At a conference in Monaco, James Dow, VP Global Engineering at Royal Bank of Canada (RBC) stated that the banking sector now regards technology companies as serious competitors in the finance industry. Dow further pointed out that several US technology companies were each in a position to purchase the entire shareholding of multiple major banks in all-cash transactions.

To take the most extreme example, Apple is sitting on US $178 billion in cash or "marketable securities" that could easily be converted into cash. So with that fat a wallet, which banks could Apple buy?

Well, let's start with Royal Bank of Canada, the largest financial institution in Canada, since Dow brought this up. That will cost $90 billion, leaving another $88 billion -- more than enough to cover the $76 billion required to buy Morgan Stanley, my former employer.

Now, to be clear, this is purchasing with cash reserves only. If we can pay with Apple stock too, then we have another $546 billion or so to play with (if we ignore the effect on share prices of announcing such a takeover), so enough to buy Goldman Sachs ($90 billion), HSBC ($180 billion), JP Morgan Chase ($251 billion), and still have $25 billion left over.

Obviously, the competition authorities would take issue with any one company buying multiple large banks, but why not one each for Apple, Microsoft, Google, and Amazon? A sobering thought for anyone running a bank.

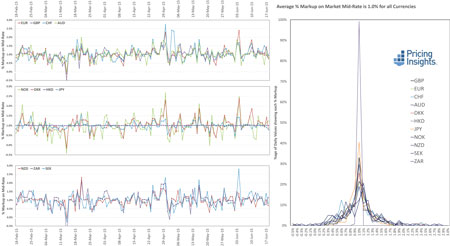

Now what if the tech companies try to just eat the bank's lunch instead? Well Amazon Web Services (AWS), in its quest to be the world's most customer-centric company, is now offering to charge its customer's credit cards in the customer's choice of 12 currencies, not just in the USD in which their prices are quoted. The cynical among us will be saying "Ah, but I bet they get you on the exchange rate." I must admit, that this was my thought, too, and even after monitoring AWS's rates and comparing them against mid-market FX rates for seven days, I still thought that AWS might "widen their spread" as interest following their announcement died down. So we have persistently collected the AWS FX rates from its portal each day for four months, and compared them against the published end-of-day mid-market rates (see Figure 1). We can see that AWS has been extremely consistent in its generosity, charging an average of just a one-percent premium over the mid-market rates, with a very narrow spread around that average, which may simply be due to AWS using a different reference source. This premium that AWS is charging is between a third and half what is commonly charged by credit card providers. An uncommonly good deal.

Figure 1 -- Time-series graphs for 11 currencies, showing the percent premium over the previous end-of-day mid-market rate, highlighting there is no upward trend (left). Histograms summarizing the results for each currency, highlighting the mean value of one percent and the narrow spread around the mean.

(Source: Strategic Blue's Pricing Insights service.)

In fact, if we look at some of the traditional ways in which banks make money, they are literally under siege from technology companies innovating new and improved ways of circumventing banks:

- Lending to companies and individuals -- "Peer to peer" lending companies, such as are connecting private lenders to small companies or private individuals who cannot raise finance at attractive rates from their banks. Examples include Funding Circle and Lending Club.

- Foreign exchange -- "Peer to peer" foreign exchange companies like Transferwise are matching up private individuals who want to do the opposite sides of currency conversion trades, and giving each the mid-rate in exchange for a small fee, totally bypassing the banks.

- Payment fees -- Digital wallet services such as Apple Pay, Google Wallet, and Paypal, allow money to be moved around, again bypassing the traditional banks.

I think James Dow is quite right to be worried about the competition from technology companies, and based on the rest of his presentation, RBC is looking to respond. It will be interesting to see whether other banks are similarly able to take on such a challenge, or whether they will stick their heads in the sand and hope the technology storm is just another bubble.

I welcome your comments about this Advisor and encourage you to send your insights to me at comments@cutter.com.

-- James Mitchell, Senior Consultant, Cutter Consortium