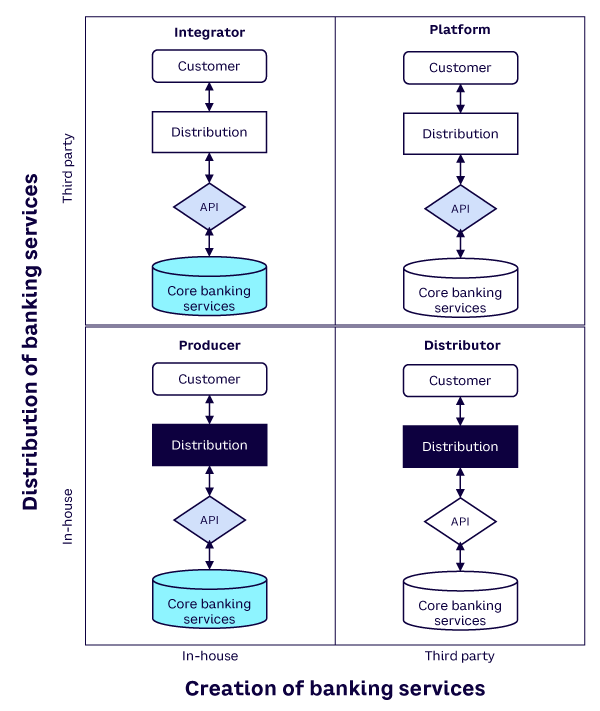

Modular architecture lets banks build their value propositions into services, functionalities, and raw data while enabling new distribution and service creation. In this Advisor, we describe a two-dimensional framework that shows how modular architecture enables four distinct roles (integrator, producer, distributor, and platform) to emerge and revolutionize traditional banking.

4 Banking Roles

Modular architectures lets new actors distribute and create banking services. These include: (1) fintechs, Internet giants, white-label banks, and mobile operators that distribute existing banking services to new customer segments; and (2) third-party actors that create reusable, scalable banking services for distribution by established banks.

These two dimensions lead us to identify four roles in banking: integrator, producer, distributor, and platform (see Figure 1). Most large banks are rooted in the integrator role (full-stack bank), controlling every aspect of the business in-house. Through various collaborations and partnerships with third parties, banks also play the roles of producer (white-label clients) and distributor (infrastructure/core banking service) across various business lines. The platform role is still at a very early development stage, but in Europe, we find pure third-party firms such as API providers Aiia and Tink. Next, we describe the four banking roles in more detail.

Role 1: Integrator

The full-stack bank creates and distributes all services to the customer in the integrator role. The bank provides all services under one brand and fully controls the customer experience. It also controls the underlying infrastructure. Currently, most banks play the role of integrator, as they control the whole value chain and have done so in the digital space since the early days of the Internet.

For instance, many banks use online and mobile channels to provide account information, payment services, and investment information to customers. This role is the prevailing norm for banks today.

Role 2: Producer

In the producer role, a minimum of two parties create services for the customer. The bank creates the service, and a third party (e.g., a neobank) distributes the service to the customer. Customer ownership and branding can be challenging for producers. For example, the EU’s Payment Service Directive 2 (PSD2) forces banks to open up their banking infrastructure to third parties, emphasizing their producer role, particularly regarding account information and payment initiation services.

Most large banks are working on a fintech collaboration strategy, but some are less inclined to adopt a producer role. Extra revenues and innovation may seem attractive, but they come with increased regulatory and compliance risks. In the B2B space, producer roles are already institutionalized for distribution purposes through private APIs for functions like data sharing and payment initiation.

Role 3: Distributor

Modular architecture can be instrumental in leveraging a bank’s Internet and mobile distribution channels, which have created a large digital customer reach over the past decades. As banks open up, they may extend their digital market presence by distributing third-party services. This is not an entirely new concept; banks have long distributed funds to other institutions and credit card companies. The challenges related to customer ownership and branding are similar to the ones noted in the producer section.

Today, many fintechs act as distributors within the payments industry. For example, e-commerce payment service providers repackage and distribute payment services created by banks and by payment service providers like PayPal, Apple Pay, and Sofort. However, banks could extend their role as distributors to become third-party providers, perhaps through account aggregation and payment-initiation services held at one or more depository organizations.

Role 4: Platform

A platform facilitates other businesses by acting as an intermediary. As a platform, banks could offer party matching, traffic, and security features like “know your customer” (KYC) and anti-money laundering (AML). Note that in the banking world, unlike IT, “platform” refers to the IT infrastructure needed to run a bank. Banks as platforms aren‘t quite the norm, although Germany’s Fidor Bank is an example. Several fintechs have adopted this model as a starting point in lending and crowdfunding business. In the platform role, the bank is a facilitator for third parties and their customers. Note that banks may allocate roles to various lines of business, including the platform role.

[For more from the authors on this topic, see: “Revolutionizing Banking Through Modular Architecture.”]