Small and medium-sized enterprises (SMEs) represent 99% of the businesses in Europe and are a major source of jobs and innovation. SMEs, however, perpetually face a lack of sufficient funding. Traditional financing mechanisms such as bank loans, venture capital, and angel investments are often not available to many SMEs. Peer-to-peer financing in the form of crowdfunding is increasingly filling a funding gap for companies that are unable to obtain traditional financing or are too early in their lifecycle to attract angel investors and venture capitalists. Indeed, it was predicted the amount of funding received through crowdfunding would exceed venture capital in 2016.

Article

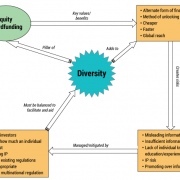

Wise Crowds, Safe Crowds: Balancing Diversity and Protection in Crowd Investing

Posted June 27, 2017 | Leadership | Amplify

Don’t have a login?

Make one! It’s free and gives you access to all Cutter research.