AMPLIFY VOL. 36, NO. 6

Klaus Meyer and Saul Estrin focus on a decision tree approach to managing exit strategies. The authors use Russia’s invasion in Ukraine as an example of complex situations that arise from major geopolitical disruptions. As companies try to extricate themselves from a country, they may need to consider whether a buyer can continue using its global names, what to do about promises to current customers (e.g., access to the App Store for Apple phones), and potential harm to the parent company from a sale. They must also consider the sticky issue of how the new owner will use critical assets (e.g., will they supply the military organizations deemed responsible for human rights abuses?).

Executives spend a lot of time strategizing about how to enter and grow their business in emerging economies. But what happens when the wind changes and stakeholders at home no longer support such international expansion, instead creating obstacles — from non-governmental organization (NGOs) campaigning against alleged human rights abuses to governments imposing sanctions on countries deemed hostile to national interests?

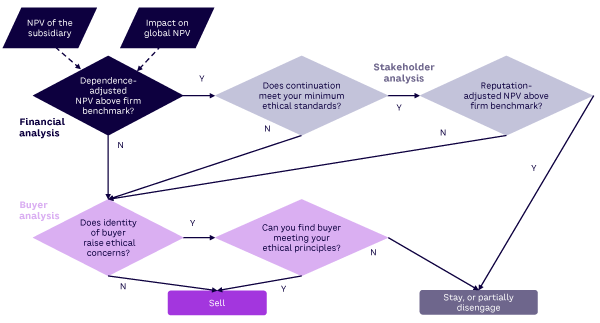

Recent geopolitical tensions, in particular the Russian invasion of Ukraine, have pushed exit strategies toward the top of many global CEOs’ agenda. Conventional analysis considers a full write-off of the invested capital as the worst-case scenario. In truth, it certainly could be worse. A company’s global operations and reputation may be at risk. So how can executives best navigate the trip wires around exit strategies? Using examples from Russia, we illustrate some key steps in making exit decisions, including using a decision tree (see Figure 1).

Financial Analysis

Let’s start with an accounting perspective. The moment a major political disruption occurs, the market value of a multinationals’ operation in the affected country collapses. In the case of Russia, this happened to the Western subsidiaries based there on 24 February 2022. Such a disruption typically leads to a drop in demand, cost increases, and a rise in economic and political risks. Moreover, potential buyers’ willingness to pay for the firm’s business unit declines sharply, especially if they are constrained by sanctions from their own governments. Western investors do not want to put fresh money into Russia, local buyers outside the energy sector lack financial resources, and third-country buyers often play a waiting game.

Thus, historical investment costs are sunk costs, and the book value in accounts is not the relevant benchmark. This is important to consider because the financial analysis of any exit strategy must be assessed against the next best option. The relevant baseline is the net present value (NPV) of the operation (if that’s the performance indicator on which you focus) based on the revenue and cost projections at the time (i.e., after the disruption).

Understanding Resource Dependencies

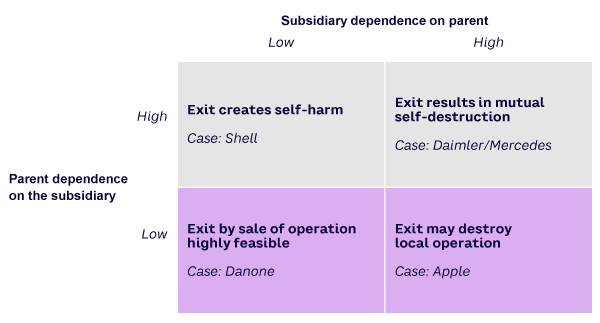

Executives must also consider the interdependence of affected subsidiaries with the rest of their company’s global operations. Multinationals typically operate highly integrated operations that span national boundaries, with regular exchanges of goods, people, and knowledge across borders. Thus, a decision to exit from one country typically has implications for the entire operation. These interdependencies are not always obvious or straightforward. Figure 2 considers four scenarios.1

The simplest scenario is that of a largely autonomous subsidiary with limited product or technology exchange with other units of the enterprise (bottom-left quadrant, Figure 2). Pure diversification investments fall in this category, as do hospitality businesses like restaurants or hotel chains.

Consider French manufacturer Danone, which has been producing in Russia since 1994. In 2021, Danone was the largest milk processor in the country with 13 factories.2 Its business model relied mainly on local supply chains and most sales were under local rather than global brand names. These product lines could be sold off to a local investor.

But Danone used global brand names (e.g., Actimel and Activa) for some products and imported specialized ingredients for others. When Danone sold its Russian operation to a local investor, a critical question was whether Danone would allow the new owners to continue using its global brand names.3

Operations that primarily serve the local market are often dependent on ongoing parent contributions in the form of specialized components or even finished products (bottom-right quadrant, Figure 2). Such operations are easily shut down by cutting off supplies. In contrast, distribution operations are not self-standing businesses and may not be able to be sold as “going concern.”

Consider Apple, the leading provider of iPhones and other appliances, competing in 2021 with Huawei and Samsung to be the number one smartphone brand in the country. Apple’s Russia operations were primarily market-oriented: selling iPhones and iPads via authorized resellers. It cut off Russia by halting product shipments in March 2022.4 Resellers thus had to shut down unless they had access to grey imports via third countries. This resulted in a substantial drop of revenues; press estimates suggested losses of sales of US $1.4 billion per year.5 Since Apple did not own its stores, an asset sale was not required.

Nevertheless, things proved complicated for Apple. Its devices are in circulation in Russia, and past buyers bought them with the expectation that software would be updated regularly and that the Apple App store would be readily available. Would Apple renege on the (implicit) promise it gave to customers? In fact, it only did so partially. Apple restricted the functionality of Apple Pay (in response to sanctions on financial transfers) and removed various apps of sanctioned Russian businesses from its smartphones.

Operations such as mining or upstream manufacturing usually create a dependence of the parent on the subsidiary (top-left quadrant, Figure 2). A disruption in a vertically integrated supply chain may severely undermine downstream operations. For mining operations, buyers are likely available because of the value of the resources in the ground, though they may face limitations if they do not have access to critical extraction technology.

For multinationals, the greater concern may be the disruption of the relationship with the subsidiary causing substantial harm to the parent. For example, Shell owned equity stakes in several oil and gas exploration projects, usually partnering with state-owned Russian businesses. Interdependencies arose from its network of local equity partners, which restricted the available options when Shell wanted to sell its equity stakes. Shell stopped all spot purchases of Russian gas and refined products and has not renewed any long-term contracts, but it was still legally obliged to take delivery of crude bought under contracts signed before the invasion.

In global supply chains like the automotive industry, dependencies in the value chain are often complex and mutual. Components are produced in specialized (internal or external) suppliers in some countries, from where they are shipped to assembly plants across Europe. Assembly plants specialize in certain car types and export the finished car to a third country, or even back to the headquarter country. Thus, components and technology flow both in and out of the country.

Consider Mercedes, which invested in a state-of-the-art passenger-car assembly line in Russia that began operating in 2019. This new production site increased Mercedes presence in Russia, despite sanctions in place since 2014. In 2022, Mercedes stopped exports of cars and vans and ceased local production, in part because new sanctions prohibited exports of high-tech components. Mercedes sold its shares in its distribution network, production plant, and joint ventures to Avtodom, a Russian dealership chain.

An interdependencies analysis must include the impact of costs and revenues of the global operation. Hence, the relevant NPV is not that of the subsidiary but that of the global operation. To inform an exit decision, the subsidiary NPV must be adjusted for losses in the NPV for the rest of the global organizations. In some cases, such losses can be mitigated by developing an alternative supply chain, but the resulting delays may prolong the presence of the controversial business unit.

Stakeholder Analysis

The pressure to exit a foreign country due to ethical reasons usually comes from the home country or the place where your most important customers are based. Nevertheless, multinational companies have obligations to stakeholders in each country where they operate. An ethics analysis thus needs to consider the full range of ethical concerns raised by stakeholders, as well as the conflicts between them.

Pressure on multinationals from home country–based stakeholders to leave a foreign location typically focuses on the association between the company and the host government, which is accused of violations of generally accepted international norms such as human rights or peaceful settlement of conflicts with neighboring countries. Multinationals often incorporate such principles in their corporate codes, and when a major conflict arises, home-country stakeholders demand disengagement.

However, there are variations in associations with the identified violations of international norms. At a most direct level, violations may occur within the multinationals’ operation, including when labor codes are strenuously violated or weapons are produced for an oppressive regime. For example, Mercedes is partner with KAMAZ in a joint venture assembling trucks, some of which are used by the Russia military. This became a highly sensitive issue after February 2022, and Mercedes froze its cooperation with KAMAZ and stopped the supply of critical components.

Multinationals are also held to account (often indirectly) for violations occurring along their value chains, including labor-standards violations among sub-suppliers and technical components being incorporated in products that eventually are used by military forces in hostile actions. Through their ethics codes, many multinationals have committed to standards for their operations and, to some extent, for their supply chains. Grave violations would fail to meet minimum ethics standards of the company and could therefore trigger an exit. Similarly, demands by host-country authorities that are in violation with laws or ethics codes at home can imply that minimum standards are violated, including provision of personal data on employees for a military draft or racially motivated prosecution.

In the discourse regarding Russia after February 2022, the political pressure has been broader: many activists and media view any form of business activity in Russia as implicit support for Putin’s government and its military operations in Ukraine. Activists are concerned both about the symbolism of continued operations in the presence of war and the potential indirect economic benefits the Russian government may gain (e.g., tax revenue).

These concerns of stakeholders at home (or in other countries where the company has a strong market presence) need to be weighed against concerns of stakeholders in the country itself. Companies have complex webs of relationships and obligations in each location where they operate. Some of these obligations are codified in contracts; others are moral obligations.

Among local stakeholders, first and foremost are employees, many of whom may have dedicated their lives to the company for years and are typically not in positions where they can (in a non-democratic country) exert political influence. Danone, for example, employed around 7,200 workers in Russia (and worked closely with dairy farmers in Russia), and its exit strategy displayed concern for their continued employment.6

Customers are the second most important stakeholders. If a company’s customers are part of the political regime, any harm caused to them may be intentional. Customers that come from vulnerable groups must also be considered. For example, if a pharmaceutical company’s medicines are lifesaving and not easily substitutable, withdrawing them would create more ethical problems than it solves. Similar ethical challenges arise for providers of food for low-income groups or baby nutrition (Danone, for example, decided to retain its baby food plant7).

The situation is also complex for those selling services along with products, creating (explicitly or implicitly) long-term obligations to their customers. We already mentioned Apple. Consider Mercedes, which sells its luxury limousines with product guarantees and after-sales service contracts. Even if Mercedes stops selling new cars in Russia, its existing customers might have a legal claim on ongoing services. To avoid lawsuits, Mercedes had to provide, at a minimum, service and spare parts to those who bought their car from a regular Mercedes dealership (no such obligation exists for grey imports, which surged in 2022).8 Thus, the acquirer of its sales network, Avtodom, also took on obligations to service and provide spare parts to existing Mercedes owners.

Buyer Analysis

Local entrepreneurs may be happy to pick up assets from departing foreign investors, especially at fire-sale prices. A private equity investor that is less scrutinized by the public than a listed company may want to take a plunge. Investors from countries that do not object to Russian policies may be happy to use the opportunity to increase market share. This begs the question: should executives care who the new owner will be? In fact, there are several reasons why selling to the highest bidder may not be in the departing investor’s interest. Consider several scenarios.

First, a sale under time pressure is likely to depress prices, possibly handing over valuable assets to potential competitors at a low price. If this acquirer is closely related to the political leaders who are supposed to be the target of sanctions, it is unclear whether the exit really contributes to the higher-level ethical objectives. For Shell’s oil and gas resources, the primary parties interested in buying its equity stakes were companies such as Gazprom and Novatek that are associated with the Russian authorities. Shell sold its petrol stations to Lukoil, a private firm that has so far avoided Western sanctions. Shell’s revaluations of book values of Russian assets add up to about US $4.8 billion9 — a small amount in light of the record $39.9 billion profits on the back of rising energy prices in 2021.10

Second, how will the new owners use critical assets? For example, will they supply the military or organizations deemed responsible for human rights abuses? Handing over assets and operations to a business oligarch with close ties to the political leaders of the country may strengthen the regime — yet the exit is supposed to weaken it. This is of particular concern for assets such as intellectual property (IP) rights, technology, or data (e.g., ISPs) that may be abused if the state attains de facto control over the business unit. In other words, a badly managed exit can play directly into Putin’s hands.

Third, will the buyer uphold the standards of the company, including the interests of the employees or the quality of products? Will they respect agreements concerning IP and brand names? This could require them to remove the brand from all properties, stay away from grey imports, and honor quality-control and service agreements. If the acquirer of the business acts unethically or provides fake products, this creates substantive reputation risks for the brand.

Fourth, what happens if the company one day wants to reenter the Russian market? Political analysts may consider a peaceful resolution of the military conflict unlikely, but businesses want to be prepared to seize opportunities when Russia reopens to business. The ideal buyer may be a group of investors closely associated with the departing investors who continue to represent the ethical values and business interests of the investor and would work with the investor once reentry is feasible and politically legitimate. Such buyers could be managers of the company or existing partners such as licensees, provided they can raise the necessary financial and human resources to run the company. Mercedes chose to sell to one of its distributors, Avtodom. With trusted partners as acquirers, it may be possible to include buy-back clauses in the sales contract, although it is not clear if these are enforceable in Russian courts.

Once you find a buyer that meets your expectations and has the necessary resources, you may still need regulatory approval. For complex M&A deals or deals in highly regulated industries like mining, obtaining all the approvals is a time-consuming process even at the best of times. It becomes even more complex if the host government is unfavorably inclined toward the parties to the deal.

Indeed, Russian authorities reportedly create obstacles to companies aiming to pull out of the country. New legislation essentially requires regulatory approval of any M&A involving the departure of a foreign investor. This gives local authorities considerable bargaining power. Moreover, contracts between the multinational and local partners are usually governed under local law and thus enforceable in local courts. A sudden withdrawal could lead to legal actions by local business partners and authorities who would probably find a sympathetic judge in the local courts. In some cases, Russian authorities have even threatened the expropriation of assets should a foreign multinational fail to live up to its obligations as defined under Russia law.

Conclusion

A decision to leave a foreign country requires complex financial, operational, and ethical considerations. First, the financial analysis of the operation under scrutiny must be adjusted to account for losses incurred elsewhere in the global organization. Second, the arguments of critical stakeholders need to be assessed for their merits, not forgetting that important stakeholders are in the country of operation. Third, the identity of the buyer may be important in many cases, as assets falling into hostile hands can cause major harm to the higher objectives that motivated the exit in the first place.

We hope our decision tree helps executives structure such decision processes.

We would like to thank Anna Tiunova for her effective research assistance.

References

1 Meyer, Klaus, and Saul Estrin. “It’s Hard to Say Goodbye: Managing Disengagement During Political Disruptions.” AIB Insights, Vol. 23, No. 2, 2 March 2023.

2 Kostyrev, Anatoly. “Other Milk Shores: Danone Leaves Russia.” Kommersant, 14 October 2022.

3 “Danonone Announces It Plans to Transfer the Effective Control of Its ‘Essential Dairy and Plant-Based’ Business in Russia.” Press release, Danone, 14 October 2022.

4 Collier, Kevin. “Apple Halts Sales of Products to Russia, Restricts Access to Russian News Apps.” NBC News, 1 March 2022.

5 “Apple to Lose $1.14 bln in iPhone Sales from Russia Pull Out.” Financial Mirror, 14 March 2022.

6 Abboud, Leila. “Danone Looks to Offload Russian Dairy and Yoghurt Business.” Financial Times, 14 February 2022.

7 Best, Dean. “Danone’s Asset Sale in Russia Welcomed — But Not Only for Ethical Reasons.” Just Food, 17 October 2022.

8 “Mercedes-Benz Returns to Russia. How Will the Brand Work Now?” WROOM.RU, 25 April 2023.

9 “Annual Report and Accounts 2022.” Shell, 8 March 2023.

10 “Live News Updates from February 2: BOE and ECB Raise Rates, Growing Pains Hit Big Tech Earnings.” Financial Times, 2 February 2023.