AMPLIFY VOL. 36, NO. 6

Douglas B. Fuller takes on the US’s chip “war” with China. Fuller says the US’s efforts in reshaping the global semiconductor industry by shifting activity away from China proves we are moving away from globalization and into de-risking. In other words, national security and supply chain resiliency now get (or should get) at least equal consideration from major economic powers. The author describes how the battle began (with Huawei’s efforts to expand its 5G infrastructure outside of China), the US’s multipronged regulatory response, and how companies should prepare for this new paradigm.

In May 2019, the US government embarked on a radical policy to use choke points it controlled in the semiconductor supply chain to counter perceived security threats from China. This action precipitated a flurry of moves and countermoves between the US government, US firms, and allied governments and their firms.

From the vantage point of the summer of 2023, the US government has succeeded in shaping the development of the global semiconductor industry by shifting activity away from China. This development is evidence that we have moved away from peak globalization (prioritizing low barriers to achieve maximally efficient and lean supply chains) and into the world of “de-risking,”1 in which national security and supply chain resiliency concerns receive at least equal consideration from the major economic powers. How did we get here?

The War Begins

When the US began its effort to reshape the semiconductor supply chain, its main objective was to prevent Chinese telecommunications giant Huawei from rolling out 5G outside China by depriving Huawei of US inputs. This proved very unpopular among Huawei’s US suppliers for several reasons. First, Huawei was a major procurer of US chips. Second, Huawei was a large purchaser of electronic design automation (EDA) tools (software used to design chips) for its in-house design firm, HiSilicon.

At the time, Huawei was one of the largest buyers of advanced chips. US firms were concerned that Huawei would turn to alternative suppliers and, to the extent that suppliers did not exist, create them through Huawei’s near insatiable demand for chips. In contrast to the economic impact US chip suppliers feared from losing Huawei as a major customer, when the US government blocked Huawei from using Google Android software, the outcome was different. Ultimately, Huawei’s smartphone market prospects abroad were harmed, while Android was only minimally impacted, since Android users could choose other smartphone brands that used Android (like Samsung), instead of only relying on Huawei.

Fortunately for US chip suppliers, the national security hawks advocating for the novel use of the US Department of Commerce’s Entity List against Huawei did not understand the many loopholes in the law. Written long before the rise of global supply chains, the export controls required software sold to a firm on the Entity List to receive an export license as long as the software was deemed of US origin. For physical goods, the goods needed to have a certain level of US-produced content. For chips, this effectively meant that they had to be manufactured in the US to require such licenses.2,3

With so many chips either produced at foundries (chip contract manufacturers like the Taiwan Semiconductor Manufacturing Company [TSMC]) or in-house chipmaking factories (“fabs”) abroad (e.g., Intel fabs in China, Ireland, and Israel and Micron factories in Japan and Taiwan), very few US-designed chips fell under the new regulations.

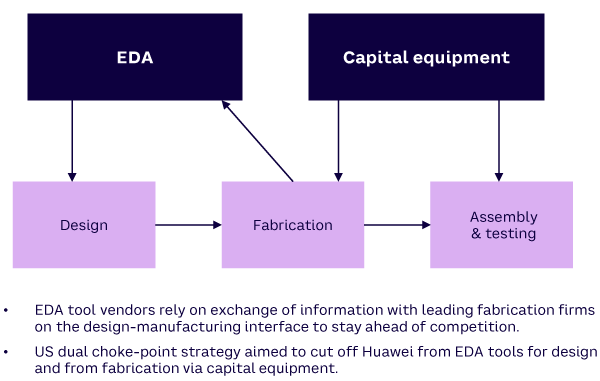

When the US government realized how ineffective its controls were, it began to revise them. The principal means was the Foreign Direct Product Rule (FDPR), announced in May 2020. With this rule, US firms could no longer provide equipment that would be used to supply Huawei, even indirectly. Thus, US capital equipment in factories abroad could not be used to manufacture chips for Huawei, even in offshore, foreign-owned factories. Similarly, it was illegal to use EDA software to design chips for Huawei without a license (see Figure 1).

US suppliers all along the supply chain were alarmed by this and began making plans to counter it. US EDA vendors had already started setting up joint ventures (JVs) in China, including Synopsys’s partnership with Advanced Manufacturing EDA Co. in September 2019. There were persistent rumors of other large EDA companies setting up JVs in China, with some speculating that these JVs were designed to be part of a string of intermediary companies to allow Entity List–designated firms to access US EDA tools.4

US capital equipment makers facing the FDPR regulations began to make their own plans to evade US export controls. In May 2020, the CEO of KLA, the third-largest US capital equipment producer, told investors that KLA would consider moving more production offshore to Southeast Asia to evade controls.5

Around the same time, US capital equipment makers conducted a war-gaming exercise to determine how to create an advanced fab without controlled American equipment. They concluded they could create such a fab in four to six years with much of the equipment still supplied by US producers’ factories abroad.6

One sticking point would be the reliance on advanced extreme ultraviolet (EUV) lithography equipment from the sole provider of such equipment, the Netherlands’ ASML. As ASML products contained significant US content, principally the critical light source component from ASML-owned Cymer, it would be difficult for EUV lithography equipment to evade controls.

When the new US controls were finalized in August 2020, Huawei lost access to advanced foundries, such as TSMC, because they were reliant on US equipment. One could have imagined a scenario in which the various companies subjected to controls worked together to circumvent them since Huawei represented a large portion of technically advanced chip orders in 2019/2020. However, the US equipment vendors, ASML, and foundries like TSMC and Samsung did not suffer from a huge fallout from declining Huawei sales (Huawei did receive permission to purchase some chips from the US Department of Commerce) because other firms, including Apple, provided large orders for foundries as Huawei’s legal orders for advanced chips ended in September 2020.

The Lull in the War

Starting with the announcement of the FDPR rules in May 2020 and continuing until broader policies were announced by the Biden administration in October 2022, industry participants adjusted to the new facts on the ground.

For example, Huawei abandoned the high-end smartphone market because of lack of access to chips. Despite the fact that Huawei is now the dominant vendor of 5G infrastructure equipment in China (because the Chinese government has compensated Huawei for losses incurred abroad due to US export controls), its sales outside China fell behind Ericsson from 2021 onward.7

For US and foreign vendors reliant on US inputs (e.g., TSMC and ASML), commerce continued with just a few bumps. Even as the US government added Chinese firms to the Entity List, these firms were not placed under the onerous FDPR rules that were specifically created for Huawei. For example, Chinese foundry SMIC was put on the Entity List for 10-nanometer-and-below processes (the lower the nanometer, the more advanced the process) but managed to access US equipment produced in Southeast Asia that could cross the 10-nanometer threshold without licenses.

Even during this lull, there were repeated rumors that the US government was aiming to impose more restrictive controls over a wider swath of China’s industry.

The Widening War

In October 2022, the Biden administration announced sweeping controls not focused on specific Chinese firms but on technologies. The stated purpose was to prevent China from even being a fast follower, trailing one to two generations behind the US’s lead in semiconductors.

The new controls include broad FDPR rules for a variety of technologies, including advanced computing and advanced semiconductor manufacturing. More significantly, the new policy prevents US persons (which includes US companies, not just individuals) from helping Chinese firms with advanced semiconductor-fabrication technologies. The main targets were chips for high-end computing and artificial intelligence (AI) and advanced semiconductor manufacturing across the main semiconductor domains (logic and memory production).

The policy effectively cut off China’s chipmaking industry from advanced US equipment. Although these moves were unilateral, the US government has from the start expressed confidence they will become multilateral with cooperation from the main foreign suppliers of chipmaking equipment: the Netherlands and Japan. For the Netherlands, the most advanced EUV and deep ultraviolet equipment is subject to US controls because of embedded American technology, so the US did not actually need Dutch cooperation aside from diplomatic niceties. The large number of Japanese vendors dictates more coordination, and Japan has announced controls. With US controls, there is presumption of denial of requests for export licenses, but export licensing is easily obtained from Japan.

China has tried to fill the gap with local suppliers, but these firms lag the performance offered by US and Japanese vendors. US vendors still voice concerns about losing out to Japanese and local vendors in the Chinese market, but market trends suggest China may be a less and less influential market. In fact, according to data obtained privately, China’s spending on capital equipment this year may be only US $13 billion, a steep drop from previous years. US export controls are one reason. The other is the dramatic shift toward proactive, Chinese-style industrial policy in the EU, Japan, and the US. With these three traditional semiconductor powers announcing ambitious programs to rebuild semiconductor capacity at home, and Korea and Taiwan doubling down on their already active support for semiconductor manufacturing at home, Chinese demand for chipmaking equipment is becoming less important in the global market.

The market shift is making it even harder for China’s local vendors to move ahead. Unlike in areas like electric vehicles where China’s policies encouraged dramatic demand expansion at home, foreign state actions to support its domestic semiconductor capacity resulted in the opposite in chipmaking equipment — China’s market actually shrank compared to other large markets. Trying to leverage China’s relatively small market to compete with entrenched and capable suppliers from Japan, the Netherlands, and the US will be very difficult.

In other areas, US policy has not succeeded nearly as well. We see this with attempts to control Chinese access to the graphics processing units (GPUs) that are critical for AI computing. While Chinese firms such as Biren Technology have been cut off from accessing the advanced fabrication abroad they need to produce their own AI chips, America’s Nvidia has designed AI chips for Chinese vendors to be just under the controlled parameters of their leading AI chips, and Alibaba and Baidu have bought copious amounts of these modified chips. There is also a question as to whether Baidu and Alibaba will suffer from the GPU to GPU data-transfer rate limits set by the US government, as these limits can potentially be overcome by software modifications using even more GPUs.

The US also neglected to consider cloud-based computing services based outside the US offering access to the computing power of supposedly controlled high-end GPUs. Regulating them would require expanding US law in ways that probably are not feasible given diplomatic realities. Not to mention that high-end GPUs are already being smuggled in (they’ve been found by journalists in electronics markets in China).8

The New Reality of Navigating National Security

The resurgence of export controls and industrial policy presents technology firms with the pressing question of how to navigate the treacherous geopolitics of today’s international business. US technology firms, including EDA toolmakers and AI chip vendors, must be concerned about losing out on large markets, particularly China, through effective and onerous export controls. There are three main strategies companies can try to avoid being damaged in these geopolitical storms: lobbying, bandwagoning, and corporate de-risking.

Many firms have lobbied for looser export controls and other new geopolitical constraints on trade. For example, Nvidia President Jensen Huang has complained vociferously about export controls even though they have yet to negatively impact his firm’s performance. He may simply be anticipating future controls that would constrain his commercial opportunities.

Other semiconductor firms affected by the new policies have tried to do the same in less public ways. Unfortunately for them, there is little evidence of gains, especially under the Biden administration, which exhibits far more strategic coherence than the previous administration. What goes for US firms is even more true for foreign firms. Huawei has unsuccessfully lobbied the US government almost continually since 2019. In areas with plausible direct and indirect large national security implications, the US government and certain allies have continued to move toward ever tougher export controls.

The new reality is not all gloom and doom, however. As the EU, Japan, and the US reinvigorate their domestic semiconductor industries, Korea and Taiwan have doubled down on their support for their large chip industries, and India has decided to jump into the chip game. Thus, US chipmaking firms and many others may find opportunities in markets easier to operate in than China. In fact, bandwagoning with governments in support of the proactive industrial policies outside China helps shift market demand to safer geopolitical countries for multinationals headquartered in the US or one of its allies. Similarly, the wisest choice for Chinese firms is to move into closer alignment with the Chinese state. Huawei has embraced new markets with significant Chinese state procurement because the Chinese state wants to support Huawei, especially now that it is under attack by foreign governments.

Corporate de-risking dovetails nicely with bandwagoning. As US multinationals (and others) see the risk of relying too much on Chinese demand and operations increase, they will embrace initiatives that enhance demand and operations outside of China. They may also de-risk by moving operations outside the US to the extent possible, given the lure of bandwagoning with US industrial policies.

For example, China moved against Micron in retaliation for US export controls on Chinese chipmakers, so Micron took advantage of Indian subsidies to expand operations in India even as it tries to convey to the Chinese government that it is a good corporate contributor to China by announcing future investments there. Intel exited manufacturing in China by selling its plant to SK Hynix at the same time it squeezed another $3 billion in subsidies from the German government and announced new investments in Israel. These moves allowed Intel to achieve a larger operational footprint in non-Chinese and non-US locations.

Some policymakers and pundits may view these strategies as violating the ideals of economic efficiency. But new geopolitical realities dictate more corporate flexibility in pursuing healthy bottom lines. Maximizing operational efficiency and market presence in strategic markets was a smart way to sustain profitability in the world of peak globalization. Today, ignoring the heightened risks of operational efficiency and strategic market presence will have the opposite effect.

References

1 President of the European Commission, Ursula von der Leyen, first used the term “de-risking” to signal that the EU was not intent on decoupling from China completely but was instead seeking to decouple very selectively in areas of high risk. Subsequently, the US Biden administration picked up the use of this term.

2 Fuller, Douglas B. “Cutting Off Our Nose to Spite Our Face: US Policy Towards Huawei and China in Key Semiconductor Industry Inputs, Capital Equipment and Electronic Design Automation Tools.” In Measure Twice, Cut Once: Assessing Some China-US Technology Connections. Johns Hopkins University Applied Physics Laboratory, 2020.

3 Fuller, Douglas B. “China’s Counter-Strategy to American Export Controls in Integrated Circuits.” China Leadership Monitor, No. 67, March 2021.

4 Fuller (see 2).

5 “KLA Corporation (KLAC) CEO Rick Wallace on Q1 2020 Results — Earnings Call Transcript.” Seeking Alpha, 5 May 2020.

6 Fuller (see 2).

7 Patey, Luke. “The 5G Fracture.” The Wire China, 11 September 2022.

8 Ye, Josh, David Kirton, and Chen Lin. “Focus: Inside China’s Underground Market for High-End Nvidia AI Chips.” Reuters, 20 June 2023.