During the first two quarters of 2016, Cutter Consortium conducted a survey that focused on the methods, tools, and techniques surrounding business adoption of disruptive technologies. We collected data across multiple industries and countries, but primarily from the US. There were just about as many business professionals as technology professionals who responded to the survey. The purpose of the survey was to understand how companies identify, pilot, and deploy specific emerging or disruptive technologies.

So, given all the attitudes about technology adoption, from both technology and business professionals, what emerging/disruptive technologies are in play? Here are the results of the popularity contest.

The “winners” — those technologies that are on the pilot lists of many companies and promise the greatest potential — include cloud computing, with 38% piloting cloud services (SaaS, IaaS, etc.), 25% piloting private cloud, 17% piloting public cloud, and 21% piloting hybrid projects. Other pilot winners are big data analytics (34%); e-learning (26%); social media listening (20%); BYOD (19%); wearables (18%); the Internet of Things (IoT) (17%); security technologies (14%), including mobile device management and multilayer authentication; e-payment systems (13%); and location-based services (12%). These technologies all made the list because they are perceived as having the most impact along the continua of competitive fear, digital transformation, and cost reduction — three excellent reasons to pilot a suite of specific technologies.

Of special note is the variety of big data analytics planned pilots, including structured (23%), unstructured (19%), and integrated (19%). Several years ago there was barely an understanding of structured versus unstructured data analytics, but today interest is strong in all kinds of analytics, reflecting a much deeper understanding of structured, unstructured, integrated, descriptive, explanatory, predictive, and even prescriptive analytics.

Two unmistakable plans are clear: (1) the intention to pilot multiple flavors of cloud computing and (2) multiple big data analytics pilots. What’s surprising about this is not the general interest in cloud computing and analytics, but the depth of the interest in both. Companies have clearly distinguished among competing technologies within these broad technology families. Some other technology clusters also stand out, including BYOD, wearables, e-payment systems, and e-learning technologies. Plus, the IoT looks relatively strong, especially given its “newness.”

What is surprising is the relative lack of interest in some digital security technologies — including hardware tokens, mobile application wrappers, virtual desktop containers, crowdsourced threat protection (all on the pilot lists of only about 5% of respondents), and decoys and honeypots (4%) — and especially automated reasoning (AR)/artificial intelligence (AI) (6%). Digital security is a core competency of digital transformation and AR/AI is a foundation technology that enables and extends whole classes of other technologies. However, it may be that the hype has already outstripped the perceived potential of these technologies.

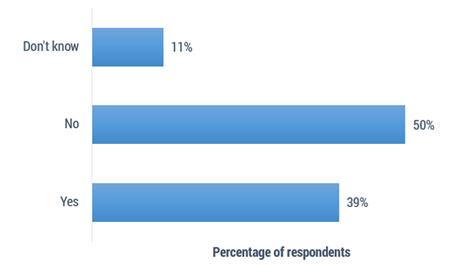

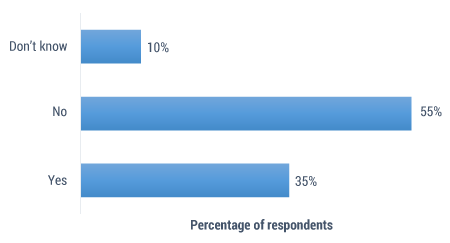

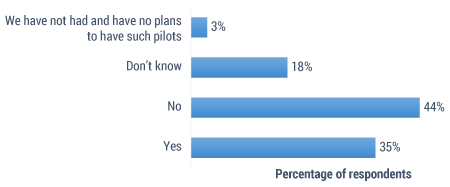

The data also indicates that companies have developed different attitudes about technology adoption and are committed to piloting many specific emerging/disruptive technologies in 2016 and beyond. Several important attitudes, plans, and trends emerged about technology adoption. For example, nearly 40% of surveyed companies are “professionalizing” emerging/disruptive technology adoption (see Figure 1) and about a third are creating formal innovation labs (see Figure 2) — but it has taken them a long time to get here. Figure 3 shows that companies are also rushing their pilots even if it means failing to measure success or failure (only about a third have ROI measurement processes in place around their pilots).

Figure 1 — Are there professionals at your company who specialize in the rapid prototyping

Figure 1 — Are there professionals at your company who specialize in the rapid prototyping

of emerging/disruptive technologies?

Figure 2 — Does your company have a formal innovation lab tasked with piloting emerging/disruptive technologies?

Figure 3 — Does your company quantitatively measure the success/failure of emerging/disruptive technology pilots?

[For more from the authors on the results of the survey, see "The Adoption of Disruptive Technologies."]