AMPLIFY VOL. 36, NO. 7

Social expectations for corporate responsibility are changing rapidly across the global economy, with a large increase in the number of companies reporting on environmental, social, and governance (ESG) performance, a rising demand for sustainability reporting regulation, and an increased emphasis on sustainable brand performance from younger generations.1

Corporations are frequently asked to comment on or change strategy related to decisions or activities that violate social expectations. For example, Adidas and Ye (formerly known as Kanye West) dissolved their partnership after Ye made antisemitic remarks in October 2022, causing the hugely popular Yeezy clothing and shoe line to swiftly swing from asset to liability.

Indeed, potential liability and brand contagion were so dramatic that they caused a drop in operating profit. In February 2023, Adidas reported that its 2023 revenue would decline by US $1.3 billion and operating profit by $534 million due to this decision (but showed no sign of a reversal).2 Adidas plans to strip Yeezy logos from existing inventory to try to make the products sellable and cut losses.

Yet, there is substantial opportunity for innovation as businesses adjust to this new paradigm and try to avoid issues like those faced by Adidas. Proactive measurement and management of consumer product impacts can minimize the risks of running afoul of social expectations and enable analysis and decision-making alongside financial metrics by translating those impacts into units of currency. We call this “monetary impact accounts.”

What Are Monetary Impact Accounts?

Today, most mainstream ESG reporting frameworks require disclosure of corporate and investment input and output. Examples include cubic meters of water intake and discharge, metric tons of greenhouse gas produced, nitrogen and phosphorous emissions, and wages paid. Although important, these disclosures do not capture the ultimate ESG effects of corporate activities.

For a more complete view, corporate input and output data must link to impacts and outcomes through impact pathways. Here are two examples:

-

CO2 emissions increase the relative concentration of gases in the atmosphere (outputs). This causes increased radiative forcing, increasing the Earth’s global average temperature, which sets off pathways (impacts) that ultimately reduce crop production, affect human health, accelerate species extinction, and cause a decline in ecosystem health (outcomes).

-

Consumer packaged goods companies produce and manage a portfolio of food and beverage products (outputs). Their choices regarding the nutritional component of this portfolio, marketing practices, and pricing (among other elements) have implications for who purchases the product, what nutrients are accessible at a certain price point, whether the products are recyclable, and whether children are more likely to ask for or purchase the product. These have numerous downstream implications (impacts) on increasing or decreasing obesity, health, and environmental degradation (outcomes).

Because they focus on the beginning of the impact pathway (inputs and outputs) rather than the end point changes for the various stakeholders affected, current ESG reporting frameworks do not contain the amount of information needed to properly evaluate corporate sustainability performance. Today's frameworks provide an important starting point by standardizing scope and measurement of these data points, but they are insufficient. To assess corporate sustainability and product impact, we need to see a complete impact pathway.

Even if impacts to affected groups or the environment were clearly disclosed, this would not be sufficient to achieve the economy-wide changes needed to solve some of society’s biggest problems. One reason is that many impacts are measured in units specific to a particular discipline. For example, disability-adjusted life year (DALY) and quality-adjusted life year (QALY) are used by public health officials to assess the burden of disease when comparing treatment options.

We frequently hear that corporate decision makers and investors struggle to comprehend the following:

-

Is the impact metric a lot or a little?

-

Is the impact metric in line with thresholds or benchmarks?

-

Are the impacts from one choice better or worse than those for another?

-

What produces the greatest positive or minimizes the negative impacts for those affected?

The solution is using rigorous data and stakeholder-driven approaches to reflect the impacts created by any given corporate activity or choice.3 Impact-weighted accounts use impact monetization to supplement traditional financial accounts used in financial and managerial accounting. By providing comparable, transparent measures of impacts for stakeholders, we can truly understand whether a product, project, or organization creates net value.

Monetarily valued impacts are interoperable with financial analyses and can be directly compared to financial returns, providing critical context to decision makers.

Incorporating ESG into Product Design & Development

Product development involves market intelligence on consumer trends and tastes, emerging technologies, competing products, expected costs, production requirements, and projected-total-demand and market-share estimates.

Often, assumptions from these analyses are aggregated into a pro forma profit-and-loss projection used to determine whether the contribution to profit margins is high enough to justify green-lighting the project and/or prioritizing it.

Some organizations have incorporated ESG analysis into their product development process by analyzing reputational risk and ESG metrics. Unfortunately, barring a glaring redline issue like animal welfare, sanctions, child-labor risk, or massive environmental risk that can halt a project, the ESG analysis is often subordinate to the financial analysis. It is just too hard to compare the two.

This is where monetary impact accounts are most helpful, translating these disparate metrics into language that can be understood, compared, and acted on by various stakeholders (senior leaders, boards of directors, investors, and customers).

The Impact-Weighted Accounts Product Framework

Between 2019 and 2022, the Impact-Weighted Accounts (IWA) Project at Harvard Business School developed a framework that categorizes various impacts so that they are measurable and comparable, making it easier to understand trade-offs.

In designing that framework, IWA referred to these five guiding principles:

-

Consistency — ensures the framework has consistent units, scale, and approach, increasing the relevance of the information, its understandability for business decision makers, and the comparability of information.

-

Incentive alignment — encourages consideration of the behavior that is incentivized by the framework to ensure it aligns with positive environmental and social impact.

-

Best-in-class benchmarking — mitigates the possibility that the impact of a product or industry is benchmarked to a very low threshold.

-

Conservatism — bases the framework in conservative assumptions and comparisons, increasing the likelihood of faithful representation while mitigating the probability of positive bias through “cheap talk” and “impact-washing.”

-

First-order effects — limit scope to impacts from product usage. We recognize this excludes impacts to both broader stakeholders in the value chain and higher-order impacts to the direct stakeholder, but it likely decreases measurement error.4

IWA used frameworks and tools from other leading organizations in the impact measurement and valuation ecosystem, including the Capitals Coalition and the Impact Management Platform, to develop its framework and accompanying guidance. The harmonization of frameworks and methodologies is a critical step toward widespread adoption of monetary impact accounts.

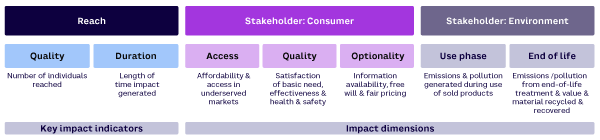

The IWA product-impact analysis framework shown in Figure 1 ensures comparability between various product-design choices and provides clarity about not only the total impact of the product, but also the drivers of that impact (i.e., price, environmental impact in use or end of life, or features of product design). The framework dimensions are consistent across different products and industries, but the metrics used to analyze those dimensions are unique due to inherent heterogeneity in products.

Key Results

Analysis of more than 50 companies across seven of the 11 Global Industry Classification Standard (GICS) sectors shows that product impacts can be a driver of substantial positive impact.5 The data set consisted of product-impact estimates for leading firms across seven GICS sectors spanning four years, 2015–2018.

The data set is limited to firms that are publicly traded in the US with more than $2 billion in revenue (to ensure data availability). The firms meeting these thresholds include 15 automobile manufacturers, 11 consumer packaged foods manufacturers, 4 consumer finance firms, 6 airlines, 12 telecommunications operators, 4 water utilities, and 9 oil and gas companies. Because of a lack of data availability, product-impact estimates for packaged foods manufacturers are limited to a single year: 2018.

Given the small sample, we did not intend to achieve statistical significance. Rather, the goal was to provide a blueprint of how financial analysis could be conducted in the presence of more data. Our analysis presents associations rather than causal links between product impact and financial performance (which would require a significantly larger data set of product-impact estimates).

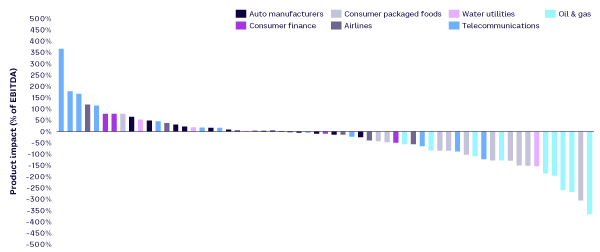

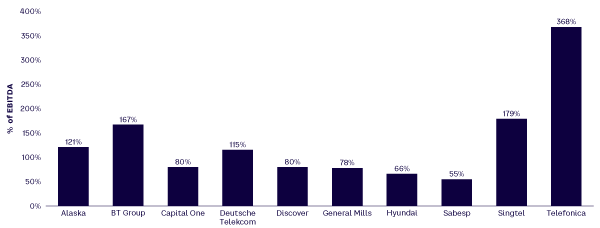

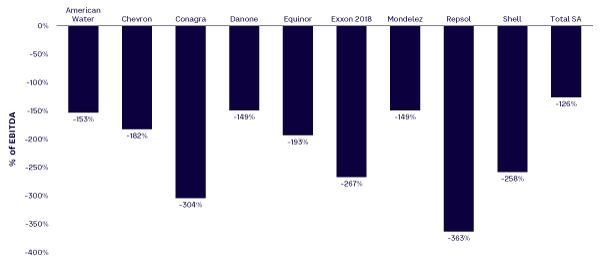

To compare companies of different sizes and scale, we present the results as a percentage of EBITDA (earnings before interest, taxes, and amortization). Figure 2 shows the diversity of impacts across industries in 2018. Figures 3 and 4 provide additional granularity, showing the 10 companies with the most positive and negative product impacts.

The impacts measured are a direct result of specific choices made by corporates in designing, pricing, marketing, and distributing their products. Traditionally, product development decisions have been made to maximize profit and resonance within target markets while minimizing cost. Monetary impact accounts produce information that informs decisions related to trade-offs between profitability and product impact.

Figure 2 shows that the consumer packaged foods and oil and gas industries tend to generate overall negative product impact for society while the telecommunications industry tends to generate positive product impact. Several other industries present opportunities to fine-tune product portfolios for positive impact — companies in the same industry are on both sides of the positive/negative impact line.

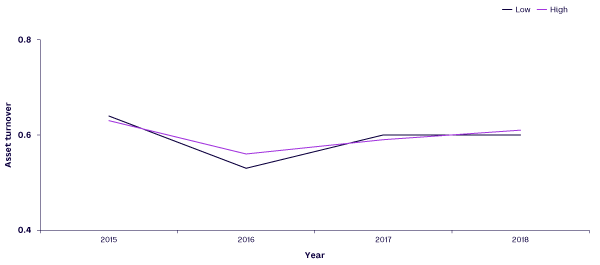

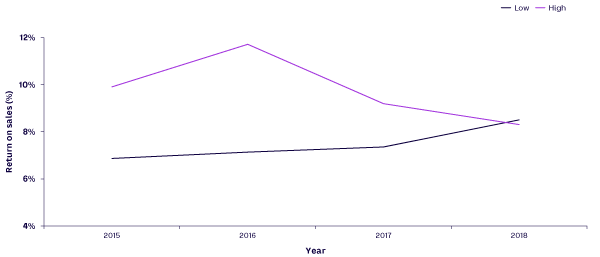

We used the data to answer three performance-related questions. First, do products with more positive impact sell more over time? Second, do products with better impact enable a company to exhibit a higher profitability ratio in terms of return on assets (ROA)? Third, we decomposed ROA to a profitability-margin effect (in terms of return on sales [ROS]) and an operating-efficiency effect (in terms of asset turnover) to understand what might be driving differences in profitability, according to the following equation:

ROA = ROS × asset turnover = (operating income)/sales × sales/assets

We categorized firms in our sample as high-impact or low-impact, based on overall product impact from 2015–2018 and then benchmarked within industry. The high-impact and low-impact samples consist of seven automobile manufacturers, six consumer packaged foods manufacturers, two consumer finance firms, three airlines, six telecommunications firms, two water utilities, and four oil and gas firms.

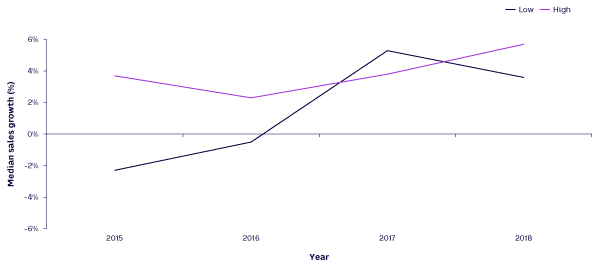

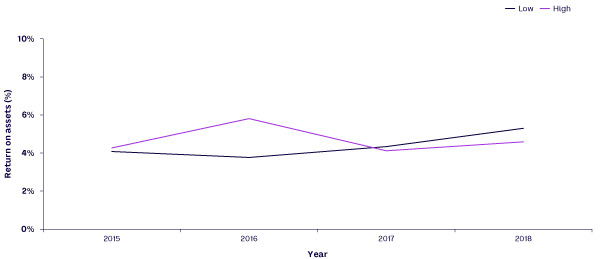

We first compared year-over-year sales growth of high-impact and low-impact firms to identify whether firms with higher product impact demonstrated higher sales growth. We calculated the median estimate within each group to avoid outliers from calculating the mean value. Figure 5 shows that high-impact firms tend to display higher sales growth. Figure 6 shows that high-impact firms display similar or slightly higher ROA.

Figure 7 shows that high-impact firms achieved a higher ROS for three out of four years. Figure 8 shows that high-impact firms had a similar asset-turnover ratio as low-impact firms.

We recognize that it’s currently difficult to determine clear associations with financial performance. As the product-impact analysis framework is expanded by academics and corporations to additional applications and industries, the International Foundation for Valuing Impacts, which grew out of work from the IWA Project, will continue to examine the relationship between a company’s product impact and profitability.

The Future of Product Development

Given rapidly changing social norms, we expect the trends seen so far to continue and the differences between high-impact and low-impact firms to expand. Firms that quickly adopt methodologies that allow them to evaluate alternatives in product design to maximize impact will have a significant advantage over firms that do not. In addition to potentially losing market share, firms risk making investments or CAPEX decisions related to product development that could end up being costly mistakes or result in stranded assets stemming from reputational damage.

References

1 Versace, Chris, and Mark Abssy. “How Millennials and Gen Z Are Driving Growth Behind ESG.” Nasdaq, 23 September 2022.

2 Valinsky, Jordan. “Adidas Says Dropping Kanye West Could Cost It More Than $1 Billion in Sales.” CNN, 10 February 2023.

3 The ISO 14008 Standard as well as the Capitals Coalition Social & Human Capital and Natural Capital Protocols provide guidance for what constitutes a well-defined monetization coefficient and accepted price-discovery methodologies.

4 Serafeim, George, and Katie Trinh. “Impact Accounting for Product Use: A Framework and Industry-Specific Models.” Harvard Business School, 2021.

5 The automobile manufacturers included in the data set are: BMW Group, Daimler, Fiat Chrysler Automobiles, Ford Motor Company, General Motors Company, Honda Motor Company, Hyundai Motor Company, Kia Motors, Mazda Motor Corporation, Nissan Motor Company, Groupe PSA, Subaru, Tesla, Toyota Motor Corporation, and Volkswagen Group. The consumer packaged foods firms included in the data set are: Ajinomoto, Campbell’s, ConAgra Brands, Danone, General Mills, The Hershey Company, Hormel Foods Corporation, The Kellogg Company, The Kraft Heinz Company, Mondelez International, and Nestlé. The consumer finance firms included in the data set are: The American Express Company, Capital One Financial Corporation, Discover Financial Services, and Synchrony Financial. The aviation firms included in this data set are: Alaska Airlines, American Airlines, Delta Air Lines, JetBlue Airways, Southwest Airlines, and United Airlines. The telecommunications firms included in this data set are: AT&T, BT Group, Deutsche Telekom, Nippon Telegraph and Telephone, Orange, Singapore Telecommunications, Swisscom, Telefónica, Telenor, Telstra, Telus Communications, and Verizon. The water utilities firms included in this data set are: American Water, Sabesp, Severn Trent, and United Utilities. The oil and gas firms included in this data set are: BP, Chevron Corporation, Eni, Equinor, ExxonMobil, Petrobras, Repsol, Royal Dutch Shell, and TotalEnergies.

Disclaimer: The framework and results presented in this article were developed by the IWA Project at Harvard Business School. The International Foundation for Valuing Impacts (IFVI) grew out of the IWA Project. In 2022, IFVI launched as an independent organization with rights to the IWA Project’s intellectual property and the team in order to scale and achieve the ambitious goals set out by the G7 Impact Taskforce in its December 2021 report.

IFVI assumed the right to all the IP and work products of the IWA Project in December 2022. This article represents legacy research. Under the governance established by IFVI, the Valuation Technical & Practitioner Committee (VTPC) has been established to direct, validate, and approve the IWA research and methodology produced by the cooperation of IFVI and the Value Balancing Alliance (VBA) (The “Mandate”). The above research has not been evaluated by the VTPC at this time, and thus does not reflect the views or positions of that body, but the research is expected to be submitted in due course of IFVI’s research agenda.

© 2023 International Foundation for Valuing Impacts