AMPLIFY VOL. 36, NO. 7

The pressure on companies to do something about the environment has grown substantially over the past decade, after years of many companies either watching from the sidelines or refusing to engage at all. That pressure is coming from all fronts — investors, customers, regulators, proxy advisors, and the media — and is often targeted at the board of directors.

According to a board member of a diversified financial services company: “We want to be apolitical, but it’s kind of hard to be that. It goes back to examining what we say we stand for. Is that in conflict or harmony with certain things that are going on in the world?”

How a company handles environmental concerns — or crises— is central to what it stands for, and it’s becoming increasingly divisive. Not surprisingly, it seems every major country is focused on how environmental information should be disclosed to stakeholders, with a focus on climate-related information. For many years, companies have been presented with a patchwork of conflicting rules and requirements, making it hard to compare them, even within an industry. Executives and boards have been calling for the multiple prevailing standard-setters to not only consolidate but to do so on a global scale. This article examines how companies and boards can navigate the landscape of climate-related information disclosure and provides recommendations on managing the journey.

The Disclosure Landscape

Disclosure priorities for companies include those that have a substantial impact on the company or its stakeholders and/or are considered material information by a well-known standard-setting board like the US Securities and Exchange Commission (SEC) or the Sustainability Accounting Standards Board (SASB). Responsibility for the disclosure of material information rests with senior management and boards, and firms often have a formal disclosure committee to decide these matters.

Climate-related disclosure activity is centered around three overarching organizations. The International Financial Reporting Standards (IFRS) covers some 140 country jurisdictions, requiring disclosures about physical risks, transition risks, and climate-related opportunities. It fully incorporates the Task Force on Climate-Related Financial Disclosures (TCFD) and includes SASB’s climate-related industry-based requirements.

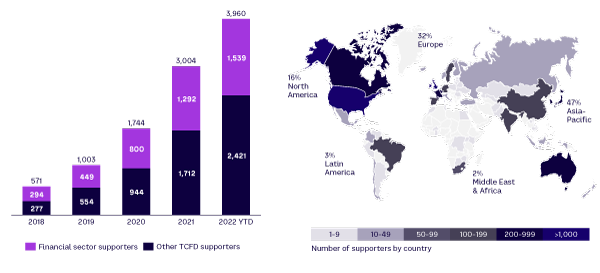

TCFD recommendations on climate-related financial disclosures are a good place for companies to start because its 2017 recommendations were designed to solicit decision-useful, forward-looking information that can be included in mainstream financial filings. The recommendations center around four thematic areas representing core elements of how organizations operate: governance, strategy, risk management, and metrics/targets. The organization’s 2022 status report indicates it’s seen an increase in the number of governments and regulators incorporating TCFD into their rules and guidance each year since 2017.1

SASB’s niche is providing individual standards, by industry, that identify the sustainability factors most likely to have material financial impacts on a company to inform investors. In November 2021, during the United Nations (UN) Climate Change Conference (COP26), IFRS announced the formation of the International Sustainability Standards Board (ISSB) as yet another unifying attempt. In February 2023, ISSB voted to release global guidelines that attempt to harmonize environmental disclosures available for regulatory purposes, which would go into effect in January 2024.

ISSB’s standards require companies to report emissions from their Scope 1 direct operations and their value chains, including suppliers. These value chain emissions (known as Scope 3) will require extra time, due to the challenge of gathering data from suppliers. (Scope 2 includes indirect greenhouse gas [GHG] emissions from the generation of purchased or acquired electricity, steam, heating, or cooling consumed by the company).

Until its 2023 policy update, Institutional Shareholder Services (ISS), the largest proxy advisory firm in the world, did not have recommendations for climate accountability, despite buying its way into the ESG ratings arena in 2018. In its 2023 report, it asks for detailed disclosure of climate-related risks according to the framework established by TCFD.2

In October 2021, the UK government established rules requiring UK-based companies to disclose climate-related financial information in the form of the Corporate Sustainability Reporting Directive (CSRD). This follows on the April 2021 European Commission (EC) proposal of a CSRD framework that would amend existing reporting requirements to include a broader range of companies. EC tasked the European Financial Reporting Advisory Group (EFRAG) with developing reporting standards that consider existing standards and frameworks, including TCFD’s framework. In late June 2022, the European Parliament and the Council of the EU reached a provisional agreement on CSRD, which further expands the scope of companies covered and describes the phase-in of reporting requirements beginning with financial year 2024.

Concerns & Pushback

Although it’s likely that standards coming out of the EU and the US will have some crossover with ISSB, it’s still a moving target. A 2022 letter signed by 80 CFOs asked ISSB to include social issues other than climate. With good reason, some international executives have raised concerns about how ISSB’s rules will interact with SEC’s proposal to require companies to report on GHG emissions and climate risks.3

Included in SEC’s proposal are disclosure of the processes and frequency by which board committees discuss climate-related risks and how they consider these exposures in relation to the company’s business strategy, risk management, and financial oversight. Also potentially required is disclosure about whether and how the board sets climate-related targets or goals and how members oversee progress toward achieving these aims.4 The disclosures are modeled in part on TCFD’s disclosure framework, signifying possible coalescence around this framework.

The proposed rule amendments, which could be finalized as soon as late summer 2023, take issue with the current disclosure rules (that companies have to disclose climate costs and risks they judge to be material) because it allowed companies to simply decide that certain costs/risks weren’t material. The result is fewer companies reporting.

Under the new rules, companies would have to analyze climate-related costs and risks for each line item of their financial statements, such as revenue, inventories, or intangible assets. Any climate costs that are 1% or more of each line-item total would have to be reported. Many companies have spoken out against these changes, including heavy hitters like Amazon, Walmart, and BlackRock.5

Stock Exchange Developments

Stock exchanges are also taking up the charge. The UN Sustainable Stock Exchanges (SSE) launched a database that provides information on the 132 stock exchanges taking actions to support enhancing climate-related financial disclosures in line with TCFD recommendations in their markets.6 In the US, the New York Stock Exchange (NYSE) and the Nasdaq have joined SSE. Nasdaq has published a TCFD compliance report since 2020, and NYSE publishes “ESG Guidance: Best Practices for Sustainability Reporting,” which is designed to assist companies with ESG disclosure by highlighting key elements of good-quality reporting.

According to TCFD’s 2022 status report, an increasing number of stock exchanges are requiring and/or reporting via TCFD (see Figure 1). For example, in October 2021, the London Stock Exchange Group issued “Guidance on Climate Reporting Best Practice and TCFD Implementation” for companies listed on the London Stock Exchange’s markets. In December 2021, the Singapore Exchange mandated that all issuers must provide climate reporting in their sustainability reports.

Despite these welcome attempts at consolidation, some companies find themselves putting together three reports: one for SEC, one for ISSB, and one in the EU via CSRD. SEC estimates the plan will raise the cost to businesses to comply with its disclosure rules from US $3.9 billion to $10.2 billion.7 That ongoing additional annual cost will be greater for small publicly listed companies, due to their need to hire staff to manage the process.

Where to Go from Here?

The board of directors generally has two functions: strategy and oversight. It should be no different for ESG.

In terms of strategy, it’s less a question of whether a company should report on climate-related financial information but how it will do so. Boards and management should work together to define their climate agenda by asking questions like “What areas are important to our business, our industry, and our investors/employees/consumers?”

The reporting frameworks just discussed will dictate some of this, but there is room for firms to put their own stamp on it. My conversations with directors reveal that most boards struggle to develop the type of long-term strategy necessary for environmental change. Here’s how one director put it: “We strive for a good give-and-take with management once we see their plan, but with climate disclosures looming, we need more expertise. When we revisited our board matrix, it was eye-opening.” To be sure, a board needs either the expertise or the necessary education.

It’s also important to consider the area(s) in which a company can realistically make a difference and demonstrate real progress. Given that greenwashing is a frequent concern with ESG, the last thing companies want is to be overly aspirational. Indeed, 48% of global executives recently told Capital Group they believe greenwashing is still prevalent in the asset management industry.8

Boards also need to stay up to speed on potential regulatory changes and their strategic implications. For example, the Heartland Institute, which advocates for anti-ESG bills, has identified, proposed, or passed bills in 24 US states, with Florida and Indiana the latest to pass such laws. Similarly, the US Supreme Court’s 6-3 decision in West Virginia v. EPA in June 2022 called into question whether or not SEC has the legal authority to adopt and enforce its proposed climate-related disclosure rule, even while the final set of guidelines are expected in late summer 2023.9

Since the big three institutional investors (BlackRock, Vanguard, and State Street) are looking specifically for a company’s ability to transition to a net-zero economy and what business risks that may cause, the specifics of this transition must also be part of strategy. Here, reporting on Scope 1 and Scope 2 emissions (those relating to systems that are within reasonable control of the firm) serve as the minimum.

Oversight flows from strategy. Not only do boards need to know what management is doing in terms of collecting, analyzing, and verifying the company’s climate data, but these efforts must be a central part of ESG oversight. According to board members I interviewed, this data should be in hand before disclosure and reporting decisions are made. “At the very least, we need it alongside reporting,” said a board director at a midsized bank-holding company. The board needs that information to perform its oversight and assess whether the time and money going toward sustainability are focused on long-term value.

Thus, it’s important to have a dedicated management team accountable for the reporting to ensure information accuracy. Since 88% of institutional investors subject ESG to the same scrutiny as operational and financial considerations, this is a C-suite and board-level responsibility.10 After Sarbanes-Oxley passed in the US in 2002, boards began establishing disclosure committees. These still matter and can be made up of insiders and board members to enhance coordination and information flow. This contrasts with the nominating and governance committee, which must be composed of independent directors, and now accounts for most of the board oversight of ESG issues. According to Spencer Stuart’s 2022 Board Index report, however, just 12% of S&P 500 companies have a standing committee dedicated to the environment.11

To gain oversight of climate-related disclosures, one must understand disciplines from electricity to emissions to ecology before tackling the myriad frameworks for disclosing information. This idea resonated with directors I spoke with: “We’ve needed to ramp up very quickly over the past three years, and I still don’t feel like I know what I’m talking about,” said a consumer products company board member.

Conclusion

Companies face some serious challenges when it comes to climate disclosures. These challenges come from a wide variety of stakeholders, including institutional investors, regulators, stock exchanges, consumers, and the public at large. This is one reason to anchor your climate-change strategy in social and organizational purpose and connect it to specific company operations. The strategy and oversight roles of the board intersect at climate change, suggesting companies need to onboard people with both climate competency and board expertise — a tall order.

References

1 “Task Force on Climate-Related Financial Disclosures: 2022 Status Report.” Task Force on Climate-Related Financial Disclosures (TFCD), October 2022.

2 “Americas: Proxy Voting Guidelines — Benchmark Policy Changes for 2023: US, Canada, Brazil, and Americas Regional.” Institutional Shareholder Services (ISS), 30 November 2022.

3 Williams-Alvarez, Jennifer. “Proposed Sustainability Disclosure Rules Draw Comments and Concerns.” The Wall Street Journal, 12 August 2022.

4 Banham, Russ. “Mastering the SEC’s Climate Challenge: A Guide for Directors.” Corporate Board Member, accessed July 2023.

5 Eaglesham, Jean, and Paul Kiernan. “SEC Considers Easing Climate-Disclosure Rules After Investor Pushback.” The Wall Street Journal, 3 February 2023.

6 “ESG Disclosure Guidance Database.” Sustainable Stock Exchanges (SSE) Initiative, accessed July 2023.

7 Eaglesham, Jean, and Paul Kiernan. “Fight Brews over Cost of SEC Climate-Change Rules.” The Wall Street Journal, 17 May 2022.

8 Ground, Jessica. “ESG Global Study 2022.” Harvard Law School Forum on Corporate Governance, 17 June 2022.

9 Zucker, Taryn, Lauren Lee, and Evelyne Kim. “West Virginia v. EPA Casts a Shadow over SEC’s Proposed Climate-Related Disclosure Rule.” Harvard Law School Forum on Corporate Governance, 3 August 2022.

10 “Edelman Trust Barometer 2021.” Edelman, 2021.

11 “2022 US Spencer Stuart Board Index.” Spencer Stuart, accessed July 2023.