AMPLIFY VOL. 36, NO. 6

Jin Yoon provides an examination of financial data from a group of US and Chinese technology companies. Analysis spanning several years on price to earnings (P/E) and enterprise value to revenue (EV/Rev) clearly shows a negative effect on share prices from geopolitical risk: a 24% discount on a forward P/E basis and a 42% discount on forward EV/Rev. Yoon says the analysis demonstrates the profound impact that geopolitical turmoil can have on a company or industry’s market value and that this finding can guide investors and operators as they try to mitigate geopolitical risks.

Geopolitical risk impacts global business in myriad ways. Over the last few years, companies have faced supply chain issues, limited access to capital markets, and heightened regulatory scrutiny — all emanating from increased geopolitical turmoil.

As the final word in this issue of Amplify, this article contains data on the impact of geopolitical risk on share price. Understanding the relationship between geopolitical risk and share price is obviously important for publicly traded companies and investors in such companies. Additionally, although management theories and practices are regularly discussed, their link to and impact on financial performance often remain vague. The goal of this article is to make that connection clearer — highlighting and demonstrating the ways geopolitical risk can negatively affect share price.

Approach

Given the ongoing China-US trade dispute and continuing geopolitical issues between the two countries, New Street Research wanted to see whether we could quantify the impact of this geopolitical dynamic on Chinese Internet companies, referred to hereafter as “Chinese Internet Names.”

Chinese Internet Names generally underperformed against the Nasdaq during the first half of 2023. Geopolitical tensions, including the “balloon incident” in February and the cybersecurity probe of Micron in April, spurred a sell-off of Chinese Internet Names shares. Simultaneously, signals that the Chinese central government may shift its focus from stimulus to long-term reforms are driving concern for Chinese equities. Although macroeconomic signs have shown recovery on a month-to-month basis, geopolitical risks remain as tensions between China and the US persist. Given all this, we wanted to understand the extent to which geopolitics has affected the performance of Chinese Internet Names.

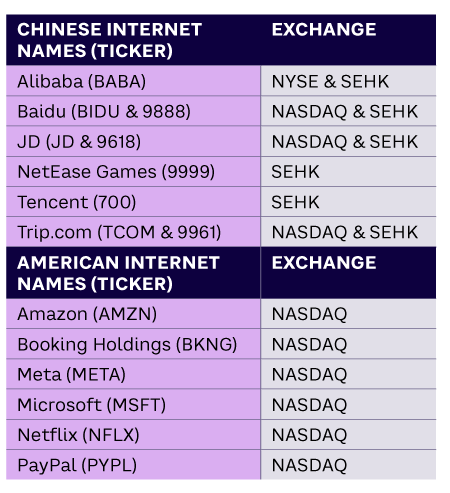

We selected a group of US (“American Internet Names”) and Chinese technology companies, six from each country. Of the six Chinese companies, four are dual listed on an exchange in the US and the Stock Exchange of Hong Kong (SEHK). NetEase Games and Tencent are the only Chinese companies in our sample listed solely on the SEHK. All US companies in our sample are listed on Nasdaq. The companies used in our analysis are shown in Table 1.

For each company, we examined the monthly data of forward multiples for both price to earnings (P/E) and enterprise value to revenue (EV/Rev) from 2018 through the first four months of 2023. We then compared the average forward P/E (or EV/Rev) of the six Chinese Internet Names over the average forward for P/E and EV/Rev of the six American Internet Names. A value of less than one implies that the average forward multiples of the Chinese Internet Names traded at a discount relative to the American Internet Names. Events that specifically affected the Chinese market were excluded from our analysis. For the sake of brevity, our explanation focuses on data from 2020 to 2023.

Analysis

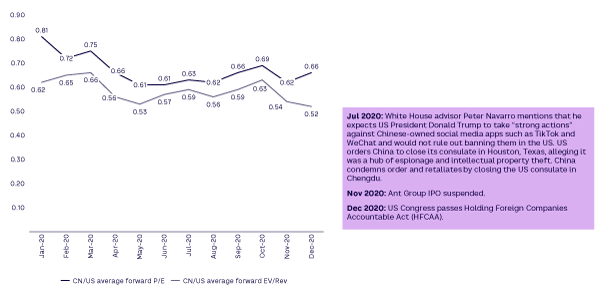

2020

For 2020, our analysis of the average China/US forward P/E and EV/Rev ratios during months with geopolitical events (see Figure 1) shows that Chinese Internet Names traded at a 36% and 44% discount, respectively, compared to American Internet Names.

During non-geopolitical event months (excluding November), the average China/US forward P/E and EV/Rev ratios show that Chinese Internet Names were not discounted to as great a degree, trading at a 31% and 40% discount, respectively.

November was excluded from our analysis because of the impact on Alibaba’s valuation related to the suspension of the Ant Group’s initial public offering (IPO). Our analysis shows that in 2020, the discount was wider by approximately 7% P/E and 7% EV/Rev during months when impactful geopolitical events occurred as compared to months without such events.

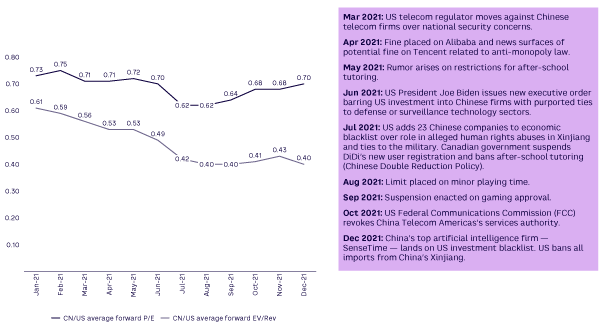

2021

The 2020 pattern repeats in 2021. Analysis of the average China/US forward P/E and EV/Rev ratios during 2021 shows that for months when disruptive geopolitical events occurred (see Figure 2), Chinese Internet Names traded at a 30% and 53% discount, respectively, compared to their American peers. During months without geopolitical events, the average China/US forward P/E and EV/Rev ratios were less impacted, trading at a 28% and 45% discount, respectively.

To ensure accuracy, the months of April, July, August, and September were excluded from non-geopolitical month consideration due to a variety of regulatory actions. In April, Alibaba was fined, and Chinese ride-hailing giant DiDi faced scrutiny and suspension related to its overseas IPO. August and September were removed because of the impact related to the suspension of gaming approval. Taking these additional factors into consideration, the discount was actually wider than the numbers indicate, namely ~3% P/E and ~16% EV/Rev during months with geopolitical events compared to months without geopolitical events in 2021.

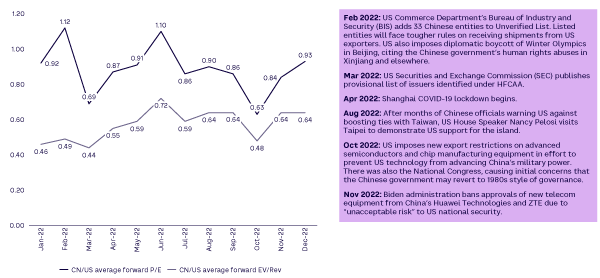

2022

The pattern is similar in 2022. The average China/US forward P/E and EV/Rev during months when there were geopolitical events affecting US-China relations (see Figure 3) show that Chinese Internet Names traded at a 16% and 45% discount, respectively, compared to their American peers.

The average China/US forward P/E and EV/Rev ratios during months without relevant geopolitical events show a lower discount: 7% and 39%, respectively.

Our analysis excluded April and October as months without geopolitical events. April was not considered due to the COVID-19 lockdown in Shanghai, and October was not included because of concerns related to policy directions that might emerge from the Chinese Communist Party’s 20th National Congress. Comparing our findings, we see that the discount was even wider: ~10% P/E and ~9% EV/Rev during months when there were relevant geopolitical events as compared to months when there were no such events.

2023

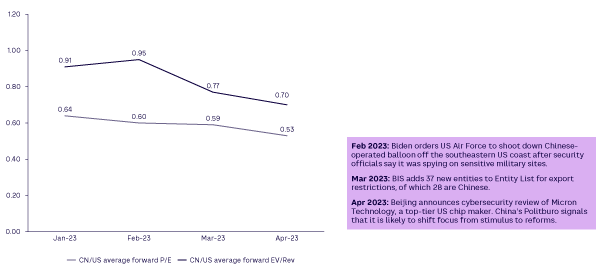

Our analysis of January-April of 2023 shows that the average China/US forward P/E and EV/Rev ratios during months with pertinent geopolitical events (see Figure 4) indicate that Chinese Internet Names traded at a 14% and 41% discount, respectively, relative to American Internet Names.

The average China/US forward P/E and EV/Rev ratios during months in which these types of events did not occur show that Chinese Internet Names traded at a less pronounced discount: 9% and 36%, respectively.

Based on our analysis, we see that the discount was actually wider: ~5% P/E and ~7% EV/Rev during months marked by geopolitical events impacting China-US relations.

Key Takeaways

Based on analysis of the total study period (2018 to beginning of 2023), we believe that after excluding outliers, on average, large-cap Chinese Internet Names traded at a 24% discount compared to large-cap American Internet Names on a forward P/E basis. The discount was even wider when considering forward EV/Rev: Chinese Internet Names traded at an average of 42% discount relative to their American peers during the same period.

Share prices fluctuated materially during months of heightened geopolitical tensions between China and the US. Based on our analysis, we estimate that geopolitical tensions contributed to high-single-digit percentage points of the overall trading discount observed over the past five years. Our analysis demonstrates the profound impact that geopolitical turmoil can have on a company or industry’s market value.

In addition to quantifying the impact of geopolitical risk on share price, we feel this analysis can guide investors and operators as they think about mitigating geopolitical risks.

At the company level, organizations that build contingencies and resiliency into their operations and strategic planning can better weather geopolitical storms and preserve market value relative to peers that do not. Thus, managers should spend more time considering and planning for such contingencies and enhancing organizational robustness, and investors should include due diligence of such factors when considering an investment.

At a broader level — if a company is part of a larger group or an investor is taking a portfolio approach — such risks should be considered holistically and comprehensively as opposed to piecemeal when implementing new continuity policies and/or risk management practices like hedging around markets and foreign-exchange fluctuation.

Although geopolitical risk is broad in scope and deep in impact, aspects of it can be measured, and through that measurement, organizations and investors can better weather the proverbial storm.

© 2023 Jin Yoon/New Street Research