AMPLIFY VOL. 36, NO. 5

The only way to avoid risk is to do nothing. And even that carries the risk of nothing getting done. To be active is to bear risk. To be productive is to bear risk. Some risk can be expected from past experience and mitigated, and some risk can be anticipated with less precision and best-effort contingency plans put in place. But risk cannot be removed from life or business practice.

Each year in the UK, nearly 6,000 people are hurt by their trousers and another 10,000 by their socks and tights — to the extent that they need hospital treatment. Our trousers and tights are not out to get us, but risk exists. Nor do most of us consider how to mitigate the risk posed by getting dressed. The associated risk has not occurred for us — at least not beyond the extent to which our response of grabbing the side of the bed hasn’t mitigated it.

In business, investors and infrastructure operators make risk assessments moment to moment based on historical information, likely future events, and/or ways in which risk can be expected to materialize. A great deal of management time goes into reducing or managing the extent of anticipated risk and likely impacts. The cost of mitigating this risk and establishing contingency plans is well thought through and broken down into costs and possible market responses.

Typically, economic regulators deal with risk through the weighted average cost of capital (WACC) they assign to a regulated company for the period of the price control. The WACC considers “normal” risk for equity and credit investors, then makes adjustments based on how risky the regulated business is relative to a benchmark. For example, regulated water companies tend to have a lower WACC than airports because they are deemed less risky. Regulated airports generally have higher levels of demand risk than regulated water companies.

At one level, the economics of risk are simple: the riskier a business is, the higher the return an investor will require to put their money into that business. But things get complex very quickly when we start to think about just how risky a business is and who should pay for that risk.

The answer, of course, is that the consumer pays — but how? Regulators only have two choices. One option is for the regulated company to bear the risk, in which case we see a higher WACC and higher charges. Alternately, the consumer bears the risk (e.g., by the regulator “insuring” the business against certain events), in which case charges may be lower, at least until the risk crystalizes.

The general idea with respect to airport regulation is that if you can reduce the risk borne by the regulated airport, it will be less expensive and better for consumers. That opens up another contentious area — the risk is still being borne and paid for, just not by the regulated business. However, our interest here is not in the mechanics of risk in general, but in how regulators can deal with unanticipated shocks.

Dealing with Shocks at Dublin & Heathrow Airports Pre-COVID

Shocks happen, and when they do, they tend to affect passenger volumes at airports. Heathrow Airport Limited (HAL) is the business that owns and operates Heathrow Airport, and when it was putting forward its business case for the next price control on airport charges back in 2014, it specifically considered the issue of demand shocks. More precisely, it looked at how negative shocks like volcanic ash, avian flu, and 9/11 affected passenger volumes through the airport.

One can argue about whether short-term shocks lead to an overall loss of demand or just a demand shift (i.e., people still fly but on another day) and whether events like the Olympics (which was expected to boost tourism to the UK in 2012) lead to an overall decline or increase in passengers. One could also argue that the extent of the impact of a demand shock (e.g., from unexpected snowfall) might turn on how efficient the airport’s response is to the shock.

However, we know for certain that shocks occur, and when they do, they can have an adverse effect on demand. The UK Civil Aviation Authority’s (CAA) approach, broadly, was to take this shock data, make a few adjustments, and argue that while you can’t tell exactly when a shock will hit, they tend to happen every X years and have an average effect on demand. CAA divides one by the other to come up with an average annual figure that is applied to the passenger forecast to offset volumes.

CAA argues that it is not double counting to include both the WACC increase for risk and the shock factor, as they account for different situations. According to CAA, the risk uplift in the WACC should only contain the risk that the CAA accommodation in the passenger forecast is wrong and so should be smaller. However, as CAA has never stated what the WACC uplift was, it’s impossible to say what effect the shock factor had on the WACC.

In contrast, the Irish Aviation Authority (IAA) price-control settlements for Dublin do not include explicit shock uplifts in the WACC or an adverse shock generator in the passenger forecasts. Rather, IAA relies on the more traditional method of allowing the market to add in the cost of the risk of shocks and assumes that is what has happened when it makes its WACC decision.

What Happened During COVID?

The difference between the COVID-19 pandemic and previous shocks is that it lasted much longer and its effects were much more significant. Consequently, it is reasonable to assume that mechanisms designed to deal with lesser shocks might be overwhelmed. Indeed, the responses by the two regulators were different, but each was consistent with their original positions on factoring in shocks.

CAA’s position was that shocks were already accounted for in the settlement, so all that needed to be done was to make HAL whole because the pandemic’s impact was so much larger than anticipated. CAA faced a decision on how to do this. It could either allocate an additional amount to the OPEX settlement (so-called fast money, as the airlines would have had to pay back over a short period) or allocate an additional amount on the regulated asset base (so-called slow money, as the airlines would pay the money back over a much longer period through funding the depreciation of the regulated asset base). Given the state of the airline industry at the time, CAA chose the slow money approach. One can argue about the amount repaid, but in essence it was making HAL whole following an unexpectedly large shock.

In Dublin, the strategy was different. Rather than a “truing up” like at Heathrow, IAA and the Irish government reacted in real time. IAA suspended portions of the settlement (CAPEX triggers and service-quality targets were suspended), and there was support from the national government. IAA estimates these packages of support were worth some €220 million to the airport operator over two years.

In addition to responding differently to the pandemic, the regulators took different approaches to their most recent price-control announcements. CAA put in place a significant framework to account for shocks like the pandemic. This included the retention by the CAA of the adverse shock generator (which it calls the “Shock Factor”) and the traffic risk sharing (TRS) mechanism.

In essence, the Shock Factor is an overlay of a percentage decrease in the forecast of passengers determined by CAA for a regulatory period. CAA describes the result of applying the Shock Factor as a risk-weighted forecast of passenger numbers. It does this to take into account the impact on passenger numbers of both the frequency and likely impact of noneconomic shocks for a regulatory period. For the current regulatory period, a Shock Factor value of 0.87% was applied by CAA to its passenger-numbers forecast to result in a prediction that has been adjusted down by 0.87% to take into account the prospective impact of shocks on the outturn of passenger numbers for HAL.

TRS reflects variations of traffic volume outturns from what was forecast, and from what was the basis of airport charges, through adjustments to the regulatory asset base (RAB). If passenger numbers were well below the forecast, for example, there would be a CAA-approved increase in value of the RAB. This would result in future increased charges to depreciate the increased RAB and/or an amount of charges being paid by users.

At a detailed level, CAA has implemented two “bands” based on the extent of prospective passenger volume variations from what was forecast and was the basis for the price cap established by CAA. First, there is a band designed to take account of passenger variation volumes of up to 10%. CAA has decided that within this band, 50% of traffic-related airport charges risk would be shared with airlines and the passengers that fly with them. Second, CAA established another band for volume outturns of more than 10% from what was forecast. CAA states that where variations are more than 10%, 105% of traffic-related airport charges risk would be shared with users.1

By comparison, IAA has not seen the need to dramatically change the architecture of its price control. There are no bands to take account of variations in passenger numbers from what was forecast and no adverse shock-adjustment factors. For IAA, it is essentially business as normal.

How Robust Are the Airports?

To determine robustness, we must first establish some context. Both airports use hub models, pooling passenger demand from a wider range of destinations than point-to-point airports. Healthy hub airports tend to be more resilient to adverse economic shocks than point-to-point airports.

In 2017, CAA commissioned a comparison of Heathrow with a number of other airports, looking at EBITDA as a measure of financial performance and passenger volumes as a measure of demand. The study showed that when looked at in terms of EBITDA per passenger, Heathrow performs well against its comparator group and is outperformed only by Hong Kong and Seoul. Further analysis shows that Heathrow’s EBITDA performance was in the top two or three comparator airports and that over the 2011–2015 period, Heathrow’s performance was improving.

The same study also included data for Dublin Airport, but was not specifically designed to assess Dublin’s performance against a comparator group. While Dublin’s financial performance was solid, Heathrow consistently outperformed it, and Dublin’s performance was consistently toward the bottom end of the comparator group.

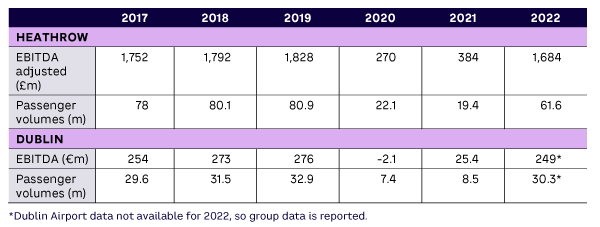

When the pandemic hit, both airports were profitable and had passenger volumes near capacity (see Table 1). The effect of the pandemic on EBITDA and passenger volumes was dramatic and seems to have lasted for two years (2020 and 2021). It’s interesting to note that Heathrow still reported a strongly positive EBITDA and that Dublin remained broadly profitable (although it recorded a small negative EBITDA of -€2 million in 2020 before recovering in 2021).

The strong recovery in 2022 is also interesting. Heathrow EBITDA and passenger volumes improved by 338% and 218%, respectively. At Dublin, the numbers were 880% and 256% (although this is slightly misleading as Table 1 compares Dublin Airport 2021 performance with group performance for 2022).

There is some debate between the two airports and their airlines about the speed of the recovery and its likely path. What we can say for certain is that recovery has been rapid, financial performance is improving, and even the most pessimistic forecasts suggest a return to pre-pandemic traffic numbers by 2025. Consequently, we can conclude that both airports are relatively resilient.

Who Was Right?

Dublin and Heathrow airports aren’t directly comparable. Although they are both hubs, there are notable differences. Heathrow is a major hub, one of the world’s busiest and strategically important globally. Dublin is a secondary hub that’s experiencing strong growth and is well placed to gain business in the lucrative transatlantic market. Their ownership structures, debt-to-equity ratio, and ambitions are all different. What matters is whether the regulatory interventions are appropriate and support their development.

Both airports were relatively near to capacity pre-pandemic, were relatively robust during it, and have now experienced strong traffic recovery.

Airport investors need certainty to invest. Of less certainty is the rate of return they will demand. The offering from IAA is a straight RAB environment that is effectively underwritten with support from the regulator and the government if the shock is severe enough to warrant it. Such an approach is flexible and agile, and the regulatory compliance costs are low. IAA and the Irish government have demonstrated that they will be accommodating should this type of shock hit again.

The downside is the amount of trust this approach relies on. Investors must trust that a future regulator will be sympathetic and supportive in the event of another pandemic-type shock. If they believe that to be the case, all is good; if they don’t, some risk will be priced in, and costs at Dublin Airport will rise.

Conversely, CAA has fettered the discretion of the future CAA by creating a regulatory superstructure that determines how it would react. The plus side is certainty for investors. The downside is the regulatory cost and the risk that the dead bands are incorrectly set, alongside any gaming or unanticipated behavior that goes with any regulatory decision.

Essentially, any final conclusion turns on how one views the pandemic. If one sees it as a one-off in terms of the size and scale of the shock that was properly dealt with at the time, a big regulatory structure isn’t needed. This is especially true if the markets trust the regulator to do the right thing.

Alternatively, if one thinks the pandemic marked a change and that shocks are likely to become larger, longer-lasting, and unpredictable to the point that they overwhelm existing regulatory arrangements, a CAA-type approach is wise. This is especially true if prices are particularly sensitive to the WACC or the regulator is not fully trusted by the markets.

Although it is too early to say whether we are now in a world where pandemic shocks will be common, it does appear that recovery has been rapid and strong for these two airports and the airlines that fly from them. If the COVID-19 pandemic was a one-off, it should be readily accommodated within existing regulatory structures, and there is no need for the additional regulatory superstructure adopted by the CAA.

The truth is, both regulators are gambling: IAA on its credibility and the COVID event being a one-off, CAA on the world having changed and markets needing it to fetter its discretion. Unless we see another COVID-type event, IAA’s gamble seems the one more likely to pay off.

Reference

1 “Final and Initial Proposals for H7 Price Control.” UK Civil Aviation Authority (CAA), accessed May 2023.