Digital disruption impacts every part of our lives and every single industry. Klaus Schwab, founder and executive chairman of the World Economic Forum, calls this “The Fourth Industrial Revolution,” which is “characterized by a range of new technologies that are fusing the physical, digital, and biological worlds, impacting all disciplines, economies, and industries, and even challenging ideas about what it means to be human.”

The financial services sector was one of the first to be impacted by digitization, and for many years, banks (and also insurers) have been innovating their offerings to respond to the increasing demands of customers, changing regulations, and heightened competition. But the real disruption — which has changed banks’ business models and the way they interact with consumers — began with the emergence of fintech. Increasingly, small, nimble, technology-savvy companies are unbundling the offerings of traditional banks; consider online lenders (e.g., Lending Club, Zopa) that provide loans to customers who, due to strengthened credit criteria, have lost access to conventional bank loans, or remittance companies (e.g., TransferWise, Azimo) that allow customers to send money abroad at the fraction of the cost charged by banks. In recent months, the trend has been observed even more strongly in the insurance space with the rise of insurtech, which impacts the whole insurance value chain, from customer onboarding, through risk assessment, to selling the products, and finally to claims processing.

Digital transformation has become inevitable, and banks and insurers are looking for the most efficient strategies for the digital age.

A Changing Landscape

Solution-Based Customer Experience

Digital disruption results in consumers looking for an experience that is efficient, provided in real time, integrated, flexible, accessible, relevant, and intuitive. Fintech and insurtech companies shift the focus from products to solutions, directing their efforts toward solving real problems. For example, M-Pesa provides consumers in Kenya (and other markets) access to financing and microfinancing products through their mobile devices. By leveraging the new technologies, M-Pesa developed a holistic understanding of customer needs and proposed simplified products and relevant solutions. Other examples include Trov, an on-demand insurance firm that allows customers to insure specific products, and Cuvva, which launched pay-as-you-go insurance to address the needs of infrequent drivers.

Despite the inroads being made by fintech startups, a recent survey found that the top priority of most banks remains the transactional banking relationship, with customer experience being a secondary focus. Yet a 2014 report by PwC highlights the need for banks to move away from a distribution strategy focused on products and channels toward a customer-centric strategy that focuses on meeting the customer’s needs with a seamless, omnichannel experience. Banks should leverage consumer data and insights to prepare tailored offerings and services. One bank that takes this approach is Metro Bank. Calling itself a “retail concept that happens to be a bank,” Metro models its branches on the Apple store concept (much loved by consumers) and provides an omnichannel experience to its “fans” (Metro’s term for its customers).

Disruption of Business Models

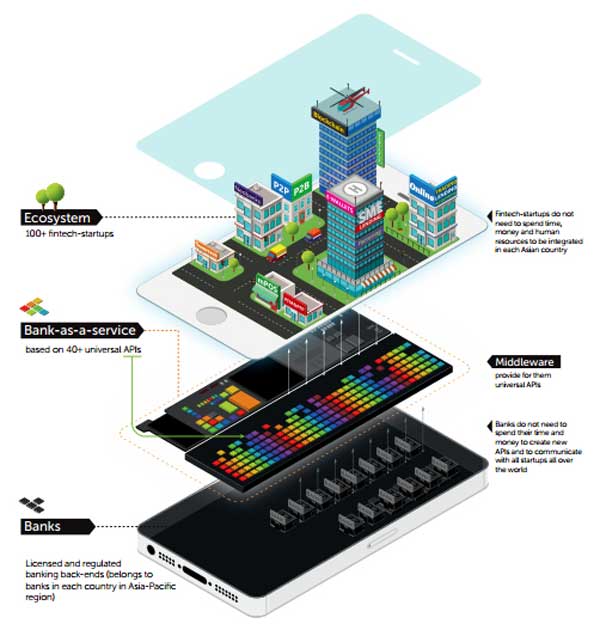

In a report on APIs and bank as a service (BaaS) in the fintech realm venture capitalists David Brear and Pascal Bouvier present banking as a platform (BaaP) as an effective strategy for delivering value to customers in the digital age (see Figure 1). The bank provides a licensed and regulated core back-end infrastructure and layer of APIs through which different players in the ecosystem can offer their products and services to the bank’s customers. For example, BBVA (Banco Bilbao Vizcaya Argentaria) partnered with Dwolla to enable customers to make real-time payments.

Figure 1 — Banking as a platform. (Source: Life.SREDA VC.)

Brear and Bouvier observe that banks (and insurers) have long benefited from economies of scale but suggest that they recently lost a network effect, as fintech firms keep unbundling bank offerings, thereby peeling off some of their customers. Banks and insurers that face stiffening competition can no longer enjoy the “We were first, why change?” status quo. Banks and insurance companies do not “own” the customer anymore.

Regulatory Changes

In addition to the above changes, the EU’s Payment Services Directive (PSD2) will further accelerate digital disruption as banking data will (with customer consent) be shared with third parties through secure open APIs, allowing third-party developers to create helpful services and tools that customers can utilize.

McKinsey analysts Henk Broeders and Somesh Khanna point out that for years banks and insurance companies have focused on driving digital transformation by upgrading Web and mobile technologies and creating innovation and testing centers. They list “four fundamental ways in which digital capabilities can be used by banks to create value”:

- Increasing connectivity with customers, employees, and suppliers

- Using big data and advanced analytics to extend and refine decision making

- Enabling straight-through account opening

- Fostering innovation across products and business models

That said, the speed of change, their old legacy systems, a limited talent pool, and the lack of an innovation culture have encouraged banks and insurance companies to take another tack: exploring collaboration with startups as the way to drive digital innovation.

Strategies for Incumbent and Startup Collaboration

Depending on their objectives, banks and insurers can choose different models of working with startups. For example, if they wish to add additional value for their customers but have no resources to develop products and services in-house, they may choose to buy a fintech solution and integrate (e.g., BBVA buying Finnish online banking startup Holvi). Alternatively, they may wish to distribute the risk and simply partner with another company that provides a complementary product (e.g., Berlin-based mobile bank N26 joining up with P2P money transfer service TransferWise).

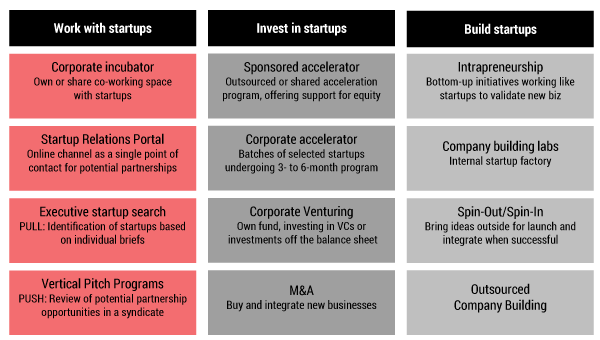

At The Heart, a European center for corporate-startup collaboration, we have identified the following ways of engagement (see Figure 2). The details of each strategy are described below.

Figure 2 — Incumbent and startup collaboration strategies. (Source: @TheHeartWarsaw.)

Working with Startups

Companies can work with startups by setting up an incubator, developing collaboration platforms, conducting scouting projects, or participating in dedicated programs.

Corporate Incubator

The role of a corporate incubator is to offer startups resources such as product knowledge, mentoring, accounting assistance, office space, legal guidance, and the like, so that they can focus on the core of their business and grow it. Incubators differ from accelerators (described below), as they neither invest in nor take equity from startups. Examples include:

- UK-based insurer Aviva has created the “Digital Garage” in Singapore. This dedicated coworking space allows IT specialists, creative designers, and business leaders to identify, collaborate, build, and test new ways to deliver innovative products and services for customers.

- Deutsche Telecom’s incubator, hub:raum, links the company with startups, entrepreneurs, and subject matter experts in the digital ecosystem.

- Insurance and financial services giant AXA has launched Kamet, an insurtech incubator where disruptive products are designed, created, and offered to insurance clients. Projects are led by employees as a way to inspire an innovation culture in the organization and merge the nimble approach of the startups with AXA’s product expertise worldwide.

Startup Relations Portal

Some established companies set up platforms to collaborate and develop relationships with startups. Like career sections on corporate websites, such portals are the entry point for external startups to learn about incumbents’ current calls to partner with startups or to pitch their own solutions in areas of corporate interest.

An example of such a platform is the Innovator’s Edge, which gives traditional insurers the chance to interact and collaborate with insurtech startups. An example outside the financial services sector is the Unilever Foundry, which enables startups to find calls for ideas from different Unilever brands and respond with ideas and solutions. The young companies also receive access to Unilever advisors and mentors and can attend Foundry events around the world.

Executive Startup Search

Companies that are looking to solve a particular business challenge via partnership with startups often use scouting services, which scan the ecosystem based on the individual corporate brief. Nordea Bank has teamed up with Nestholma Venture Accelerator and scouted around 50 startups, while companies like ING and BNP Paribas leveraged external scouting partners to source and select startups in their areas of interest.1

Vertical Pitch Programs

In the case of industry-wide or cross-industry topics, companies can work in syndicates to search for the best solutions. A fintech program run at The Heart helped eight banks to identify the most important cybersecurity challenges and matched them with potential scaleups to provide the relevant solutions.

Investing in Startups

Banks and insurance companies may decide to invest in startups via accelerators, corporate venture capital funds, or M&As.

Sponsored Accelerator

Accelerators, like incubators, offer a wide range of support by linking experts to startups and providing operational support. The difference is that accelerators invest in their startups and support them in so-called cohorts. Examples include:

- WERK1, a Munich-based digital incubator, has worked with leading insurance companies to launch the W1 Forward InsurTech Accelerator.

- Aviva is partnering with Silicon Valley digital startup accelerator Plug and Play.

- Direct Bank of Singapore (DBS) launched an accelerator powered by “venture catalysts” Nest.

- Many leading insurance incumbents have invested in the Global Insurance Accelerator, which aims to develop an ecosystem in which they support startups and nurture innovation in the insurance industry.

Corporate Accelerator

Instead of developing an ecosystem, banks and insurers may choose to run an in-house accelerator, which is typically a three- to six-month program for the selected startups. Examples include:

- Allianz X is a digital accelerator, powered by Munich-based insurer Allianz, where startups and insurance experts collaborate during 100-day sprints on incubating business ideas.

- Mumbai-based Yes Bank has partnered with T-Hub (a startup incubator) and Anthill (“a speed scaling platform for early growth stage startups”) to launch a business accelerator program for fintech startups called Yes Fintech.

- The innovation arm of MetLife Singapore, LumenLab, introduced the Collab accelerator, which focuses on supporting scaleups in fostering innovation in response to industry needs.

Corporate Venturing

A corporate venture capital (CVC) fund is set up by companies aiming to invest corporate funds directly in external startups, hoping to make a return on investment when a startup is sold or moves onto a stock exchange. Examples include:

- Citi Ventures oversees a global network of labs and manages an internal Acceleration Fund, focused on disruptive technologies and business models, such as blockchain technology, cryptocurrencies, wearables, the Internet of Things, future commerce, cybersecurity, and authentication.

- Global insurance company XL Catlin launched a CVC fund to attract startups aiming to solve the challenges related to business risk.

M&A

An M&A focuses on buying and integrating solutions, allowing corporations to win competitive advantage and take a leading role in driving innovation. Examples include:

- BBVA bought Finnish banking startup Holvi, Mexico’s Openpay, and US-based tech company Simple. It also invested 30% in the UK-based Atom Bank.

- Allianz bought a stake in insurtech firm simplesurance.

Building Startups

To acquire expertise in developing nimble and customer-centric offerings and to foster an innovative entrepreneurship culture, companies may decide to build startups in-house.

Intrapreneurship

Intrapreneurship can be defined as a bottom-up initiative that works like a startup to validate a business idea. Such a strategy introduces to the company the concept of thinking like an entrepreneur and, as such, discovering new opportunities, adopting a customer-driven mindset, extracting the most value from limited resources, and delivering solutions quickly to the market. One example is goodie, “an intuitive, smartly designed shopping platform ... created as an internal startup” by Warsaw-based Millennium Bank.

Company Building Labs

Companies may also decide to identify, build, and globally scale new business models, as Allianz has done with Allianz X.

Spin-Out/Spin-In

This is a strategy in which a company takes an idea outside business-as-usual operations, sends off a team of employees to develop the idea into a solution, invests in it, and when the solution is proved, buys it back. The spin-in model has been very successful for Cisco in bringing new products quickly into new markets.

Outsourced Company Building

A good example of this strategy is Berlin-based FinLeap, “a company builder specializing in fintech.” As reported by TechCrunch, FinLeap successfully launched solarisBank, as well as “Savedo, a marketplace for investment products; FinReach, a software-company that has created an automated account switching kit; Valendo, an asset-based lender; Pair Finance, an online debt collector; and zinsbaustein.de, a digital platform for real estate investments.”

Which Strategy Is the Right One?

Deloitte identifies three approaches banks can use to counter disruption, scenarios that also apply to insurance:

- Maintain a dominant position, staying on top of the trends and protecting their business model by leading innovation (e.g., ING). This option may help companies to retain their competitive advantage, but it is resource-intensive, including money and talent. Firms must be able to react to market trends and implement solutions quickly, which is often a challenge, especially when a bank/insurer is constrained by legacy systems.

- Reinvent (meaning relaunch) the business after convergence of new technologies. Analyzing business objectives may lead a bank/insurer to decide to drive digital transformation and relaunch its business. One example is Citi in the UK, which decided to close its physical branches and move all customers to online and mobile channels.

- Join an ecosystem — offering investment, know-how/expertise, and a consumer base — and collaborate with startups to deliver innovative solutions quickly and cost-effectively. This option allows a bank/insurer to merge the best of two worlds. One example is DBS, which partnered with digital banking and customer analytics provider Moneythor to provide customers with personalized financial recommendations and insights.

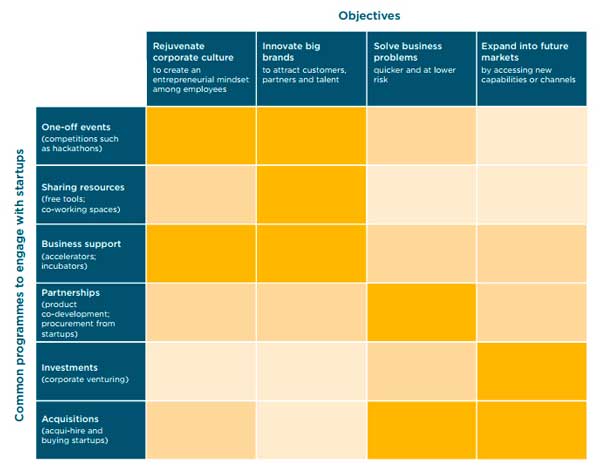

To decide which partnerships and models to pursue, banks and insurers should determine what their business objectives are and what role they want to play in fulfilling them. In other words, what would they like to achieve by working with a startup? The “innovation foundation” Nesta provides a useful matrix to map possible objectives (see Figure 3).

Figure 3 — Nesta’s collaboration framework, which indicates how common types of startup programs tend to deliver against key objectives in working with startups. The darker the field, the more suitable a program is for satisfying key objectives. (Source: Mocker et al.)

Even if your organization has nothing to do with banking or insurance, you can follow a similar procedure when considering your response to digital disruption. Once you have decided on your objectives, conduct an analysis of the key competencies of your business and those that could be complemented by partnering with startups. Leveraging the strengths of a startup can help your company to become lean and agile, focus on customer-centric solutions and not on products, strengthen your talent pool, acquire new technologies, and so on. Keep in mind that you will also need to identify KPIs by which you can measure the success of your partnership(s).

As a manager, you should also ensure that you have board support in fostering innovation. Appoint innovation champions who can help your company achieve organizational and cultural readiness for innovation. Key to success are employees who are inspired, engaged, and allowed to take risks, test, and learn (and sometimes fail) on the way to creating a collaborative culture that can lead to win-win partnerships for the benefit of customers, employees, shareholders, and the business.

Once you choose a strategy, leverage networks to scout and attract appropriate partners. It is usually more effective to tap into existing networks than to run in-house scouting, which requires a specific skill set, a strong network, and investment of resources (time, budget). The World Economic Forum recommends:

... finding and becoming part of networks that can help identify potential partners for collaboration as well as developing the company’s reputation as an attractive innovation partner. Networks in this sense include both structured and self-organized groups, including industry clusters and associations, online communities, informal business connections, research communities and links that can be provided by specialized advisers, intermediaries, and capital providers. Such networks are invaluable for identifying and connecting with firms to collaborate with.

Finally, whichever model and strategy you decide to follow, it is important to stay focused, keep things simple, and clearly communicate your objectives. Organizational theorist Henry Chesbrough suggests using an open innovation model to make the best use of internal and external ideas and resources. He also offers the sage advice that “building a better business model is more important than getting to market first.”

1 This finding is from internal data from The Heart.