CUTTER BUSINESS TECHNOLOGY JOURNAL VOL. 30, NO. 9

Deepika Shah and Rajesh Vishwanathan present an engagement framework that enables insurers to optimize their relationship with the insurtech startups most likely to impact their business models and processes. The authors’ ultimate purpose is to define a relationship model for small and medium-sized insurance companies “that neither have the financial resources nor the management expertise of their larger competitors.” Of interest here is their due diligence process to determine the “fit” between insurers and the insurtech startups. The authors offer a checklist of criteria that speak to the cultural, leadership, and technological compatibility of the engagement team. They then shift to the features of the engagement itself, describing an engagement model to help insurers navigate the sometimes complicated relationship with insurtech startups.

Small and medium-sized insurance companies need to engage with insurtechs to fully take advantage of the insurtech wave and leverage it successfully. In this article, we highlight avenues for sourcing, curating, and building long-term relationships with the insurtech firms that are most suitable for the incumbent organization’s strategic requirements.

Most insurance industry commentators are unanimous in their view that the insurance industry is ripe for disruption by insurtechs, probably in a more dramatic manner than the recent technology disruption of the financial industry. So far, the insurance industry has been characterized by very little innovation in terms of technology and very little focus on customer experience (CX). These are the specific areas that form the sweet spot for many startups. Hence, there has been a surge in the number of startups focusing on the insurance sector.

These startups primarily focus on and target particular value pools in the insurance sector rather than seek to provide an end-to-end solution. One reason behind this approach could be that insurance (especially life insurance, health insurance, etc.) is more trust-driven, which allows the incumbents to score better over the insurtechs. However, the scale of operations developed over time by the incumbents cannot be matched by the insurtechs in the short term. Hence, insurtechs are seeking to address specific challenges, such as improving CX, the innovative use of technologies, and so on.

The Insurtech Impact

Insurtechs are characterized by agile delivery models and rapid innovation that delivers smarter solutions, leveraging best-of-breed and cutting-edge technologies. They have very few legacy processes and systems to manage and thus are generally in a better position to deliver solutions at very low cost and at a faster rate compared to the incumbents. This enables insurtechs to offer a greater value proposition at a lower cost.

In turn, this affects all the incumbents. In particular, the impact on small and medium-sized insurance companies will be higher compared to their larger counterparts that have greater resources at their command. Thus, it is critical for small and medium-sized insurance companies to address the challenges posed by insurtechs sooner rather than later.

The Insurtech and Incumbent Relationship

The relationship between the incumbents and the insurtechs is changing rapidly.1 Insurtechs have demonstrated that they are in a position to challenge the incumbents by leveraging smarter technology and agile ways of working. At the same time, the incumbents are realizing the benefits of the practices introduced by the insurtechs.

In the financial sector, banks and emerging fintechs are partnering, where the incumbents retain ownership of their end customers, and the fintechs improve user experience and customer-centricity. This trend is slowly finding its way into the insurance sector, too. Insurtechs now seem to be focusing on providing services to insurers and helping the incumbents unlock value.

An increasing number of insurance companies are making a strategic decision and investment in either working with insurtech organizations or bringing those capabilities in-house to increase responsiveness. Moreover, based on conversations with various clients and insurtechs, we believe that the relationship is evolving to a partnership model, where the incumbents are leveraging the capabilities of the insurtechs to fill critical capability gaps.

Later in this article, we frame two scenarios in which to build a relationship model — for those companies that neither have the financial resources nor the management expertise of their larger competitors.

Challenges with Startups

Working with startups is quite challenging, especially for companies in sectors such as insurance where the pace of change is very slow. This problem is further compounded in the case of smaller organizations because the focus on innovation is generally constrained by various organizational factors, including budgets, management capacity, and technical expertise. The typical challenges that organizations face when dealing with insurtechs include:

-

Accessing the right pool of insurtechs relevant to the incumbent’s needs is a challenge. We have observed a variation in maturity of solutions that startups offer toward addressing a particular business use case requirement. For example, Israel offers impressive startup solutions in the space of machine learning–based optical character recognition (OCR) and photogrammetry, while deep learning classification and predictive solutions are more prominent in Singapore.

-

Recognizing that the technology maturity of the incumbent (both in terms of architecture and personnel) is important, since the realization of benefits from the new technologies depends on the ability of the current landscape to integrate with the new technologies.

-

Understanding that regulatory compliance with respect to data security, privacy, storage, and so on, creates challenges in service delivery. For example, the insurtech might offer the solution only on the cloud, which might not conform to the laws of the country in which the incumbent is located.

-

Identifying the right set of use cases is one of the most important challenges, as this will determine the success of the engagement and might quite often determine the future of the initiative.

-

Considering the maturity of the product is also key because it might take much longer to deliver the desired results with a product that is still under development or not yet commercialized.

Some typical challenges for the insurtechs include the following:

-

Startups find the process of engaging with incumbents time-consuming and often frustrating. Thus, it takes a great deal of effort to identify the right set of stakeholders to whom to pitch the capabilities.

-

Incumbent organizations typically lack the necessary processes and software-support capabilities.

-

Lengthy and bureaucratic decision-making processes also discourage startups, which are more accustomed to quick and agile decision making.

Unique Challenges for Small Companies

The disruption caused by insurtechs is both a challenge and an opportunity for small and medium-sized insurance companies. On the one hand, disruption will lead to increased pressure on margins; on the other, it will provide insurance companies with an opportunity to create differentiators by leveraging new technologies.

In addition to the general challenges listed above, small insurance companies face some unique ones as well, including:

-

The availability of funds and management support for strategies, such as partnership/investment or acquisition, is limited in this segment.

-

Typically, small insurance companies have resource constraints in terms of availability of top management for an extended period of time or the capability to create and manage dedicated functions to support ongoing innovations.

-

The experience of such companies in working with startups is also limited, thereby increasing the challenges to adapt to the ways of the insurtech.

-

With constrained resources, there is little time for experimentation and, hence, a low tolerance for failure. This is also reflected in the types of technologies employed as well as the stage of the technology and the status of the startups with which the companies prefer to engage.

-

Limited technical expertise to manage interactions with the startups and also to manage the solutions post-deployment leaves the incumbents exposed to risk of failure of the product or of the startup itself.

The Way Out

Insurtechs are not going away, so it is essential for incumbents to strategize and leverage the insurtechs to address those areas considered important by customers and where the insurtechs add significant value (e.g., advanced analytics, enhanced CX). At the same time, it is critical that small and medium-sized insurance companies ensure that any investments made will deliver expected results and de-risk themselves to the desired extent. To achieve these goals, the incumbents need to develop a clear strategy to guide the following aspects of engagement with insurtechs:

-

A holistic approach

-

An insurtech evaluation framework

-

An engagement model between the insurtech and the incumbent

The next sections describe each aspect in greater detail.

Holistic Approach

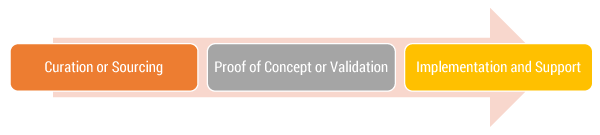

A holistic approach for insurtech engagement can be broadly divided into three phases: (1) curation or sourcing, (2) proof of concept or validation, and (3) implementation and support (see Figure 1). Based on the maturity of the use cases and the overall solution proposed, the incumbent may skip a step or, alternately, fast-track some steps.

Curation or Sourcing

This first phase involves the identification of startups that match the set of use cases that the incumbent insurance company would like to develop. This is a crucial phase because it determines the quality of insurtechs in the funnel and the quality of solutions that the incumbent would eventually acquire. The key steps involved in this phase are:

-

Identifying the focus areas and defining the use case. Given the wide variety of options available in the insurtech arena, starting with a set of capabilities that the incumbent intends to focus on and build upon is definitely the suggested starting point. Focus areas should be based on existing capability gaps or ones that take advantage of upcoming trends or market disruptions at play. A business-first approach, starting with a business question, can work alongside a technology-led approach, starting with a technology in mind, to arrive at the most suitable and relevant list of areas upon which to focus. Examples could be analytics from drones or satellite imagery for an insurance company offering crop insurance products, technology-assisted underwriting in the case of life insurance, or a connected home solution for those providers dealing in homeowner’s insurance.

-

Scanning for relevant insurtechs. Insurtechs can be scanned through multiple channels (e.g., aggregator sites, insurtech accelerators, venture capitalists, and academic institutions). Having a local presence in the countries where a specific insurtech is located helps provide a great advantage in building a network and getting through to the right insurtech company.

-

Evaluating and engaging the insurtech. The evaluation and engagement of the insurtech needs to be done in a scientific manner to ensure that the companies and solutions selected meet the needs of the incumbent and are also reliable and robust from both a technical and a business perspective. A detailed evaluation framework is described later in this article.

Proof of Concept or Validation

Here’s where the rubber meets the road, in the truest sense. From a viability perspective, this phase is crucial for immature technologies/applications or where the incumbent insurance company would like to test things further before investing. It presents the opportunity to try out the solution in a near-production environment. Three key steps are:

-

Plan and prepare. The key outcomes of this step include a charter (purpose, goals, and objectives) for the pilot, the plan to carry out the pilot, and a clear definition of the success criteria. The success criteria definition is important to help evaluate the pilot outcomes and define what “success” will look like. Preparation also involves the identification and onboarding of key stakeholders as well as the provisioning of any software, infrastructure, and data needed for the exercise. Another key element is in ensuring adherence to regulations and organizational policies (e.g., data privacy) while executing the pilot.

-

Execute. This step is the actual execution of the pilot. Issues that come up during this step will need to be identified and resolved as soon as possible because they will have a bearing on overall results. It is important that the key stakeholders from the incumbent are aware of the progress of the pilot and can resolve any delivery issues as needed. The outcomes of the execution phase could include quantitative feedback (e.g., number of records processed accurately and accuracy of the model) and qualitative feedback (e.g., usability of the solution and coverage of the solution).

-

Evaluate. This final step involves comparison of the outcomes with the expectations (and also with other solutions if possible) and with the current state within the incumbent to understand the impact and benefits that the new solution brings.

Implementation and Support

The implementation phase involves actual deployment and configuration and could be treated as a live project. In some cases (involving advanced analytics and AI-based solutions), the deployment phase will be followed by a training phase, where algorithms are configured and trained for the specific use case. In working with the insurtech, this might require specialized skills from a particular domain as well as a technical perspective. Quite often, ROI is not available immediately. The solution (especially in the case of deep learning/AI-based solutions) may require a gestation period (sometimes as long as two to three years) before results are evident.

Insurtech Evaluation Framework

The hunt for a suitable insurtech, which not only brings the desired business value to the table but is also the least painful to align with from an IT perspective, needs to be approached in a systematic manner. The framework needs to incorporate a holistic evaluation methodology that not only looks at the suitability of the product, but also the viability of the startup and the likelihood of a long-term engagement with the insurtech. The various factors that must comprise the evaluation framework include:

- Insurtech fit

- Leadership of the insurtech and advisors

- Financial viability

- Funding status

- Active client base and industry experience

- Solution fit

- Regulatory compliance

- Ease of use

- Diversity of platforms supported and any constraints

- Architecture compatibility, such as ease of integration, maturity of interfaces, etc.

- Nonfunctional aspects, such as security, performance scalability, etc.

- Operational maturity

- Implementation time and rollout time

- Customizability of the software for organization-specific needs

- Availability of support personnel

- Training and documentation

- Upgrade, maintenance, and product roadmap

- Commercial proposition

- Licensing models and sales model

- Geography-specific pricing models

- Solution delivery model (SaaS/on-premises installation)

These factors must be evaluated in detail for each insurtech in order to identify the best fit as far as overall value proposition is concerned. The importance of each factor will vary, not just from one incumbent insurance company to another, but also for each use case. For example, for fairly mature requirements and low-touch solutions (e.g., products that work on open source technology such as OCR scanning), the selection of the right insurtech partner and the offered solution might not be as critical as it would be for solutions that work on proprietary technologies and algorithms, where the risk of dependency for developing and maintaining the proprietary solution offered by the insurtech would be very high and, hence, critical.

Engagement Model

Depending on the business scenario being strengthened by the insurtech, there are two possible methods to build engagement between the incumbent and the insurtech: (1) a direct engagement model or (2) an engagement through a service provider.

Direct Engagement Model

For focus areas where the business requirement is clearly established and refined and the technology has reached a fair degree of maturity, the incumbent can look to directly engage with the insurtech startups. This model is good for technologies that have crossed the “exploration” cusp and are in the “wider adoption” stage. Larger incumbents are more likely to be in a better position in terms of required resources to govern and guide such a direct engagement model than are the small and medium-sized insurance companies.

We have found that it is best to approach this model as a project, and the project team should comprise a representative from various areas, including:

-

Line of business being served

-

Application most impacted

-

Infrastructure and security team members

It is important to empower this team to make financial and technical decisions and, at the same time, the team must be capable of mapping the business need to the offerings of the insurtech to ensure a good product fit within the overall landscape of the incumbent.

There also needs to be a plan to train technology and business teams within the incumbent organization to handle long-term operations or a plan to ensure that the insurtech will be able to support the proposition throughout its lifecycle. Adopting a machine learning–based OCR solution for validating a filled-in proposal form against provided identity proofs is a good example of a use case that a direct engagement model can handle.

Be aware that this engagement model consumes a lot of management resources by way of dedicated personnel and requires a great deal of time and effort to ensure that the right insurtechs are identified and solution propositions are effectively leveraged. Moreover, this model presumes awareness of, and easy access to, the insurtech pool, which might not always be the case. Finally, with direct engagement, the risk is primarily borne by the incumbent.

Engagement Through Service Provider

Engagement through service providers is better in cases where the incumbent has limited bandwidth to source and evaluate insurtechs and also in cases where risk management is a key concern of the incumbent’s stakeholders. The presence of a service provider helps manage the entire value chain of startup engagement holistically while mitigating much of the support and sourcing risks that the incumbent might otherwise have been exposed to.

Service providers add a lot of value by not only bringing the required skills to translate the business requirements and carve out the solution scope, but also to help source, evaluate, and then, if needed, manage the validation and implementation phases of the solution. However, for these benefits to accrue, it is critical to identify and select the right service provider for the exercise. Some key attributes that incumbents must seek are:

-

Value proposition in terms of the startup network and connections with accelerators, insurtechs, and venture capitalists in the geographies of interest to reach out to the right startups

-

The capability to deliver from an end-to-end perspective (i.e., strategy formulation, use case definition, solution implementation, and support)

-

A proven track record in identifying and curating startups and translating solutions into tangible and credible innovations

-

A presence in the startup’s home country to ease some of the otherwise painful legal prerequisites

This model of engagement is less agile than direct engagement; the service provider and the incumbent will need to make an effort to ensure that lessened agility does not become a hurdle as far as decision making goes. Furthermore, since there is no dedicated team for innovation in this case, top management support is critical to ensure that the engagement projects get due priority.

Conclusion

Small and medium-sized insurance incumbents should view the disruption caused by insurtechs as an opportunity and should seek to build collaborative partnerships with them. While “transformation” is a journey most insurance incumbents want to undertake, we have observed that a focused and gradual transformation works better for such companies. The incumbents need to follow a systematic approach to identify, curate, and apply the right insurtech at the right stage of their transformation journey to make the required difference and impact. The engagement through service provider model described in this article helps increase revenue and reduce cost by addressing typical constraints around budget, management bandwidth, and technology expertise that these companies face.

[Disclaimer: the views expressed in this article are personal views of the authors and do not reflect the view of Tata Consultancy Services Ltd.]