AMPLIFY VOL. 38, NO. 4

From societal shifts and geopolitical tensions to rapid technological advances and a surge of diverse stakeholders, corporate boards face unprecedented challenges that require new governance approaches. Traditional leadership structures, once taken for granted, are coming under scrutiny as companies strive for independence, transparency, and effective decision-making.

The lead independent director (LID) role emerged in the late 1990s and early 2000s as investors and governance experts pushed for stronger board independence, particularly in companies where the chair and CEO roles are combined. This shift followed high-profile scandals like Enron and WorldCom, prompting calls for greater accountability. Designed to provide independent leadership and a clear communications channel, LIDs have become key fixtures on many public company boards — often recommended or required by corporate governance codes and institutional investor guidelines.

Despite this, questions linger about when a LID is truly essential, when the role may be redundant, and how its responsibilities vary across organizations. Central to unlocking its potential is crafting clear, adaptable mandates that reflect each board’s unique structure and governance needs.

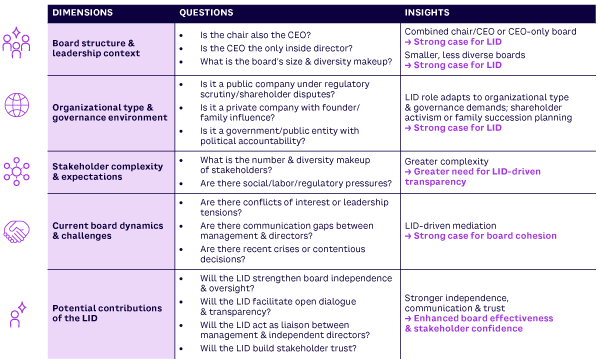

This article explores the evolving role of LIDs across public, private, and government boards and introduces a framework to help boards decide if, when, and how to appoint a LID (see Table 1). By considering board structure, organizational context, stakeholder complexity, and regulatory dynamics, boards can tailor the LID role to boost governance and transparency effectively.

When & Why Boards Need a LID

Investors seem to agree that, because independent directors are expected to safeguard stakeholders’ interests, the presence of a LID can boost investment efficiency, especially in firms with weak governance, information asymmetry, and/or low-transparency financial reporting.

Often, appointing a LID arises from the need to balance power and preserve board independence. A common trigger is the combination of chair and CEO roles — a setup that concentrates leadership and can complicate oversight. This arrangement, prevalent in many corporations, raises concerns among investors and regulators about potential conflicts of interest.

In these cases, the LID acts as a counterbalance, chairing independent director sessions, setting agendas, and serving as liaison between the chair/CEO and the board. This fosters management accountability and balanced strategic discussion.1 About half of US companies (but less than 10% of EU companies) combine the chair and CEO roles, making the LID a critical governance mechanism for investor confidence and regulatory compliance.2

Johnson & Johnson, where the roles are combined, uses a LID to safeguard board independence and oversee succession planning.3 Microsoft, which separates chair and CEO roles, appoints a LID to enhance oversight and manage complex governance matters.4

Another prominent scenario involves a CEO-only board, in which the CEO is the sole inside director amid a board of independents. Amazon’s board, under Jeff Bezos’s leadership, exemplifies this dynamic. Bezos served as chair and CEO for many years, with independent directors guiding oversight. The LID role was crucial in balancing founder influence with independent governance, helping to maintain accountability during high-growth phases and complex strategic decisions. In recent years, Amazon’s LID has served as the primary board contact for shareholders to engage with on matters such as the company’s executive compensation program.5

Governance practices vary globally, and so does a LID’s scope of responsibilities. In the US, LIDs are common, reflecting both the prevalence of activist investors and the regulatory expectations of increased dialogue and coordination in the midst of market disruptions. Europe, where chair and CEO roles are more often split, sees less need for LIDs, although countries like Germany increasingly recognize their relevance amid growing trends in workforce transformation and governance standards.6,7 In Asia-Pacific, the appointment of LIDs is on the rise, aligned with investor demands for more nuanced oversight.8 In addition, a growing network of small and medium-sized enterprises in each region has experienced increased governance demands in supply chain due diligence, prompting many to formalize roles like LID to enhance leadership accountability without adding complexity.9

Beyond structure, LIDs are key in boards facing leadership tensions or conflicts of interest. Their independence helps them mediate disputes, promote cohesion, and address critical issues constructively.

Although LIDs often strengthen oversight, the role isn’t foolproof. Small private boards with limited governance complexity or strong independent chairs may find the role redundant or even counterproductive. In such cases, a clear governance culture and defined delegation of authorities can suffice. We must keep in mind that the Wells Fargo fake accounts scandal, which emerged in 2016, revealed governance failures despite having a designated LID. This reminds us that LIDs must have real authority, clear responsibilities, and be willing and able to drive active engagement.10,11

Limitations & Challenges of LIDs

Boards should recognize that the LID role, although valuable, involves limitations and challenges. LID effectiveness depends heavily on the board’s culture and the support of fellow directors. In organizations where independent directors are passive or lack confidence, the LID may struggle to exert meaningful influence and risk, becoming a figurehead rather than a force for oversight.

In my experience, the LID’s Achilles’ heel is that overlapping roles (e.g., committee chairs or independent chairs) can blur accountabilities and weaken LID authority. This overlap often stems from unclear role definitions, which can be resolved through deliberate mandate design and board dialogue. Additionally, cultural and organizational factors (hierarchical norms or founder dominance) can limit the LID’s independence and willingness to challenge management. Recognizing these risks is essential for designing clear mandates and cultivating board cultures that truly empower the LID.

Finally, appointing a LID may add unnecessary complexity to smaller boards with straightforward governance structures, creating extra layers of communications without proportional benefit. Boards should carefully weigh these challenges and tailor the LID role by defining clear mandates, ensuring role clarity, and fostering a supportive culture to maximize its effectiveness.

When LIDs Don’t Work as Intended

There are several situations in which the LID role may fall short or complicate governance:

-

In boards with weak independent director engagement, the LID may lack the support needed to influence decisions effectively.

-

If the chair remains overly dominant or unwilling to collaborate, the LID’s ability to balance power will be undermined.

-

When roles and responsibilities overlap with other board leaders (committee chairs or independent chairs), confusion and inefficiency can arise.

-

In family or founder-led firms with resistant to formal governance changes, the LID may be sidelined or ignored.

-

Overreliance on the LID can breed complacency, causing other directors to relax their vigilance and disengage from active oversight.

Recognizing these pitfalls helps boards design roles and processes that empower the LID without creating unnecessary friction.

Establishing Clear LID Mandates

To set your LID up for success, focus on these best practices:

-

Define clear responsibilities. Specify duties such as liaising with management, engaging shareholders, and resolving board conflicts. Example: In a publicly listed company or a government entity, the LID’s mandate may explicitly include quarterly shareholder outreach.

-

Customize the mandate. Tailor it to your company’s size, sector, ownership, and culture — no cookie-cutter roles here. Example: A family-owned firm can give the LID a stronger role in succession planning, reflecting its unique governance needs.

-

Empower with authority. Ensure the LID can access necessary resources, information, and call special meetings independently. Example: The LID has a dedicated budget approved by the board to hire external independent advisors, enabling swift responses to emerging risks.

-

Review and update regularly. Governance evolves; mandates should, too. Schedule periodic reviews to keep the role relevant. Example: After a major regulatory change, it is wise to consider updating the LID’s mandate to include enhanced oversight of compliance.

-

Communicate widely. Make sure all board members and key stakeholders understand the LID’s role and authority. Example: Companies may choose to hold an annual orientation session spotlighting the LID’s responsibilities as a way to foster board cohesion.

Following these practices helps ensure the LID is not just a title but a meaningful leadership position. Specifically, ensuring the LID has access to independent advisers is a game changer. In the boards I’ve worked with, this autonomy enabled swift navigation of emerging risks.

In an informal survey conducted in January–October 2023 among 80 participants in the University of Chicago’s Circular Economy and Sustainable Business Management certificate program, I found that effective LID mandates can improve stakeholder engagement rates up to 90%, ensuring responsibilities are clear and actionable within organizations (see Figure 1 for more data).

Tailoring the LID Role Globally

Governance cultures and regulatory environments shape how LIDs operate worldwide, underscoring the need for tailored mandates rather than one-size-fits-all solutions. For example, in Germany’s two-tier board system, supervisory board chairs often fulfill functions similar to a LID, but firms are increasingly appointing LIDs to strengthen independent oversight amid changing labor market dynamics. In Japan, interest in LIDs is rising as companies seek transparency and global investor confidence despite traditionally hierarchical boards. Australia and Canada promote LIDs through governance codes emphasizing power balance and stakeholder dialogue, and Latin American adoption varies widely, often driven by investor pressure and evolving governance standards.

These international variations illustrate how crafting LID mandates requires sensitivity to local governance contexts, regulatory expectations, and cultural norms. Boards benefit from adapting the LID role to fit their unique environment, ensuring clarity, authority, and relevance.

Nuances Across Board Types

LIDs take on distinct characteristics depending on the type of board they serve. Public companies, private firms, and government entities face unique governance pressures, stakeholder expectations, and operational realities that shape how the LID functions and the value the role can add.

Public Boards

In public companies, the LID often anchors governance amid regulator, shareholder, and market scrutiny. Operating under strict frameworks like US Security and Exchange Commission (SEC) rules, LIDs ensure independent directors have a strong voice, facilitate open management dialogue, and oversee strategic agendas addressing the ethical deployment of technology, skills-gap concerns, and more. Many S&P 500 firms appoint LIDs precisely because the chair and CEO roles are combined. Coca-Cola’s LID exemplifies this by bridging independent directors and management, driving transparency and stakeholder engagement on AI and environmental and social responsibility.12

Private Boards

Private boards are often smaller and more closely held. Here, the LID role may be informal or absent, reflecting a culture valuing agility and founder influence. However, as private firms grow or prepare to go public, governance needs increase. LIDs can help balance founder control, oversee succession, and guide transitions.

Government & Public Entity Boards

Boards of government agencies and public institutions face political oversight and public accountability. Here, LIDs act as stewards of legitimacy and trust, ensuring open, fair, and responsive decision-making. For example, the UK’s National Health Service (NHS) trust boards similarly appoint senior independent directors as LIDs to uphold governance and transparency standards.13

Across board types, a LID’s effectiveness depends on adapting the role to an organization’s needs and governance culture. Rather than applying a uniform approach, boards should adapt LID mandates to fit their size, industry, stakeholders, and strategic goals.

The LID as a Driver of Transparency & Effective Decision-Making

Transparency and sound decisions are vital in today’s complex governance environment. The LID plays a pivotal role as a trusted intermediary among directors, management, and stakeholders.

One primary contribution is fostering open, candid boardroom dialogue. By facilitating independent director discussions and providing confidential channels outside chair or CEO influence, the LID ensures that diverse perspectives shape deliberations.14 This is especially important as boards wrestle with upskilling and re-skilling needs, AI ethics, and evolving regulations that demand nuanced, forward-looking approaches.

The LID also mediates contentious decisions, balancing competing interests and preserving unity. Their independence lets them navigate conflicts objectively, guiding consensus without diluting accountability.

Recently, Coca-Cola’s LID led special board sessions on stakeholder engagement, transparent reporting, and governance of environmental and social commitments amid activist pressure on plastic and water use. These efforts can greatly uplift investor confidence and advance strategy-aligned sustainability practices.15 Coca-Cola’s example shows how an engaged LID can deepen board dialogue and strengthen trust on complex governance issues.

Externally, the LID is a critical contact for investors, regulators, and stakeholders seeking assurance of integrity and responsiveness. By embodying transparency and independence, the LID bolsters the board’s credibility beyond its walls.

The LID’s impact depends not only on role clarity but also on board culture and empowerment. Supported effectively, the LID can transform governance dynamics, fostering informed, balanced, and transparent decisions that align with stakeholder expectations.

Designing an Effective LID Mandate

To meet the growing demands of governance, boards should craft LID mandates that are clear, flexible, and tailored to their company. An effective mandate clarifies the LID’s authority, covering areas such as facilitating independent director meetings, serving as a liaison between the board and management, and engaging with shareholders on key governance issues. It should also empower the LID to proactively address challenges like technological risks and talent management.

Mandates should reflect the company’s size, sector, culture, and strategic priorities rather than relying on a one-size-fits-all model. Regular reviews of the mandate ensure it stays relevant as the business environment evolves. By designing a mandate that balances authority with accountability, boards can equip their LID to be a true catalyst for effective oversight and long-term value creation.

Looking Ahead: The Evolving Role of the LID

As AI technologies become more integral to business and labor markets continue to shift, the LID role will expand beyond traditional oversight. Innovation-driven companies will increasingly depend on LIDs to navigate the complex intersection of rapid technological change, ethical considerations, and talent dynamics. These directors will need to bridge the gap between cutting-edge innovation and responsible governance, ensuring that advances in AI don’t outpace the company’s ability to manage risks or support its workforce.

With labor market pressures mounting, the LID of the future will need to be a dynamic leader who is fluent in governance, technology, and human capital challenges — ready and able to steer companies confidently through a long-term innovation cycle.

Conclusion

The LID has a vital governance role to play in today’s dynamic boardrooms. Although not universally required, the LID plays a crucial part in preserving board independence, enhancing transparency, and strengthening decision-making — especially when leadership power becomes more concentrated or challenges multiply.

Boards that carefully assess their unique structures, dynamics, and external pressures can better decide when and how to adopt or evolve the LID role. Given a clear mandate and supportive culture, the LID role becomes a flexible, practical tool to improve governance quality and build stakeholder trust.

References

1 Plouhinec, Marion. “The Role of Lead Independent Directors in Enhancing Board Effectiveness.” Harvard Law School Forum on Corporate Governance, 25 November 2018.

2 Lopez, Sandra Herrera, and Veronica Nikitas. “Investors Press US Boards to Separate Chair, CEO Roles.” Institutional Shareholder Services (ISS), 24 August 2023.

3 “Corporate Governance Overview.” Johnson & Johnson, accessed 2025.

4 “Corporate Governance.” Microsoft, accessed 2025.

5 “Guidelines on Significant Corporate Governance Issues.” Amazon, accessed 2025.

6 Aquila, Francis J. (ed.). “The Shareholder Rights and Activism Review.” Eighth edition. Law Business Research Ltd, 2023.

7 Stobbe, Antje. “Why German Companies Should Embrace the Role of Lead Independent Director.” Allianz Global Investors, July 2022.

8 “Asia-Pacific Region: Proxy Voting Guidelines/Benchmark Policy Regulations.” ISS, 9 January 2025.

9 “Due Diligence Explained.” European Commission, accessed 2025.

10 Office of Public Affairs. “Wells Fargo Agrees to Pay $3 Billion to Resolve Criminal and Civil Investigations into Sales Practices Involving the Opening of Millions of Accounts Without Customer Authorization.” Press release, US Department of Justice, 21 February 2020.

11 Huskins, Priya Cherian. “Naming and Shaming: The Fed Publicly Admonishes Wells Fargo’s Former Lead Director.” Woodruff Sawyer, 24 April 2018.

12 “2025 Proxy Statement: Notice of Annual Meeting of Shareowners.” The Coca-Cola Company, 17 March 2025.

13 “Code of Governance for NHS Provider Trusts.” NHS England, 23 February 2023.

14 Plouhinec (see 1).

15 The Coca-Cola Company (see 12).