In a new Cutter Consortium survey, we seek to understand how companies identify, pilot, and deploy specific emerging or “disruptive” digital technologies. Here are the major research hypotheses:

- Due to the unprecedented pace of technology change, conventional, staged, requirements-driven technology adoption models are changing — and probably disappearing altogether.

- Emerging and potentially disruptive technology is adopted very differently (much faster and less purposefully than technologies were previously vetted and deployed).

- “Consumerization,” cloud computing, and shared governance have emerged as the major drivers of emerging business technology adoption, and personal technology becomes professional technology, often overnight, delivered by cloud providers and directly accessible to business units.

- The decoupling of technology solutions away from integrated technology platforms (e.g., ERP and DBMS platforms) is rapidly progressing, especially due to the emergence and availability of decoupled-yet-integrated infrastructure services (IaaS) and software applications (SaaS) through cloud delivery.

- We’re also hypothesizing that new technology adoption models will be “instant” and “continuous,” and that distinctions among adoption categories (e.g., “early,” “late,” “laggard") will blur and eventually vanish, replaced by whole new technology adoption approaches, models, and best practices.

Some examples:

- Apple iPads were adopted at an unprecedented rate – instantly – with relatively little or no formal requirements analyses.

- Social media listening was explored without hesitation.

- Facebook and Twitter instantly became marketing channels.

- BYOD just happened.

- Content/file sharing with Dropbox was immediate.

- Mobile applications are downloaded and deployed continuously.

- Facetime and Skype are in constant use, and who doesn’t use Uber and Waze for personal and professional transportation?

Are These Rapid Adoption Experiences Anomalies or Precedents?

Traditional technology adoption models describe a process that’s phased and driven by validated requirements analyses. These traditional models have defined the technology adoption process for decades. Some of them include:

- Bass diffusion model

- Technology acceptance model

- Technology lifecycle

- Diffusion of innovations (after Everett Rogers, see below)

- Crossing the chasm

- Matching person and technology model

- Hypecycle

- Lazy user model

- Early adopter

Many companies have a simple view of the technology adoption process and where they’re located on a technology adoption lifecycle, such as the well-known “diffusion of innovations” model developed by Everett Rogers (see Figure 1).

Figure 1 — Everett Rogers's diffusion of innovations.

Emerging hardware, software, and networking technologies like the Internet of Things (IOT), automated reasoning, cashless payment systems, real-time analytics, augmented/virtual reality, 3D printing, and always-on tablets are changing the way business operates.

How are they adopted? Is there an elaborate “requirements validation” process that screens the technologies, or are there other processes that vet the candidates most likely to impact business processes and models? What are the most rapidly deployed emerging technologies? How do they get selected? Who’s deploying them? And how quickly?

Once emerging technologies are selected, how are they piloted? There are a variety of “systems design and development” methods, models, and techniques companies have used for decades, including:

- Systems development lifecycle (SDLC)

- Rapid application development (RAD)

- Open source development

- Object-oriented programming

- Joint applications development (JAD)

- Software prototyping

- End-user development

- Extreme programming (XP)

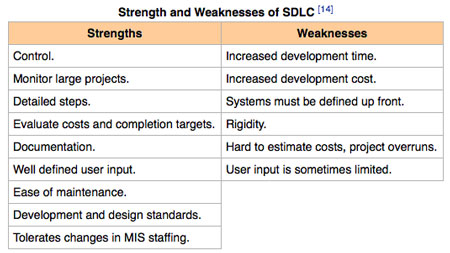

The SDLC is the model that many companies have followed since the 20th century. The SDLC has its strengths and weaknesses, as suggested in Figure 2.

Figure 2 — The strengths and weaknesses of SDLC.

Are companies slow to vet and adopt emerging technologies and slow to test, develop, and deploy technologies? How does this design and development methodology dovetail with technology adoption models? Are specific vertical companies developing as many applications as they previously developed? Has application development moved to onshore and offshore third parties and away from the companies that deploy applications (increasingly developed on PaaS platforms and hosted in global SaaS clouds)? Or have companies thrown these models out the window and replaced them with whole new approaches to emerging technology adoption and deployment?

Please consider completing the survey. It should take less than 15 minutes to complete. Please also provide your email address so we can update you on survey results.

[In a special peer-to-peer session for Cutter members on 23 March 2016, Cutter Fellow Steve Andriole will lead a discussion on how companies identify, pilot, and deploy specific emerging or “disruptive” technologies. In addition to leading the discussion, Andriole will provide insight into which emerging technologies are piloted and deployed the most aggressively by companies in your industry, based on the results of his latest study. Peer-to-peer attendees will receive a complimentary copy of the Cutter report based on the data collected.]