Strategic advice to leverage new technologies

Technology is at the heart of nearly every enterprise, enabling new business models and strategies, and serving as the catalyst to industry convergence. Leveraging the right technology can improve business outcomes, providing intelligence and insights that help you make more informed and accurate decisions. From finding patterns in data through data science, to curating relevant insights with data analytics, to the predictive abilities and innumerable applications of AI, to solving challenging business problems with ML, NLP, and knowledge graphs, technology has brought decision-making to a more intelligent level. Keep pace with the technology trends, opportunities, applications, and real-world use cases that will move your organization closer to its transformation and business goals.

Recently Published

In this Executive Update, the first of three related articles, we examine financial services as an example of a highly regulated industry and outline the regulatory landscape that creates points of tension for cloud adoption. We also incorporate perspectives from a differentiated range of stakeholders, including lawyers, technologists, compliance executives, and outsourcing managers.

Data breaches are front and center in the news again. And with the hacking of the US Democratic National Committee's (DNC) servers, allegedly by Russian security services in an effort to influence the outcome of the American presidential election, and Yahoo's latest announcement of a yet another hack involving data associated with more than one billion (!) accounts, it is obvious that no system should ever be considered entirely safe from breaches, regardless of the data security and protection solutions in place.

Tackling Technology Debt

It is nearly impossible to prevent technology debt from being created — product/service lifecycles are getting shorter, making time to market an imperative for which taking shortcuts becomes a necessity. However, the size and scope of the technology debt being created can be contained, and on rare occasions some technology debt can be prevented, with proper analysis of the impact of a proposed workaround on business process agility/scalability.

Cognitive computing requires more than just a collection of advanced algorithms. It involves the use of massively parallel processing (MPP) architectures to coordinate the interaction of the various natural language processing (NLP), machine learning (ML), statistical, and other algorithms as well as the retrieval and integration of data acquired from different systems. This enables processing to arrive at an intelligent decision or outcome when analyzing large volumes of data or interpreting a user’s natural language question.

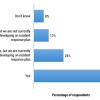

Data-centric security has been around for a while; however, it is receiving renewed attention as a way to extend data protection and security to end-point and edge devices as well as computing associated with cloud, mobile, and IoT technologies. Such applications can be complicated to protect because they tend to stretch the bounds of what we’ve come to consider as quite a well-defined computer network. To gain insight into the various trends and issues impacting enterprise data security and protection practices, and the extent to which organizations employ data-centric security practices and technologies, Cutter Consortium surveyed 50 organizations worldwide.

Generating new revenue streams, collaborating with customers and business partners, sensing customer sentiment — there are many reasons to adopt social media. But what is the best way to go about it, and how can you measure the results once you have? Is there a model for getting started?

Asia’s Payments Revolution

The economic gains brought by digital payments are significant. Greater financial inclusion and less friction in commerce lead to increased spending on goods and services. This, in turn, creates a virtuous economic cycle whereby increased consumption translates into more jobs and higher income. Moody’s Analytics estimates that increasing electronic payments contributed an additional $296 billion to consumption between 2011 and 2015, or a 0.1% cumulative increase in global GDP during the period. They also created 2.6 million jobs on average each year. By harnessing payments innovation, Asia can further accelerate its economic growth.

Many observers believe that distributed ledger technology (DLT) will bring fundamental disruption to relationships in a borderless, modern economy that has become more decentralized and more connected than ever. A recent report from the World Economic Forum pointed to blockchain — one potential implementation of DLT — as a revolutionary decentralized trust system that will reshape the global economy. The UK government has been researching DLT for some time now, exploring how the government can use the technology to benefit the country and its citizens. The bank-backed R3 blockchain consortium has gathered key players from the financial markets to work together on blockchain adoption in the financial industry. The year 2016 will definitely be remembered as the moment when blockchain and DLT emerged into the mainstream.