemicals, iron production, and steel production now, while clean hydrogen supply and infrastructure scales up to meet requirements in the 2030s. It also provides a more permanent solution for industries like cement that cannot fully adopt hydrogen due to unavoidable emissions arising from production processes.

Current European Picture

The combination of its industrial base, far-reaching climate targets, and tightening regulations means Europe has an urgent need to decarbonize. But to date, Europe’s progress has lagged other regions, including the US, Australia, and Japan.

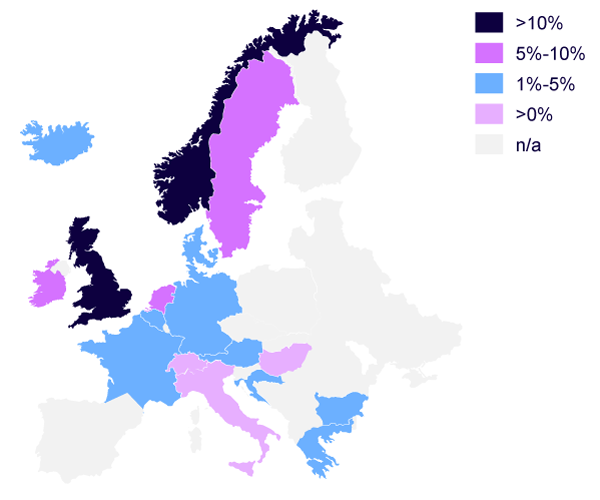

This is starting to change. Twenty European countries have either built or plan to build carbon-capture facilities that will be operational by 2030, dramatically increasing capacity from today’s annual 1.8 megatons of CO2 captured to up to 102 megatons by that date, as shown in Figure 1. Europe would shift from representing under 5% of global carbon-capture capacity to 28%.4

![Figure 1. CCS capacity in Europe operational by 2030 by project status (source: Arthur D. Little, International Energy Agency [IEA])](/sites/default/files/Amplify/2023/amp2311_dix_F01.png)

(source: Arthur D. Little, International Energy Agency [IEA])

These figures may be on the conservative side, as they are based on announced projects already at the advanced development stages. Further capacity increases are likely due to potential policies from the EU and national governments, driven by pressure to meet climate targets. For example, Germany is expected to introduce a comprehensive carbon management strategy in the coming months that could lead to a growth in local projects.5 Some experts see an even stronger uptake of carbon-capture capacity: GlobalData forecasts almost 140 megatons of CO2 per annum,6 and Rystad Energy predicts more than 200 megatons.7

Eighty percent of this capacity will be concentrated in five Northern European countries, led by the UK (51 megatons of CO2), the Netherlands (13 megatons), Norway (10 megatons), France (6 megatons), and Germany (4 megatons).8

These countries plan to use carbon capture in the production of blue hydrogen and/or ammonia, especially the UK and Norway. Further applications vary significantly between countries, based on expected needs:

-

UK — power and heat generation, especially for gas and biomass power plants

-

Norway — waste to energy plants and cement production

-

The Netherlands — coal power generation

-

France — iron and steel production

-

Germany — cement production

Impact on European Emissions

The increase in carbon-capture capacity will have an enormous impact on European emissions. Even basing calculations on the conservative 102 megatons prediction, it will correspond to ~10% of CO2 emissions covered by the EU Emissions Trading System (from power generation, heavy industry, and civil aviation) in 2022.9

This impact will not be distributed equally across Europe, with countries around the North Sea benefiting most, notably Norway (where it will make up 32% of 2022 emissions), the UK (16%), and Sweden (10%).10 By contrast, carbon-capture facilities are predicted to represent just 2% of French emissions, 1% of those in Germany, and a negligible amount in Italy, as shown in Figure 2.

(source: IEA, European Environment Agency)

CCUS as Business Opportunity

In addition to emissions reduction across Europe, CCUS offers a range of business opportunities to players across the value chain:

-

Capture. Responsible for 50%-66% of total carbon-capture and sequestration costs, the capture market requires significant capital investment but offers the highest revenue potential. Opportunities include designing and building CO2-capture infrastructure, operating and maintaining these facilities, and providing trading services for CO2 commodities and allowances under the European Union Allowance (EUA).

-

Transport. Distributing CO2 via pipeline, truck, or ship (or offering an end-to-end transport/distribution service) provides the smallest relative economic potential, but investment costs are low.

-

Storage. The design, building, and operation of CO2 storage facilities requires significant investment, particularly if storage is offshore.

-

Usage. Providing CO2 to customers as an alternative to storing it opens new revenue opportunities.

-

CCUS as a service. Rather than focusing on individual parts of the value chain, players can manage the entire upstream, midstream, and downstream lifecycle, a significant opportunity.

European Regulatory Drivers

The “carrot and stick” of regulatory costs and subsidies will drive both the volume and the value of the CCUS market. For industrial and power-generation companies in the European Economic Area (EEA), applying carbon capture removes the need to pay for EU carbon allowance certificates under the EU Emissions Trading System (ETS). It also opens new revenue streams if the captured carbon is sold as a commodity or if it generates tradeable carbon-removal certificates (e.g., when processes generate negative emissions such as through captured and stored biogenic carbon).11

This means current and future carbon pricing is critical to the economics of CCUS. In the case of the EU ETS, carbon prices have significantly increased since 2020, from a range of €5-€25 tCO2 to €80-€100 tCO2 in 2023. Prices are expected to rise above €110 (around US $116) tCO2 by 2030.12

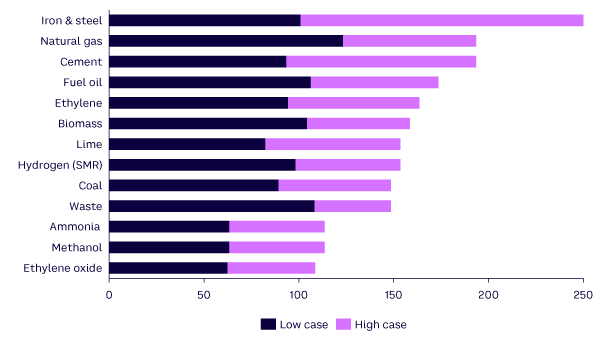

Comparing carbon prices with the levelized cost of carbon capture and storage (CCS) shows it can be a cost-effective option for selected industries if the current levelized cost is below €100 (about US $106) tCO2.13 This means CCS is particularly relevant for industries with high concentrations of CO2 in flue gas, including producers of ammonia or ethylene oxide, and for newer plants that incorporate CCS from the outset and have large annual carbon-capture volumes.

As technology matures, the levelized cost will fall further while carbon prices rise. This means lower-cost CCS facilities (e.g., new builds and large-scale plants) could be economically attractive in most industries (see Figure 3). However, CCS will still not be cost-competitive without subsidies in certain industries, including iron and steel production and power generation from natural gas.

(source: Arthur D. Little, IEA, Global CCS Institute)

Industries not yet commercially attractive for CCUS require subsidies. Countries that are focusing on CCUS (including the UK and the Netherlands) have established subsidy programs. For example, the Netherlands applies the same subsidy program (Sustainable Energy Transition Subsidy Scheme [SDE++]) for both renewable energy projects and CO2-reduction efforts such as CCUS.

The Porthos Project, which aims to store CO2 in the North Sea, was awarded half of the 2021 SDE++ budget as subsidies.14 If other European countries introduced similar subsidy programs to the UK and the Netherlands, it would likely accelerate their local carbon-capture industries.

The CCUS Value Chain

Given its accelerating growth, the total European market for CCUS is expected to be between €10-€12 billion (US $10.5-$12.6 billion) by 2030 (according to Arthur D. Little analysis based on conservative predictions of 102 megatons of capacity). The CCUS value chain brings together a wide variety of players across its different stages, and unlocking individual opportunities and accelerating the ecosystem requires every player to understand the specific challenges they face.

Key players in the CCUS value chain include:

-

Capture. Companies in this space are either energy-intensive industries/power plant operators looking to apply carbon capture to decarbonize their assets or energy utilities serving as an enabler/service provider to customers. Successful players are likely to have strong B2B/industrial customer relationships, allowing them to offer capture as part of an integrated energy strategy.

-

Transport. These players are usually infrastructure operators (e.g., gas distribution/transmission system operators) aiming to handle the transport and logistics of CO2 onshore and offshore, either via pipelines or truck/ship. This space is best suited to companies that have infrastructure in place and already operate in adjacent areas.

-

Storage/usage. Storage opportunities abound, especially for oil and gas companies with a combination of project management capabilities and access to storage sites like depleted gas fields. Suppliers must build relationships with companies looking to incorporate captured carbon in novel products, such as e-fuels or green building materials.

-

Enablers. These include companies that can provide technologies and services (e.g., plant engineering or maritime logistics) that act cross-functionally on all levels of the CCUS value chain, along with suppliers of products and services and policymakers that can shape the role and market uptake of CCUS. Success as an enabler requires building effective partnerships with players across the value chain and strong project management capabilities.

Building a Strategic Roadmap

To unleash the potential of CCUS, each competitive segment must take specific success factors into account.

Capture

-

Energy-intensive industries and power plant operators. These players must be able to compare the short-term/long-term role, potential, and cost of CCUS in decarbonizing their assets and operations with alternative pathways such as hydrogen. Given that the market is still in development, effective scenario planning is essential for strategic decisions. These what-if scenarios, which also cover potential alternatives to CCUS, must be combined with signposts, such as changes in the regulatory landscape, EUA price developments, and technological breakthroughs. The results of these exercises can be used to generate no-regret decisions now and decarbonization roadmaps and investment decisions down the road.

-

Energy utilities. Energy utilities are ideally positioned to support their business clients in effectively applying CCUS. To achieve this, they must understand the value the CCUS market provides and determine the most attractive business opportunities. To understand market dynamics, energy utilities must build a picture of potential future CCUS demand, broken down by country/region and industry and mapped against a range of scenarios. From that, they can highlight and investigate attractive customer segments with unmet needs, based on factors such as the industry sector and access to CO2 infrastructure. This provides the basis to define a comprehensive business offering that includes a clear view on the best position to take within the CCUS ecosystem (e.g., becoming an orchestrator of partners across the value chain or focusing as an expert in specific areas), outlines attractive opportunities, and highlights required capabilities and partnerships.

Transport

- Infrastructure operators. Infrastructure companies need to identify relevant upstream (capture) and downstream (storage/usage) partnerships. Achieving this requires defining key partnering criteria and using these to carry out an effective target search across the ecosystem. For upstream partnerships, such as energy utilities, these criteria could include access to relevant customers and the availability of critical capabilities to further expand their footprint in the CCUS market. For downstream partnerships, such as with oil and gas companies, key criteria will be the availability of (or access to) storage capacities. As growing demand leads to less available storage later in the 2020s, securing early strategic partnerships with storage providers could be critical to success.

Storage

- Oil and gas companies. In Europe, almost all planned CCUS storage capacities are being developed in the North Sea, primarily by oil and gas companies, who are the gatekeepers of offshore storage facilities. To ensure there is sufficient carbon storage to meet accelerating demand, these companies need to quickly and effectively develop suitable storage sites. To do this, they must focus on capabilities like effective project-site scouting (locating sites with high potential, such as depleted gas fields), local stakeholder engagement (creating strong relationships, especially with policymakers and regulators in the permitting process), and developing relevant in-house capabilities (especially project development).

Enablers

-

Suppliers. A robust supplier landscape is critical for providing the technologies and services that will enable the CCUS market to achieve its potential. Suppliers need to quickly ramp up capacity to deliver projects and meet growing demand along the CCUS value chain. Suppliers must closely monitor market growth and scale their operations; this will require large-scale investments that, given the early stage of the European market, will generate financial risk. To overcome this, suppliers should form strategic partnerships with relevant market players to underwrite their investments, safeguard capacity in planned projects, and jointly develop and innovate key technologies, sharing the risks and benefits.

-

Policymakers. Policymakers play a key role in ensuring the CCUS market develops and grows in line with projections to deliver its decarbonization benefits. Given the relative immaturity (and cost) of CCUS, regulatory frameworks and subsidies are key to growth at both regional and country levels. These frameworks should focus on managing costs (especially investment requirements) until this still-immature technology is more cost-effective to deploy. One option is applying effective subsidies like those in the UK and the Netherlands, helping to unlock CCUS’s decarbonization potential.

Conclusion

As countries struggle to reduce emissions, CCUS is becoming a key accelerator in the shift to net zero, particularly in sectors where emissions are proving stubbornly hard to abate. CCUS can act as a bridge to the developing hydrogen economy, reducing short-term emissions while infrastructure and capacity matures and providing a long-term solution in areas where hydrogen will not deliver effective emissions reduction.

The growth of CCUS promises a financial opportunity alongside an environmental one, delivering new revenues to players across the ecosystem. This is particularly true in Europe, which is shifting from a CCUS laggard to a leader, in part to meet the region’s stringent climate targets. However, for the European CCUS economy to unleash its potential, every player, from utilities and technology suppliers to regulators and policymakers, must act now, putting in place effective strategies, building capacity, and forging partnerships across the ecosystem.

References

1 “CO2 Emissions in 2022.” International Energy Agency (IEA), March 2023.

2 “Countries.” Climate Action Tracker, accessed November 2023.

3 Working Group III. “Climate Change 2022: Mitigation of Climate Change.” Intergovernmental Panel on Climate Change (IPCC) Sixth Assessment Report, 2022.

4 “CCUS Projects Explorer.” International Energy Agency (IEA), 24 March 2023.

5 ”CCU/CCS: Building Block for a Climate-Neutral and Competitive Industry.” German Federal Ministry of Economic and Climate Protection, accessed November 2023.

6 Penman, Hamish. “Listicle: The Top 10 Projects in Europe’s CCS Pipeline.” Energy Voice, 31 July 2023.

7 “Carbon Capture Capacity Poised to Surge More Than 10 Times by 2030, But Aggressive Investment Needed to Meet Mid-Century Targets.” Rystad Energy, 25 April 2022.

8 IEA (see 4).

9 “EU Emissions Trading System Data Viewer.” European Environment Agency (EEA), 27 July 2023.

10 Tiseo, Ian. “Carbon Dioxide Emissions in the European Union in 2000, 2010 and 2022, by Country.” Statista, 13 September 2023.

11 Bioenergy carbon capture and storage or utilization (BECCS/U) is the process of extracting bioenergy from biomass and capturing and storing or using the carbon, thereby removing it from the atmosphere.

12 “EEX Futures.” European Energy Exchange (EEX), accessed November 2023.

13 Levelized costs include all costs across the value chain (capture, transport, and storage). Capture makes up between 50% and 66% of total costs.

14 “The Netherlands Grants Half of SDE++ Subsidies to the Porthos CCS Project.” Enerdata, 10 June 2021.